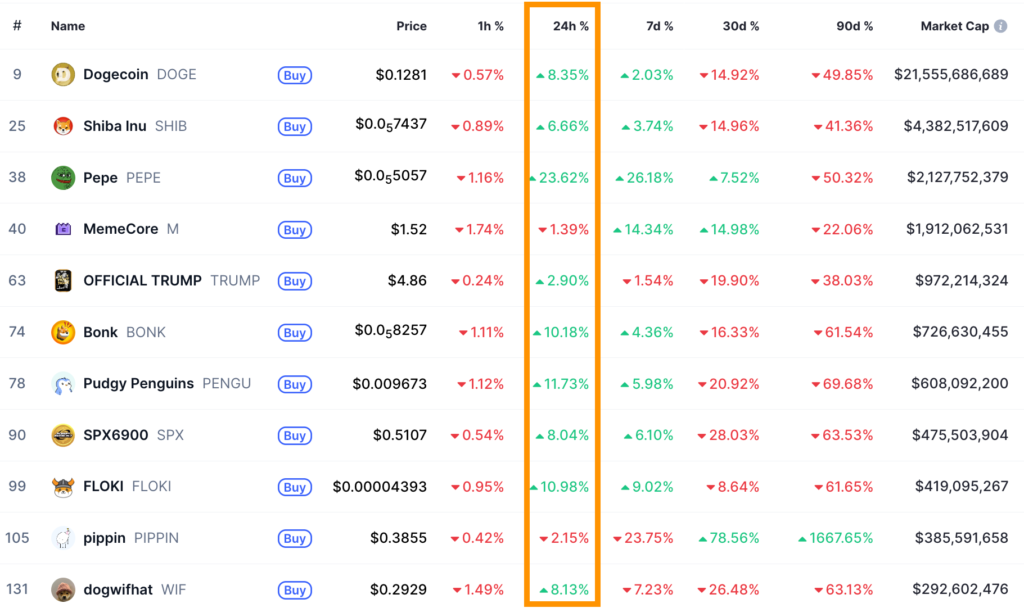

Memecoins have staged a notable comeback, adding nearly three billion dollars in market value within a single day. Tokens such as PEPE, BONK and Dogecoin emerged as top performers, delivering double digit gains and reigniting debate over whether a new meme driven cycle is beginning. The renewed enthusiasm comes as broader crypto sentiment improves ahead of 2026, with traders once again showing a growing appetite for high risk assets.

On Friday, the combined market capitalisation of memecoins climbed to approximately 39.45 billion dollars, marking its highest level in two weeks. The sharp increase followed a surge in trading activity and derivatives positioning, suggesting that speculative interest has returned to the sector after a period of consolidation.

Memecoin market capitalisation hits two week high

The total valuation of the memecoin sector rose by around eight per cent in just twenty four hours, pushing the combined market cap to levels last seen on 20 December. This move came amid a broader recovery across altcoins, as investors rotated capital away from Bitcoin and Ether in search of higher short term returns.

PEPE led the rally with a rise of more than twenty three per cent over the day. The Ethereum based token has long been regarded as one of the most volatile assets in the memecoin space, often responding quickly to shifts in market sentiment. Its rapid appreciation on Friday helped set the tone for the wider sector.

BONK, which operates on the Solana network and is often viewed as PEPE’s closest rival, followed with gains of roughly ten per cent. Dogecoin, the largest memecoin by market capitalisation and a long standing favourite among retail investors, advanced by around eight per cent over the same period.

This collective strength pushed the sector’s valuation above 39 billion dollars, adding close to three billion dollars in a single day. While this does not yet confirm a sustained uptrend, it represents a clear change in momentum compared with the subdued trading seen earlier in December.

Influencer activity and platform buzz drive renewed interest

Part of the renewed enthusiasm appears to be linked to social media attention and high profile endorsements. Ethereum cofounder Vitalik Buterin attracted attention after changing his profile picture to a meme themed non fungible token, an action that many traders interpreted as a symbolic nod towards internet culture driven assets.

In addition, growing discussion around MemeMax_Fi has helped fuel speculation. The platform is a perpetual decentralised exchange focused on memecoins, offering leverage of up to one hundred times. Such high leverage products tend to attract short term traders looking to amplify gains during periods of strong volatility.

