Mastercard Reports Significant Progress in Payment Innovations

Multinational payment services giant Mastercard has reported that it tokenised 30% of its transactions in 2024 as part of its ongoing efforts to innovate the payments ecosystem. The company acknowledged the growing influence of stablecoins and other cryptocurrencies, noting their potential to disrupt traditional financial services.

In a filing with the US Securities and Exchange Commission (SEC), Mastercard outlined key advancements in digital payments, including the development of blockchain-based business models and improved access to digital assets. The company emphasised its commitment to prudent risk management while actively supporting blockchain ecosystems and digital currencies.

“Through a principled approach, including applying prudent risk management practices and maintaining continuous monitoring of our partners that are active in the digital asset market, we are focused on supporting blockchain ecosystems and digital currencies,” Mastercard stated.

The company has collaborated with various cryptocurrency firms to enable consumers to purchase digital assets using Mastercard-branded cards and spend their balances at merchants accepting the payment network.

Revenue Growth and Market Expansion

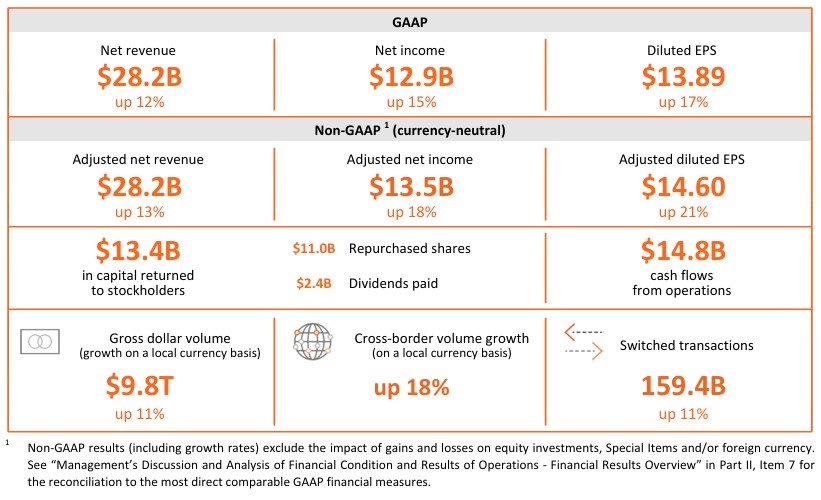

Mastercard also reported a substantial financial performance in 2024, with net revenue reaching $28.2 billion—a 12% increase from the previous year. The rise in revenue underscores the company’s continued expansion and its strategic approach towards integrating innovative payment technologies.

Stablecoins Emerge as Major Competitors

Mastercard acknowledged stablecoins as a growing competitive force in the payments industry. The company recognised that digital currencies have the potential to challenge traditional financial markets and impact its existing products.

According to Mastercard, the increasing regulatory clarity surrounding stablecoins and cryptocurrencies may contribute to their broader adoption. Digital assets offer several advantages, including accessibility, immutability, and transaction efficiency, which make them an attractive alternative to conventional financial instruments.

US Lawmakers Push for Stablecoin Regulation

In the United States, legislators are actively working on regulatory measures to manage the rising influence of stablecoins. US Representatives French Hill and Bryan Steil have introduced a discussion draft for a bill aimed at establishing a regulatory framework for stablecoins. The proposed legislation is intended to enhance the stability and credibility of digital currencies while reinforcing the US dollar’s global dominance.

Stablecoin Transaction Volumes Surpass Visa and Mastercard

Stablecoins experienced a remarkable surge in transaction volumes throughout 2024. Data from cryptocurrency exchange CEX.io revealed that the total stablecoin transaction volume for the year reached $27.6 trillion—exceeding the combined annual volumes of both Visa and Mastercard.

A key contributor to this spike has been the increasing use of automated trading bots. CEX.io lead analyst Illia Otychenko noted that while bot activity accounts for a significant portion of stablecoin transactions, it does not diminish their value, as bots are widely employed to improve market efficiency.

As stablecoins continue to gain traction, their increasing adoption could further challenge traditional payment networks like Mastercard. The company’s proactive approach to digital assets and blockchain innovations indicates a shift towards a more integrated financial landscape, where traditional and digital payment solutions coexist.