Tokenized Bonds Backed by BlackRock Fund to Be Redeemable with RLUSD Stablecoin

Tokenization protocol Ondo Finance has announced plans to deploy its tokenized US Treasury fund, OUSG, on the XRP Ledger. This move aims to provide investors with seamless access to institutional-grade government bonds, redeemable via Ripple’s RLUSD stablecoin.

According to Ondo, the Ondo Short-Term US Government Treasuries (OUSG) fund will be live on the XRP Ledger within the next six months. Ripple and Ondo also plan to “seed OUSG liquidity” as soon as the fund launches, ensuring robust market activity.

OUSG Backed by BlackRock Fund

The OUSG fund offers exposure to short-term US Treasuries, backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). Investors will benefit from intraday settlement and redemption capabilities. Currently, OUSG provides an annual percentage yield (APY) of 4.16% and boasts a total value locked (TVL) of $184 million. Each OUSG token is valued at $109.76, making it a compelling option for those seeking stable, high-quality returns.

The integration with the XRP Ledger will enable OUSG tokens to be redeemed using Ripple Labs’ RLUSD stablecoin, which was launched on 17 December 2024. RLUSD, pegged to the US dollar, has a market capitalisation of approximately $72.4 million, according to CoinGecko data.

Expanding the Tokenization Market

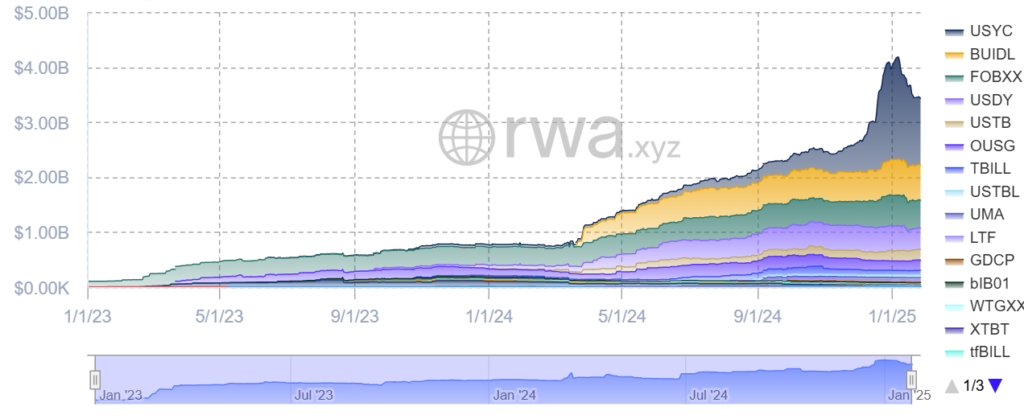

Tokenized debt instruments, such as Ondo’s OUSG, represent digitised versions of traditional assets like bonds and loans. The tokenized US Treasury market is currently valued at $3.43 billion, while the broader tokenized real-world asset (RWA) market is worth over $16.8 billion, according to data from RWA.xyz.

Experts predict significant growth in the sector. Lamine Brahimi, co-founder of enterprise digital asset firm Taurus SA, recently stated that bond tokenization could reach a $300 billion valuation by 2030. This forecast is supported by McKinsey research, which highlights a base-case scenario for rapid adoption over the next five years.

BlackRock CEO Champions Tokenization

Larry Fink, CEO of BlackRock, has been a vocal advocate for the tokenization of financial assets. He has urged the US Securities and Exchange Commission (SEC) to support the transition of traditional assets, such as stocks and bonds, into tokenized formats. As early as 2023, Fink described tokenization as the “next generation for markets,” emphasising its potential to transform global finance.

The collaboration between Ondo Finance and Ripple further highlights the growing momentum behind tokenized assets, which are increasingly being recognised as a key innovation in the evolution of financial markets.