Between May 19 and May 25, the crypto market is bracing for a series of high-profile token unlocks that could significantly impact price action and investor sentiment. Headlined by a massive 2.13 billion PYTH token release, this week’s unlocks are expected to introduce notable volatility across several tokens. Unlock events typically lead to increased supply and, in turn, potential selling pressure—especially if early investors seek to realise profits.

Pyth Network (PYTH) – May 20: The Biggest Token Unlock of 2025

Pyth Network will unlock an eye-watering 2.13 billion tokens on May 20—equivalent to 58.3% of the current circulating supply. Valued at over $330 million, this event is one of the largest token releases of the year and could significantly disrupt market dynamics.

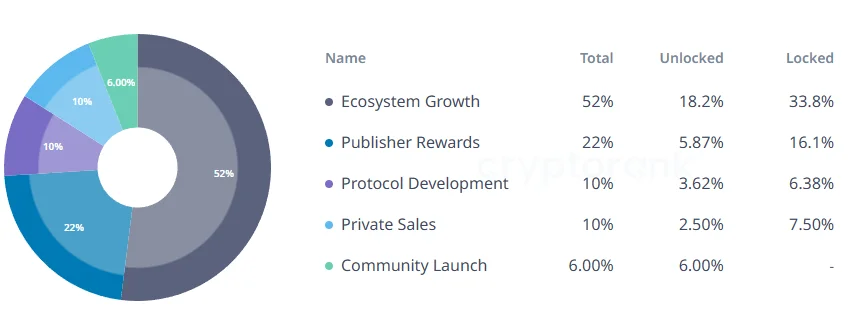

Distribution Details:

- Ecosystem Growth (21.6%): 1.13 billion PYTH tokens will be allocated to initiatives aimed at expanding the Oracle’s adoption and use.

- Publisher Rewards (24.4%): 537.53 million tokens will be distributed to incentivise data providers—an essential part of the network’s decentralised infrastructure.

- Protocol Development (21.3%): Around 212.5 million tokens are earmarked for the platform’s ongoing technical evolution.

- Private Sale Investors (25%): 250 million tokens will unlock for early backers—a potential source of short-term selling pressure.

While the ecosystem-based allocations suggest long-term growth intentions, the sheer scale of the unlock leaves PYTH exposed to intense short-term volatility. Unless substantial demand absorbs this influx, traders should expect increased price swings around the unlock date.

Polyhedra Network (ZKJ) – May 19: Strategic Distribution Amid Risk

Polyhedra Network will release 15.5 million ZKJ tokens on May 19, valued at approximately $33 million. Though not as dramatic as PYTH, the unlock represents a significant event for this emerging ZK-infrastructure project.

Token Allocation:

- Ecosystem and Network Incentives (2.65%): 8.47 million tokens will be used to support participation and long-term protocol utility.

- Community, Airdrop & Marketing (1.74%): 2.61 million tokens will go towards brand outreach and user engagement.

- Foundation Reserves (2.41%): 3.61 million tokens to ensure long-term project sustainability.

- Pre-TGE Purchasers (4%): 800,000 tokens unlocking for early investors.

Despite the well-diversified allocation, the Pre-TGE unlock is a notable risk factor. If early investors decide to cash out, this could apply downward pressure on the ZKJ price. For traders, it’s important to monitor trading volumes and whale activity in the days leading up to and following the unlock.

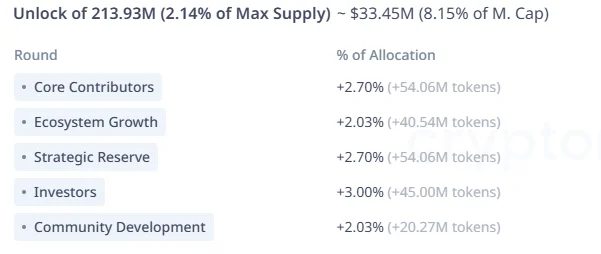

Saros (SAROS) – May 19: Solana-Linked Token Faces 8.15% Circulation Spike

Also unlocking on May 19, Saros will release 213.93 million SAROS tokens, amounting to 8.15% of its current circulating supply—worth an estimated $28 million.

