South Korea’s internet giant Naver is preparing a bold push into digital finance by acquiring Dunamu, the operator of the country’s largest cryptocurrency exchange, Upbit. The planned deal, which will reportedly be executed through a comprehensive stock swap, positions Naver to combine its fintech arm with one of the world’s biggest crypto trading platforms while advancing plans for a Korean won-backed stablecoin and other financial innovations.

Stock Swap to Create a New Financial Powerhouse

According to multiple South Korean news outlets, Naver Financial will make Dunamu a wholly owned subsidiary by exchanging shares with Dunamu’s existing investors. Unlike a traditional merger, a stock swap allows both firms to retain their structures while unifying governance under a parent-subsidiary arrangement.

Industry sources say board meetings to approve the transaction are expected soon, with both Naver Financial and Dunamu forming task forces to manage the process. Naver confirmed in a regulatory disclosure that it is in talks over “various forms of cooperation,” including a stock exchange, stablecoin ventures and unlisted stock trading, but emphasised that final terms have not been settled.

If completed, the deal would give Naver control of two dominant financial platforms: Naver Pay, the country’s leading mobile payment service and Upbit, South Korea’s biggest crypto exchange. Upbit ranks fourth globally for spot trading volume, recording about $2.9 billion in 24-hour turnover, according to CoinMarketCap.

Stablecoin Ambitions and Web3 Expansion

Central to the planned acquisition is a shared ambition to issue a Korean won-pegged stablecoin. Both Naver and Dunamu have already revealed early plans for such a project. In July, the two companies announced a partnership to explore a won-based stablecoin and in early September Dunamu unveiled its own Web3 blockchain, GIWA Chain, along with the GIWA wallet. The GIWA ecosystem features identity verification and anti-money-laundering safeguards designed to bridge crypto with traditional finance.

A won-backed stablecoin would align with South Korea’s shifting regulatory environment. President Lee Jae-myung’s administration has pushed forward legislation to legalise stablecoins, while the Bank of Korea has signalled support for banks to act as initial issuers before expanding to private entities. Eight major South Korean banks are already preparing to launch a similar stablecoin by late 2025 or early 2026.

Industry analysts believe a Naver–Upbit stablecoin could quickly dominate the domestic market by combining Naver Pay’s massive retail network with Upbit’s crypto liquidity and user base. Such a token could also provide a platform for international expansion, with Naver reportedly exploring global fintech opportunities.

Building a Super App

The consolidation of Naver Financial and Dunamu could create a “super app” combining e-commerce, payments, traditional finance and cryptocurrency trading. Naver is often referred to as the “Google of South Korea,” operating the country’s top search engine along with email services, maps, blogs and the Naver Pay digital wallet. Integrating these services with Upbit’s crypto infrastructure would give users a single ecosystem for shopping, payments, stock trading and digital asset investment.

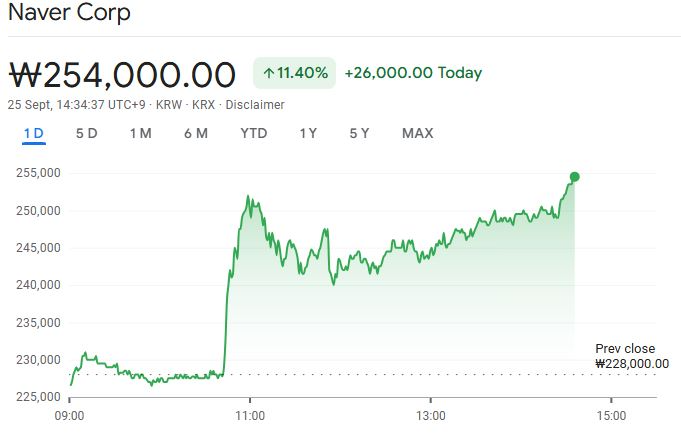

Market reaction has been swift. Naver’s share price surged more than 11% to 254,000 Korean won ($181) on reports of the deal, reflecting investor optimism about the revenue potential of a combined platform. In the second quarter, Naver reported revenue of over $2 billion and net profit of $355 million, underlining its financial capacity to absorb a major acquisition.

Crypto Adoption Surges in South Korea

The timing of Naver’s move coincides with strong growth in South Korea’s cryptocurrency market. User numbers surpassed 16 million in February and could reach 20 million by year-end, nearly 40% of the country’s 51 million population. Market revenue is projected to hit $1.1 billion in 2025 and climb to $1.3 billion in 2026, according to Statista.

Upbit’s dominant position gives Naver immediate access to this expanding market. For Dunamu, joining forces with Naver provides new funding, mainstream reach and the chance to integrate with Naver’s payment systems, creating a broader user experience and deeper liquidity.

While neither company has disclosed a timeline or final structure, the planned stock swap marks one of the most significant corporate moves in South Korea’s digital finance sector. If Naver succeeds in making Dunamu a subsidiary and launching a won-backed stablecoin, it will combine the country’s largest portal site with its leading crypto exchange, setting the stage for a new era of integrated digital finance.

The proposed “super app” could redefine how South Koreans engage with money, blending traditional banking, payments and crypto into a single platform while positioning Naver as a global fintech leader.