Shares of the Norwegian Block Exchange (NBX) surged over 138% on June 2, following the announcement of its entry into the corporate Bitcoin treasury space. The Oslo-based crypto platform revealed it had acquired 6 Bitcoin (BTC) valued at approximately $633,700 with plans to increase this to 10 BTC by the end of the month.

The stock price closed the day at €0.033 ($0.038), marking a significant one-day gain, although it remains well below its all-time high of €0.93 ($1.06) recorded in January 2022. NBX attributed the move to its strategic initiative to integrate Bitcoin into its treasury as a core asset, citing Bitcoin’s rising status as a pillar of global financial infrastructure.

Bitcoin-Backed Services and Yield Generation in the Cardano Ecosystem

NBX is not merely accumulating Bitcoin for speculative purposes. According to the company, the newly acquired BTC will be used as collateral to issue USDM, a Cardano-based stablecoin. The move is aimed at generating yield both on Bitcoin itself and within the broader Cardano ecosystem.

In a company statement, NBX said it sees Bitcoin as a means to “increase operational efficiency” and as a magnet for attracting capital from firms seeking cryptocurrency exposure. The long-term vision includes building Bitcoin-backed loan products, signalling the exchange’s ambition to evolve into a full-fledged digital asset bank.

The exchange also noted that it is in ongoing discussions to raise additional capital to further expand its Bitcoin holdings, suggesting that its treasury strategy is part of a broader, sustained pivot toward digital asset integration.

More Norwegian Firms Turn to Bitcoin

NBX is not the first Norwegian company to embrace Bitcoin at the corporate level. Back in 2021, Aker ASA, a major Norwegian industrial investment company, launched Seetee, a subsidiary focused exclusively on Bitcoin investment. Seetee currently holds 1,170 BTC, acquired at an average cost of $50,200 per coin, now worth approximately $123 million.

Additionally, K33, a Norwegian crypto brokerage, recently announced its intention to enter the Bitcoin treasury space as well, raising 60 million Swedish krona ($6.2 million) to buy and hold the cryptocurrency.

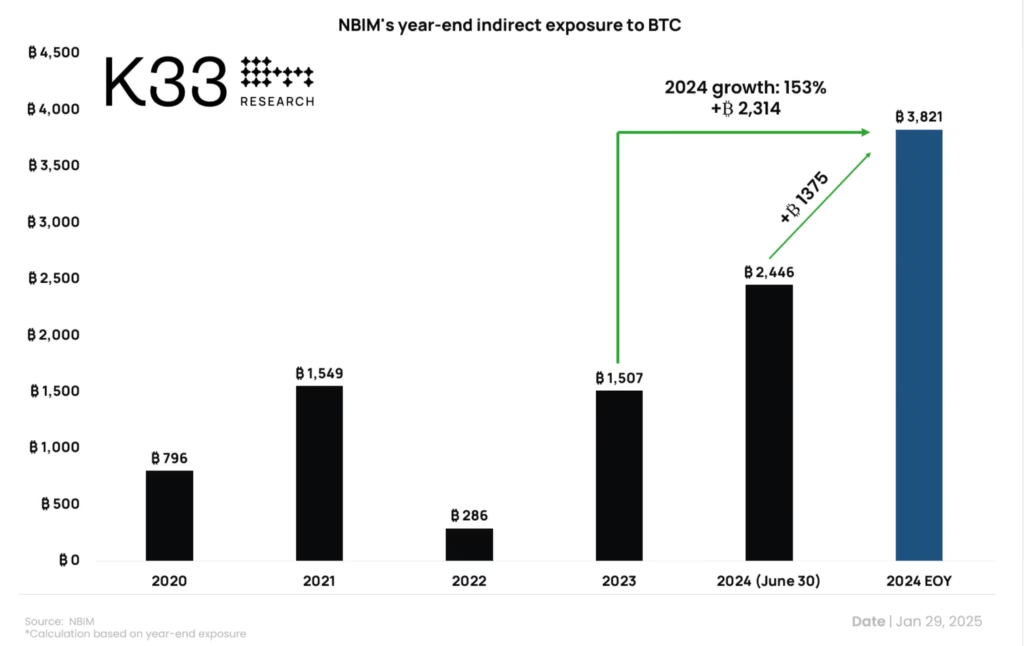

Even Norway’s sovereign wealth fund, Norges Bank Investment Management, has indirect exposure to Bitcoin. As of late 2024, it held 3,821 BTC via investments in public companies with crypto holdings.

A Global Trend: Bitcoin Holdings Boost Stock Prices

NBX’s stock performance is part of a larger trend where companies announcing Bitcoin purchases see their share prices soar. In November 2024, Blockchain Group, a Paris-based crypto company, revealed a similar Bitcoin-buying strategy, resulting in a 225% stock surge to €0.48 ($0.52).

In Asia, DigiAsia Corp, a fintech firm based in Indonesia, experienced a 91% share price increase after revealing plans to raise $100 million for Bitcoin acquisitions. The company plans this to be the first of multiple treasury purchases.

The strategy appears to be paying off for many. According to data from Bitbo, corporate treasuries worldwide now collectively hold over three million Bitcoin, valued at more than $342 billion. With institutional adoption of Bitcoin accelerating, such moves are no longer seen as fringe strategies but rather as long-term investment hedges against inflation and fiat currency volatility.