The Philippines has taken a bold step towards embracing Bitcoin at the national level. A new proposal aims to build one of the largest state-owned Bitcoin reserves in the world, signalling a significant shift in how countries view digital assets as part of their financial security.

The Strategic Bitcoin Reserve Act

On August 22, 2025, Congressman Miguel Luis Villafuerte, 36, introduced House Bill No. 421, also known as the Strategic Bitcoin Reserve Act. The proposal directs the Bangko Sentral ng Pilipinas (BSP), the country’s central bank, to acquire 10,000 Bitcoin over five years. This would mean purchasing 2,000 BTC annually until the target is met.

The plan is not just about buying Bitcoin; it is also about ensuring long-term stability. The bill mandates a 20-year minimum holding period, during which the reserve cannot be freely sold. Even after this period, sales will remain restricted, no more than 10% of the reserve could be liquidated within two years, and only for the purpose of retiring sovereign debt.

Villafuerte has described Bitcoin as “a modern strategic asset, comparable to digital gold,” arguing that the Philippines must not fall behind while other nations stockpile digital reserves.

Why the Philippines Wants Bitcoin

The Philippines currently carries around ₱16.09 trillion ($285 billion) in debt, with nearly 68% owed domestically. Lawmakers believe diversifying the country’s reserve assets is essential to strengthen financial resilience, particularly at a time of global economic uncertainty.

Traditionally, governments hold foreign exchange reserves, mainly in US dollars and gold, to back up their economies and strengthen their currencies. By adding Bitcoin, the Philippines would join the growing number of states recognising it as a hedge against inflation, currency risks, and geopolitical shocks.

Supporters argue that Bitcoin offers transparency and scarcity, two qualities that can protect national wealth in times of crisis. With a capped supply of 21 million coins, it cannot be printed or inflated like traditional currencies.

Strict Oversight and Transparency

The proposal is designed with a strong emphasis on security and transparency. The Bitcoin reserve would be stored in cold storage wallets, distributed across the country to reduce risks. Access would be limited and monitored closely by the BSP governor, alongside the Department of Finance, Department of Defense, and the Securities and Exchange Commission (SEC).

To build public trust, the bill requires quarterly proof-of-reserve audits conducted by independent third parties. These reports must be published online, allowing citizens and investors to see exactly what the government holds.

Importantly, the legislation also makes it clear that this move will not restrict private ownership of Bitcoin. Citizens and businesses remain free to buy, sell, and trade BTC without interference from the government.

The Global Bitcoin Reserve Race

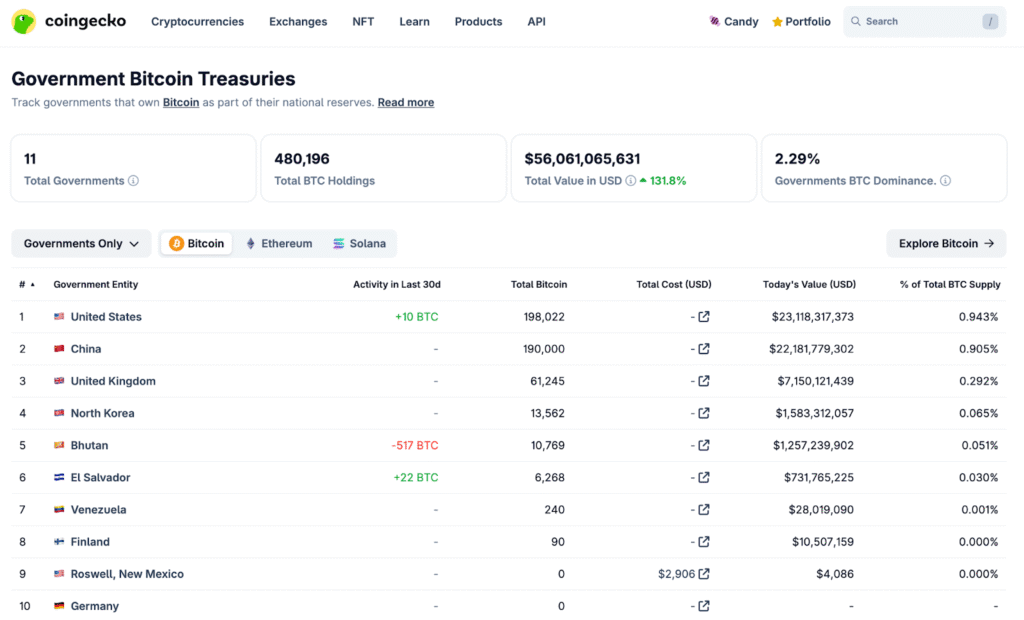

The Philippines’ plan comes as more governments explore holding Bitcoin in their treasuries. According to data from CoinGecko, eleven governments currently hold around 480,196 BTC, worth about $56 billion, which represents 2.29% of Bitcoin’s total supply.

Among them, North Korea (13,562 BTC), Bhutan (10,769 BTC), and El Salvador (6,268 BTC) stand out. El Salvador remains the most high-profile adopter, having made Bitcoin legal tender in 2021, and continues to add to its holdings. Its sovereign stash now exceeds $725 million.

If passed, the Philippines’ planned 10,000 BTC reserve valued at over $1.1 billion at the current market price of $116,850 per coin, would place the country among the top state-level Bitcoin holders, alongside Bhutan and ahead of El Salvador.

A Bold Step Into the Digital Future

The proposed Strategic Bitcoin Reserve Act reflects a growing recognition that digital assets could play a central role in national financial security. By adopting a structured, transparent, and long-term approach, the Philippines may position itself as a leader in state-level Bitcoin adoption.

Whether the bill passes into law remains to be seen, but its introduction underscores a powerful trend: as traditional systems face mounting pressure, nations are increasingly turning to Bitcoin as a hedge, a reserve, and a strategic asset.