Maple Finance, a leading decentralised finance (DeFi) protocol, has unveiled a governance proposal to use 20% of its revenues for monthly buybacks of its native token, SYRUP. The proposal, outlined on 13 January, aims to enhance rewards for stakers and align their interests with the protocol’s success.

The initiative, pending a tokenholder vote scheduled to begin on 20 January, would see Maple purchase SYRUP tokens from decentralised exchanges (DEXs) and over-the-counter (OTC) trading platforms. These tokens would then be distributed to stakers as an added incentive for their commitment to the ecosystem.

Aligning Incentives with Growth

According to the proposal, the buyback mechanism is designed to reward stakers who contribute to the long-term health of the Maple ecosystem. “By distributing repurchased tokens to SYRUP stakers, the DAO [decentralised autonomous organisation] rewards those committed to the long-term health and growth of the Maple ecosystem,” the proposal stated.

The buybacks will complement existing staker incentives funded by inflationary SYRUP emissions. Currently, 20% of new SYRUP emissions — equivalent to 1% of the token’s total supply annually — are allocated to stakers. Based on the current staked SYRUP balance, this equates to a rewards rate of approximately 5% annual percentage yield (APY).

The remaining 80% of SYRUP emissions, or 4% of the total supply annually, will remain in the protocol’s treasury. Maple’s SYRUP token has a market capitalisation of around $88 million, according to CoinGecko.

Solid Financial Backing

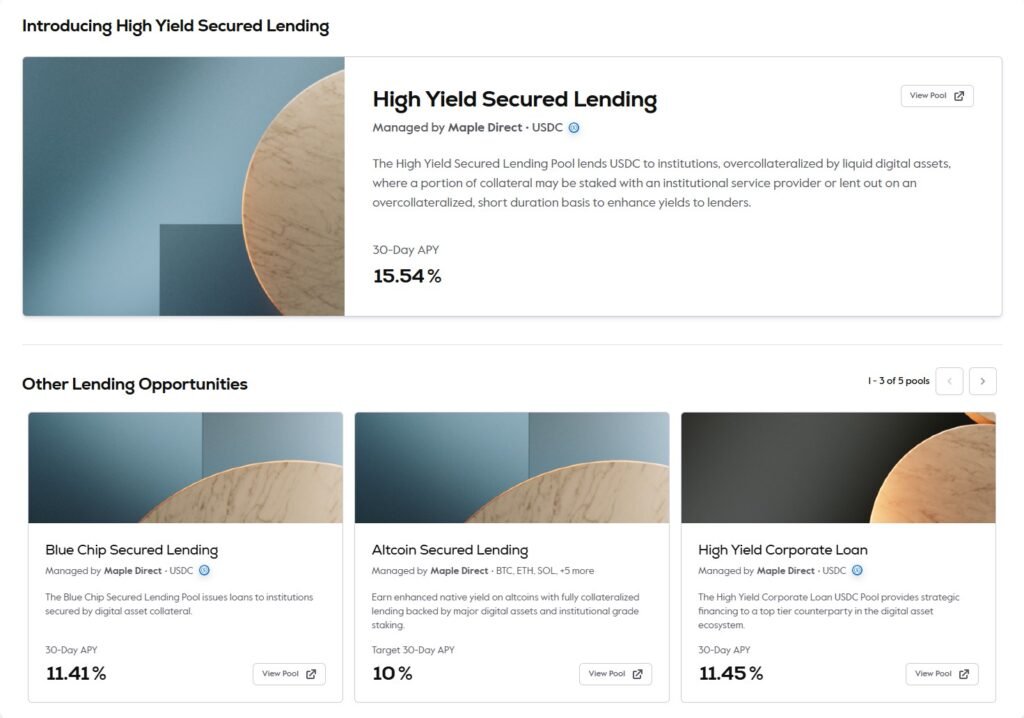

Maple Finance generates approximately $5 million in annualised revenues from its on-chain lending services. The proposed buyback programme seeks to utilise these revenues to create value for tokenholders while fostering greater engagement within the community.

DeFi’s Shift Towards Value Accrual

Maple’s initiative reflects a broader trend in the DeFi sector, where protocols are under increasing pressure to share revenues with tokenholders. Competitors such as Aave, Ethena, and Ether.fi have also introduced mechanisms to drive value accrual for their native tokens.

In November, Ethena, a yield-bearing stablecoin issuer, announced plans to share a portion of its $200 million in protocol revenues with tokenholders. Similarly, in December, Ether.fi proposed allocating 5% of its revenues to buy back ETHFI tokens for stakers.

The growing focus on tokenholder rewards is partly attributed to a potentially favourable regulatory outlook. Pro-crypto President-elect Donald Trump’s victory in the 2024 US election signalled the possibility of a more accommodating environment for DeFi protocols, according to a December report by asset manager Grayscale.

By introducing token buybacks, Maple Finance seeks to reinforce its commitment to value creation for SYRUP stakers, ensuring their interests are closely tied to the protocol’s long-term performance. The outcome of the proposal’s vote on 20 January will determine whether the plan moves forward.