Perpetual decentralised exchanges (DEXs) have emerged as one of the fastest-growing sectors in decentralised finance (DeFi), sparking a new wave of competition. Once a niche market, perpetual futures trading is now driving both liquidity and attention away from centralised exchanges and even threatening the dominance of early leaders such as Hyperliquid.

Hyperliquid’s First-Mover Advantage Tested

Hyperliquid has long been at the centre of the perpetual DEX narrative. The platform, built by a relatively small team, quickly became a top venue for derivatives traders, whale activity and speculative flows. Its fully permissionless model allowed global access, including US-based traders seeking high-risk, high-return strategies.

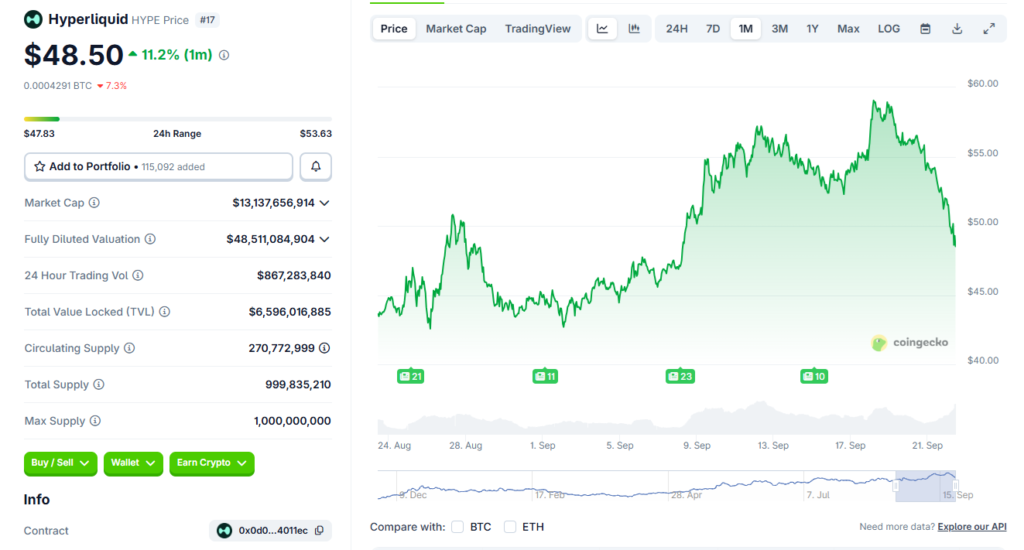

The project benefitted from a strong first-mover advantage. At its peak, Hyperliquid ranked among the top 10 fee-generating protocols in the industry, second only to Tether. Its native token, HYPE, surged toward $60 before sliding back to around $48 as competition intensified and the broader market corrected.

Now, however, Hyperliquid faces mounting challenges from newer entrants such as Aster, EdgeX and TRON-backed SunPerp, each trying to carve out liquidity, volume and user attention in a sector that has grown fiercely competitive.

New Platforms Join the Race

The launch of fresh perpetual DEXs has brought with it rapid innovation and aggressive token strategies.

Aster has drawn headlines after a 400% rally in its ASTER token, positioning itself as one of the biggest holders of BNB-USDT pairs. However, analysts note that much of Aster’s early inflows originated from Binance’s hot wallet rather than purely organic demand.

EdgeX has been gaining traction with steady growth in volumes and fee generation, showing potential as a credible challenger.

SunPerp, supported by TRON and Justin Sun, entered the market in September with promises of aggressive buybacks for SUN tokens. The announcement pushed SUN to a three-month high of $0.035, highlighting how perpetual DEX launches can trigger sharp token rallies.

These platforms are competing not only on trading volumes but also on token performance and stablecoin liquidity. Their success depends heavily on attracting whales, influencers and active traders who drive liquidity and credibility.

Market Growth Outpaces Other Narratives

The rise of perpetual DEXs is not just about individual platforms. The entire sector has exploded in engagement, influence and adoption.

According to data from Dexu AI, perpetual DEXs saw a tenfold increase in “mindshare” during September, a metric that measures discussions and mentions across news outlets, forums and social media. This far outpaced other narratives such as artificial intelligence tokens (+12%), real-world assets (+8%) and memecoins (+15%).

Today, perpetual DEXs command roughly 26% of the derivatives market and their share is expanding quickly. Analysts suggest decentralised derivatives could push total DeFi volumes past $3.4 trillion by 2025, making perpetual futures one of the strongest growth engines in the industry.

Native tokens have mirrored this trend with outsized gains. Hyperliquid’s HYPE is up more than 500% year-to-date, while Aster surged over 300% in September alone. In comparison, many other token categories have lagged behind.

Regulation, Risks and the Road Ahead

Despite their momentum, perpetual DEXs also face risks, particularly regulatory pressure. In 2023, the US Commodity Futures Trading Commission (CFTC) targeted three DeFi protocols, including Deridex, over perpetual futures trading. Current perpetual DEXs share similar features: no-KYC, permissionless models and open access for US traders.

This regulatory uncertainty has caused caution among larger players. For example, OKX has delayed the rollout of its perpetual DEX product, wary of potential enforcement actions. Still, newer projects are pressing ahead, betting that the market demand for self-custodial derivatives will outweigh compliance risks.

Another challenge is sustainability. While tokens have rallied sharply, traders warn against blindly chasing the next “hot perp token,” as liquidity can be thin and volatility extreme. HYPE’s pullback from its highs highlights the risks of overexuberance, particularly in a sector where speculation is often fuelled by influencers and short-term flows.

A Defining Story for 2025

The rise of perpetual DEXs underscores a fundamental shift in crypto market structure. Decentralised derivatives are increasingly rivalling centralised exchanges by offering deep liquidity, high leverage and trustless custody, all while maintaining transparency through on-chain infrastructure.

Hyperliquid remains the leader for now, thanks to its established user base, whale adoption and fee dominance. But challengers such as Aster, EdgeX and SunPerp are rapidly gaining ground, buoyed by token-driven hype and aggressive liquidity strategies.

With perpetual DEX tokens now holding a combined market cap above $22 billion and growing, the sector has cemented itself as one of the defining stories of 2025. The race is no longer about whether decentralised perps will succeed, but which platform will capture the lion’s share of this explosive market.