Layer-2 protocol Mantle (MNT) has emerged as one of the strongest performers in the digital asset market, breaking through key resistance levels to register a new all-time high of $2.16. The token’s surge follows months of consolidation and signals renewed investor confidence in Ethereum scaling solutions.

Since bottoming out at $0.55 in July, Mantle’s price has followed a sharp upward trajectory, completing what technical analysts identify as the conclusion of an A-B-C corrective structure. For weeks, MNT struggled to overcome its diagonal resistance and the $1.40 horizontal barrier, but once these were breached, momentum turned explosive.

On-chain and technical indicators continue to support the bullish momentum. Both the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) remain in upward trends, showing no signs of divergence, a common early warning signal of weakening momentum. This suggests that while Mantle may be overextended in the short term, its broader uptrend remains intact.

However, caution may be warranted. Mantle has now reached the 1.61 external Fibonacci retracement level of its most recent decline, an area that often acts as a temporary ceiling for asset prices. Combined with an ending diagonal pattern on its five-wave structure, the move could mark a local top before a short-term correction. Should a pullback occur, analysts identify $1.78 and $1.55 as key areas of support where bulls may look to re-enter the market.

Despite potential volatility, Mantle’s current positioning cements its status as one of the strongest altcoin performers of the quarter.

Aptos Bounces Back, Turning the Tide

While Mantle celebrates new highs, Aptos (APT), the Layer-1 blockchain often compared with Solana for its speed and scalability, has staged an impressive comeback from near-capitulation levels.

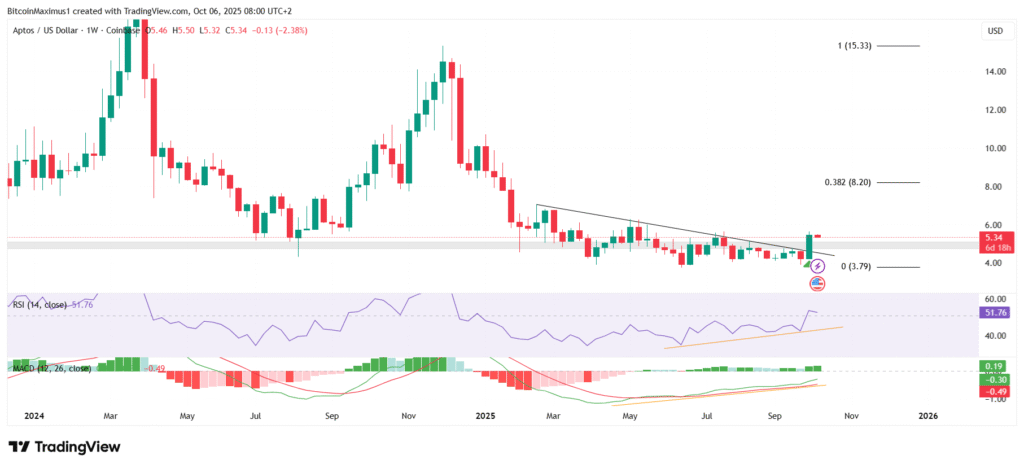

In June, Aptos price action appeared bleak as it broke below the $5 support zone, threatening to set a new all-time low. Yet, in a surprising turn of events, the breakdown proved false and the token swiftly rebounded. The catalyst came last week when Aptos announced a partnership with World Liberty Financial, igniting renewed market enthusiasm and fuelling a bullish engulfing candlestick formation on the weekly chart.

This price action not only reclaimed the $5 support but also invalidated the preceding bearish structure by breaking through a long-term descending trendline. The dual breakout has been interpreted by traders as confirmation that the downtrend may have ended.

Momentum indicators strengthen this outlook. Both RSI and MACD have printed bullish divergences, signalling that selling pressure has exhausted and a fresh accumulation phase could be underway. If the recovery sustains, Aptos may soon challenge the 0.382 Fibonacci retracement resistance at $8.20, setting the stage for a potential medium-term rally.

Layer-2s Outperform as Market Consolidates

The contrasting trajectories of Mantle and Aptos underscore a broader shift within the digital asset market: Layer-2s and scalable Layer-1s are increasingly capturing market share as investors prioritise utility and throughput.

Mantle’s ascent demonstrates how strong fundamentals, such as low transaction costs and Ethereum interoperability can propel a token even amid general market stagnation. Meanwhile, Aptos’s resurgence suggests that sentiment around newer Layer-1 ecosystems is far from dead, especially as strategic collaborations enhance their ecosystem utility.

Market analysts note that liquidity rotation is accelerating toward infrastructure projects offering scalability and developer growth. These tokens are viewed as key beneficiaries of the next wave of adoption, as both institutional and retail participants look for exposure beyond Bitcoin and Ethereum.

What Lies Ahead for Mantle and Aptos

Looking ahead, Mantle may face short-term consolidation after an extraordinary rally, but the broader structure still points upward unless the token closes decisively below $1.55. Any correction from current levels could present a healthy retracement rather than a trend reversal, allowing new participants to enter the market.

Aptos, on the other hand, appears to be in the early stages of a potential recovery cycle. Its recent bullish engulfing candle often precedes multi-week advances, particularly when supported by improving technical indicators. Should buying pressure persist, the $8.20–$9 zone becomes a logical target, representing both a Fibonacci resistance level and a key psychological barrier.

In a broader sense, the performances of Mantle and Aptos could hint at a rotational mini-altseason, where capital flows toward underperforming but fundamentally strong tokens. With Bitcoin and Ethereum showing muted price action, traders appear increasingly willing to explore newer narratives around scaling, interoperability and modular architecture.

Market Leadership Shifts Toward Scalable Solutions

As Mantle sets new records and Aptos reclaims lost ground, both tokens highlight the growing appetite for scalable, next-generation blockchain platforms. Mantle’s parabolic breakout reinforces the dominance of efficient Layer-2 ecosystems, while Aptos’s resilient recovery signals renewed confidence in its long-term viability.

Although short-term corrections are inevitable, both projects are strategically positioned to benefit from the industry’s next growth cycle. If momentum sustains into the final quarter of the year, Mantle and Aptos could remain key leaders in an increasingly competitive and innovation-driven crypto landscape.