Japanese investment firm Metaplanet has officially surpassed Coinbase in Bitcoin holdings, now owning 10,000 BTC following a recent purchase worth over $117 million. This strategic accumulation has catapulted Metaplanet to the position of the seventh-largest publicly traded company with Bitcoin in its treasury.

Latest Bitcoin Purchase Pushes Holdings to 10,000 BTC

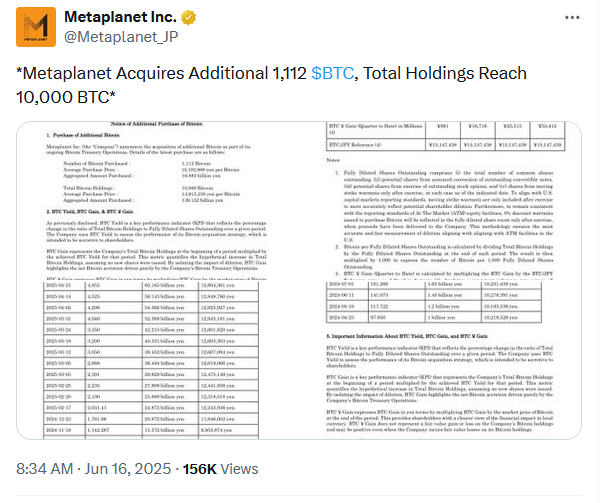

On Monday, Metaplanet revealed it had acquired 1,112 Bitcoin for 16.88 billion Japanese yen ($117 million), bringing its total BTC holdings to a landmark 10,000. This figure edges past Coinbase’s 9,267 BTC, according to data from Bitbo. The average purchase price across Metaplanet’s Bitcoin treasury now stands at approximately 13.9 million yen ($96,400) per coin.

This milestone comes just two weeks after Metaplanet climbed into the ranks of the top 10 corporate holders of Bitcoin. The firm is now placed seventh globally among publicly traded companies in terms of BTC reserves.

$210 Million in Bonds to Fuel Further Bitcoin Buys

In a parallel announcement, Metaplanet disclosed that its board had approved a new bond issuance worth $210 million. These no-interest bonds will be used exclusively for further Bitcoin accumulation. The company’s ambitious goal is to hold 210,000 BTC by the end of 2027, marking a massive shift in its financial strategy.

With 10,000 BTC already secured, Metaplanet plans to acquire the remaining 200,000 BTC over the next 18 months, an aggressive move that indicates the company’s deep conviction in the future of digital assets.

Stock Price Surges Amid Crypto Strategy Shift

Following the twin announcements, Metaplanet’s stock (3350T) saw a dramatic rally on the Tokyo Stock Exchange. Shares surged by over 22% on Monday alone, peaking at 1,860 Japanese yen. The firm’s stock has now climbed more than 417% year-to-date, fuelled by growing investor confidence in its Bitcoin-centric approach.

The rally reflects a broader trend of investor appetite for firms with strong crypto positions, particularly in times of macroeconomic uncertainty.

Institutional Confidence in Bitcoin Remains Steady

The developments at Metaplanet come during a period of mild market turbulence. Bitcoin recently saw a sharp correction, falling from $110,000 to $103,000 within three days, driven by rising geopolitical tensions. Despite the drop, institutional interest in Bitcoin remains robust.

Michael Saylor, co-founder of MicroStrategy and a known Bitcoin advocate, confirmed plans to continue purchasing Bitcoin this week. Meanwhile, Bitcoin exchange-traded funds (ETFs) experienced five consecutive days of net inflows last week, with over $1.3 billion invested by institutions.

Bitwise Asset Management CEO Hunter Horsley added that Bitcoin has the potential to rival the $30 trillion US Treasuries market, underlining the asset’s growing appeal as a long-term store of value.

Conclusion

Metaplanet’s bold pivot towards a Bitcoin-first strategy, combined with strong institutional backing across the sector, signals a deepening integration of crypto assets into traditional financial portfolios. With plans to hold 210,000 BTC by 2027 and growing investor support, Metaplanet is positioning itself as a major player in the evolving digital economy.