Key Allocations:

- Core Contributors: 54.06 million tokens

- Ecosystem Growth: 40.54 million tokens

As a project operating within the Solana ecosystem, SAROS benefits from a strong blockchain infrastructure and growing community. However, the unlock introduces a substantial volume into the market, and its impact will depend heavily on investor sentiment and liquidity at the time.

If sentiment remains strong across Solana projects, the unlock could be absorbed without major disruptions. However, traders should prepare for short-term fluctuations, especially if contributors opt to sell portions of their newly unlocked tokens.

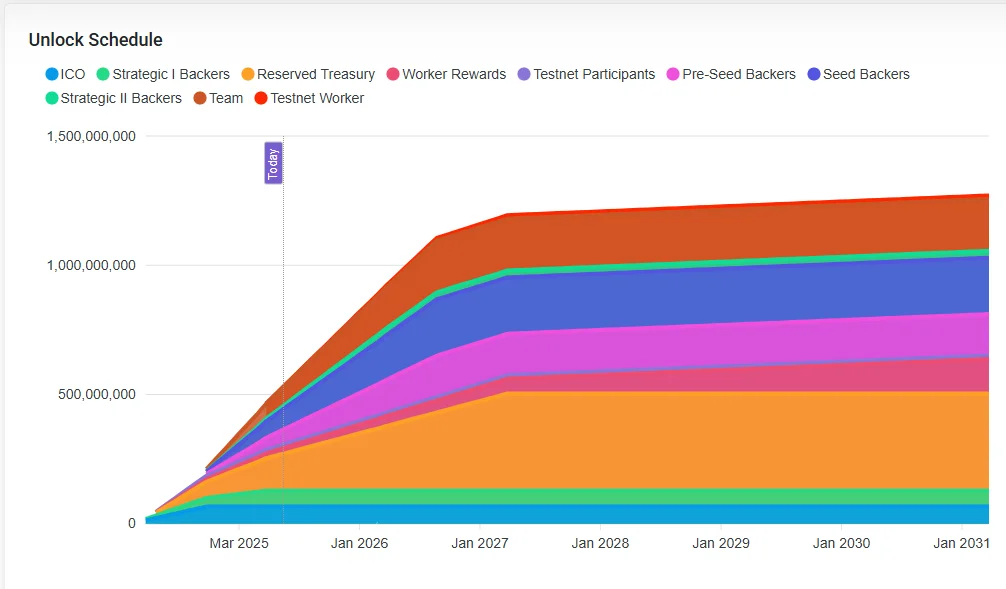

Subsquid (SQD) – May 25: Smaller Token Unlocks, Bigger Risk?

On May 25, Subsquid will unlock 38.1 million SQD tokens, representing 2.86% of its total supply and valued at $10.2 million. While modest in scale, the impact could be outsized due to the project’s relatively low liquidity.

Market Considerations:

- Subsquid is a newer player in the blockchain data indexing space.

- Even small shifts in token supply could trigger notable price swings.

- The unlock is part of its regular vesting schedule and includes team and investor distributions.

If early stakeholders decide to exit positions, SQD could face short-term downward pressure. However, strong demand for on-chain data services could offset these risks if the project’s fundamentals remain solid.

Volatility Ahead—Proceed With Caution

The coming week’s unlocks—led by PYTH’s massive release—are likely to inject substantial liquidity and uncertainty into the crypto markets. While these events reflect planned distribution schedules meant to support growth and ecosystem development, they also present real risks for short-term holders.

Traders should:

- Monitor unlock timelines and wallet activity closely.

- Evaluate project fundamentals before reacting to price swings.

- Exercise caution with leveraged positions during periods of expected volatility.

Ultimately, token unlocks are double-edged swords. They may provide liquidity and accelerate adoption if well-managed—but they can just as easily lead to selling pressure and price drops if the market isn’t prepared.