Nano Labs, a China-based crypto mining chip design firm, has taken a major step forward in its bold cryptocurrency treasury strategy. The company announced it has received an initial investment of 600 Bitcoin (BTC), worth approximately $63.6 million, as part of a $500 million convertible notes deal. This investment marks the beginning of Nano Labs’ broader plan to accumulate $1 billion worth of Binance Coin (BNB) through a combination of convertible notes and private placements.

Crypto Industry Pushes SEC for Staking Clarity, According to a filing with the U.S. Securities and Exchange Commission (SEC), Nano Labs has issued two promissory notes to investors. These notes form part of the larger $500 million deal that can be settled in either cash or an equivalent value in cryptocurrency. With this move, the company’s treasury now holds 1,000 BTC, highlighting its commitment to increasing crypto reserves.

BNB to Become Central to Nano Labs’ Treasury

Nano Labs isn’t stopping at Bitcoin. The company has made it clear that BNB will be the cornerstone of its future financial strategy. On June 24, the firm announced its goal to acquire up to $1 billion in BNB tokens in the initial phase, forming part of its long-term strategy to hold between 5% and 10% of BNB’s total circulating supply.

At current market prices, 5% of BNB’s circulating supply equals roughly 7 million BNB, valued at about $4.5 billion. This signals Nano Labs’ ambitious plan to become a major BNB holder and shows its confidence in the Binance ecosystem. A spokesperson from the company stated,

“BNB will be at the core of our next phase.”

Strong Market Reaction to the Announcement

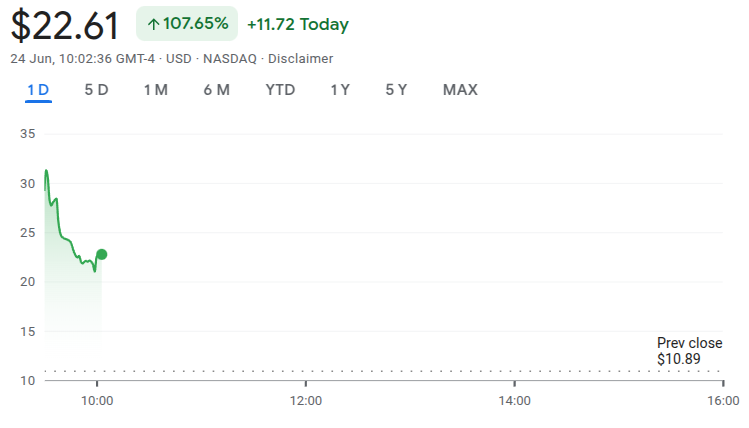

Investors have responded positively to the news. Nano Labs’ (NA) stock price surged over 14% during premarket trading on Thursday. Over the past month, the stock has climbed by more than 205%, boosted by excitement surrounding the firm’s Bitcoin and BNB treasury strategy.

This sharp rise suggests strong investor confidence in Nano Labs’ long-term vision and its aggressive move into major cryptocurrencies. If the strategy succeeds, it could position Nano Labs as a serious player in the crypto financial space, especially as institutional interest in digital assets continues to grow.

BNB Price Holds Steady Despite Market Volatility

Despite the positive news from Nano Labs, the BNB token itself remains relatively stable in price. As of the latest update, BNB is trading at $647.72, moving sideways in a tight range between $640 and $650. This follows a recovery from a price dip earlier in the week.

From a technical perspective, BNB is trading below the 50-day Simple Moving Average (SMA) but remains above the 100-SMA and 200-SMA. The Relative Strength Index (RSI) has edged up to 50.48, hinting at a possible upward move in the near term. However, trading volume has dipped by 5%, suggesting a slight decrease in market interest or investor caution.

Nano Labs’ aggressive strategy to accumulate Bitcoin and BNB could reshape its position in the crypto industry. With $500 million in convertible notes, a BNB-centric approach, and significant BTC holdings, the company is signalling its intent to play a long game in the digital asset world.

If successful, Nano Labs could become one of the largest corporate holders of BNB, further integrating itself into the fast-evolving decentralised finance (DeFi) space. As always, investors and crypto enthusiasts will be watching closely to see how this bold strategy unfolds.