MicroStrategy Adds 4,980 BTC Amid Rising Prices

Michael Saylor’s firm, Strategy (commonly known as MicroStrategy), has further expanded its position as the largest public holder of Bitcoin, acquiring 4,980 BTC worth approximately $531.1 million. The announcement, made via a US SEC filing on Monday, comes during a period of renewed investor optimism and a sharp rise in Bitcoin’s price.

Between June 23 and June 30, Bitcoin surged from around $101,000 to over $108,000, with Strategy’s latest purchases averaging $106,801 per coin, according to CoinGecko data. The company’s total holdings now stand at 597,325 BTC, accumulated at an average price of $70,982 per Bitcoin, amounting to a total investment of roughly $42.4 billion.

Year-to-Date Gains Reach 85,871 BTC

With this latest acquisition, Strategy’s year-to-date Bitcoin gain has climbed to 85,871 BTC, valued at approximately $9.5 billion. This builds on the firm’s 2024 performance, during which it added 140,538 BTC worth around $13 billion.

Strategy’s Bitcoin yield also saw improvement. The year-to-date yield increased by 0.5% to reach 19.7%, moving closer to the company’s target of 25% by the end of 2025. Additionally, its quarter-to-date yield rose by 0.4% to 7.8%.

$796 Million BTC Transfer Fuels Speculation

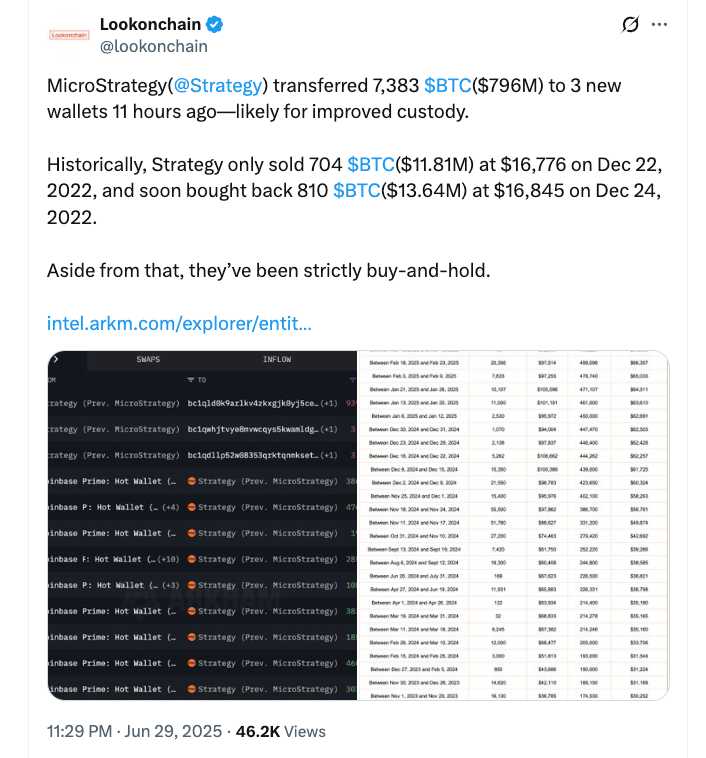

Alongside the reported purchases, blockchain analysts identified a significant movement of Bitcoin by Strategy. On Sunday, the firm transferred 7,383 BTC, valued at around $796 million, to three new wallets. According to blockchain analytics firm Lookonchain, the move was “likely for improved custody.”

Strategy’s track record shows minimal selling activity. The firm notably sold 704 BTC for $11.81 million at $16,776 on 22 December 2022 but quickly bought back 810 BTC for $13.64 million just two days later. “Aside from that, they’ve been strictly buy-and-hold,” Lookonchain noted.

A Long-Term Commitment to Bitcoin

Michael Saylor, Strategy’s co-founder and executive chairman, reinforced his commitment to Bitcoin by reposting a 2020 interview with Raoul Pal, founder of RealVision, where he detailed the company’s initial plunge into cryptocurrency. The firm first invested in Bitcoin in August 2020, a move that has since defined its corporate strategy.

“There’s a lot of traders in the market. They don’t understand the mindset of long,” Saylor said in the interview. “I’m buying it for the dude that’s going to work for the dude that’s going to get hired by the guy who takes over my job in 100 years. I’m not selling it.”

Saylor also hinted, as he frequently does each Sunday, at ongoing and future purchases, continuing the narrative that Strategy remains fully committed to expanding its Bitcoin portfolio.

Strategy Remains the Market Leader

As of now, Strategy holds nearly 600,000 BTC, further cementing its dominance in the institutional crypto space. With consistent purchasing patterns and a clear long-term vision, the firm is not only betting heavily on Bitcoin’s future but also influencing the broader market sentiment.

While many institutional investors are cautious amid global economic shifts, Strategy’s aggressive acquisition strategy signals strong confidence in Bitcoin as a long-term store of value.