Several prominent traders and commentators have described MemeMax_Fi as a platform that effectively monetises attention. According to one widely shared post on X, memes within this ecosystem are treated not just as cultural symbols but as sources of liquidity, momentum and collective energy. This narrative has resonated with a segment of the crypto community that views attention as a core driver of value in digital markets.

Bold predictions for 2026 have also played a role. Influencers have increasingly framed current price action as the early stages of a longer term recovery, encouraging followers to position themselves ahead of a potential broader rally in speculative assets.

Rising open interest signals bullish leverage positioning

Beyond spot price movements, derivatives data points to growing confidence among traders. Open interest across major memecoin futures contracts rose sharply in the lead up to Friday’s rally, indicating that participants were opening new leveraged positions in anticipation of higher prices.

PEPE recorded one of the most dramatic increases, with open interest jumping by around seventy seven per cent within twenty four hours to approximately 441 million dollars. This surge suggests a significant influx of new capital into PEPE related derivatives markets.

Other memecoins showed similar trends. PENGU saw its open interest rise by more than twenty seven per cent to roughly 90.73 million dollars. Dogecoin, which already maintains deep liquidity in derivatives markets, recorded open interest of about 1.71 billion dollars, reflecting a daily increase of around four and a half per cent.

Trading volumes in memecoin derivatives also expanded rapidly. PEPE led the way with a reported four hundred and two per cent increase in daily volume. Across the entire memecoin segment, derivatives trading volume climbed by approximately thirty five per cent to around 4.75 billion dollars in just one day.

Such increases in open interest and volume are typically interpreted as signs of bullish momentum, particularly when accompanied by rising prices. They indicate that traders are willing to take on additional leverage, betting on continued upside rather than positioning defensively.

Technical backdrop supports broader altcoin recovery

The strength in memecoins has not occurred in isolation. Technical indicators across the wider altcoin market suggest improving conditions that could support further gains. Analysts often track TOTAL3, which represents the total market capitalisation of all cryptocurrencies excluding Bitcoin and Ether, as a gauge of altcoin health.

Over the past two days, TOTAL3 has risen by roughly twenty two per cent, reaching an intraday high of about 848 billion dollars on Friday. This advance took place within an ascending parallel channel visible on the four hour chart, a structure that typically reflects sustained upward momentum.

Earlier in December, TOTAL3 experienced a pullback that pushed the relative strength index down to oversold levels near twenty five. Buyers stepped in aggressively at those levels, signalling strong demand. The RSI has since recovered to around sixty five, a reading that suggests growing interest without yet entering overbought territory.

If TOTAL3 can decisively break above the 848 billion dollar resistance area, which coincides with both the upper boundary of a triangular pattern and the two hundred period simple moving average, the market could target levels near 900 billion dollars. A move of this nature would likely provide further tailwinds for altcoins, including major memecoins.

Such a scenario would reinforce the idea that the recent memecoin rally is part of a broader shift in risk appetite rather than an isolated spike driven purely by hype.

Improving sentiment hints at early stage recovery

Another supportive factor is the gradual improvement in overall crypto market sentiment. After spending weeks in extreme fear territory, sentiment indicators have begun to stabilise and move towards neutral levels. This change suggests that investors are becoming more comfortable deploying capital after a prolonged period of caution.

Historically, memecoins tend to perform well during the early stages of sentiment recoveries, as traders seek assets with high beta and strong community engagement. The sharp moves seen in PEPE, BONK and Dogecoin fit this pattern, though they also carry heightened risk due to their speculative nature.

It remains too early to declare the start of a full meme season. Previous cycles have shown that memecoin rallies can fade quickly if liquidity dries up or if broader market conditions deteriorate. Nonetheless, the combination of rising prices, expanding derivatives activity and improving technical structures suggests that interest in the sector is genuine rather than purely fleeting.

For now, memecoins have reclaimed the spotlight, reminding the market of their ability to generate outsized moves in short periods. Whether this momentum can be sustained into the coming weeks will depend on the broader crypto recovery, trader discipline and the continued interplay between online attention and market liquidity.