Metaplanet is preparing a significant capital raise aimed at expanding its aggressive Bitcoin-focused treasury strategy. The Tokyo-listed firm has outlined plans to issue a fresh round of Class B perpetual preferred shares worth approximately $135 million, according to newly submitted filings.

$135 Million Capital Raise Through Class B Shares

The company intends to issue 23.6 million Class B perpetual preferred shares priced at 900 yen, equal to around $5.71 each. The total expected raise amounts to 21.2 billion yen, or roughly $135 million. This issuance will be executed through a third-party allotment to overseas investors. The proposal awaits approval at an extraordinary shareholder meeting scheduled for 22 December 2025.

The preferred shares carry a fixed annual dividend of 4.9 percent on a notional value of $6.34. Investors would receive quarterly payments of $0.078 when the dividend cycle begins. Holders will also be allowed to convert the preferred shares into common stock at a $6.34 conversion price.

Share Features and Company Call Option

Although the new Class B shares come without voting rights, they include specific redemption rights. Metaplanet also retains a market-price call option. This option can be triggered if the company’s stock trades above 130 percent of the liquidation preference for twenty consecutive trading days, enabling Metaplanet to redeem the shares at its discretion.

Restructuring of Existing Financing Instruments

As part of a wider restructuring of its capital instruments, Metaplanet plans to cancel its twentieth, twenty-first and twenty-second stock acquisition rights. These will be replaced with new twenty-third and twenty-fourth series rights issued to Evo Fund, a Cayman Islands based investment firm. The move remains subject to regulatory clearance.

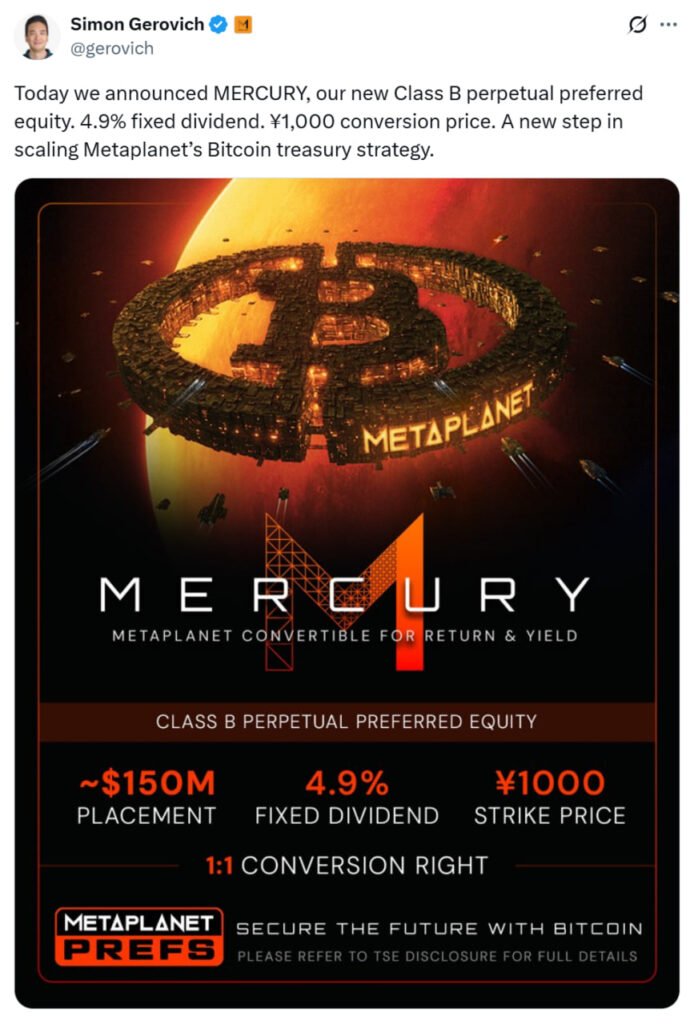

In a post on X, chief executive Simon Gerovich introduced the firm’s new preferred equity programme under the name Mercury. He highlighted the 4.9 percent fixed dividend and the 1,000 yen conversion price as key features, describing the initiative as an important step in scaling the company’s Bitcoin treasury strategy.

Metaplanet’s shares finished the trading day with a 3.20 percent gain, rising twelve points. The stock remains down by more than sixty percent over the past six months according to Google Finance.

Bitcoin Holdings Showing Deep Unrealised Losses

Despite its bold strategy, Metaplanet’s substantial Bitcoin position remains under pressure. The company is the fourth-largest public holder of Bitcoin globally with 30,823 BTC. The holdings are currently valued at approximately $2.82 billion as reported by BitcoinTreasuries.NET.

The firm acquired its Bitcoin at an average price of $108,036 per coin. With Bitcoin recently trading around $91,002, Metaplanet is now sitting on an unrealised loss of 15.17 percent. The decline marks a sharp reversal from the highs seen in October when the company’s treasury position showed improved performance.