Linea’s long-awaited airdrop launched on 9 September, marking one of the largest Ethereum-based token distributions in recent years. While the rollout has been hailed as a milestone for decentralised finance, it also sparked controversy due to network congestion, high fees and debates around fairness in allocation.

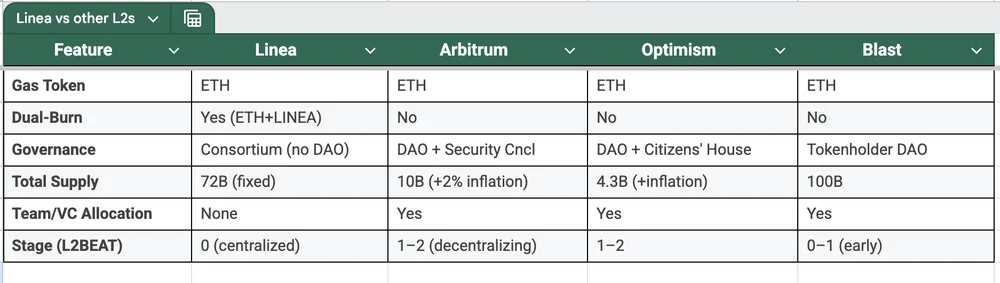

Despite these challenges, Linea’s experiment stands out for its unique deflationary tokenomics and the absence of allocations for venture capitalists or insiders, setting it apart from most Layer-2 projects.

What Is Linea?

Linea, a Layer-2 scaling solution built on Ethereum, launched its mainnet in 2023 and positioned its token as one of the most important releases since Ethereum itself. The airdrop was designed to give initial ownership solely to users, with no tokens reserved for team members or early investors.

The launch distributed 9.36 billion tokens to around 749,000 eligible wallets, making it one of the biggest airdrops in Ethereum’s history. Recipients now have 90 days to claim their tokens.

The team has also promoted the creation of what it calls the largest ecosystem fund ever established, aimed at supporting developers, projects and long-term growth across the Linea ecosystem.

A Rocky Rollout

The excitement around the airdrop was tempered by technical hiccups. Just before the Token Generation Event (TGE), Linea’s mainnet sequencer faced performance issues that briefly halted block production. Developers managed to fix the problem within an hour and the network has since stabilised.

Even so, many users expressed frustration. Transaction fees spiked during the claim process and long waiting times left some participants disillusioned. Others argued that the distribution unfairly favoured Binance Alpha users and BNB holders over active farmers.

Such criticism highlights the growing tension between ensuring accessibility and rewarding loyal community members in large-scale token launches.

Tokenomics: A Deflationary Experiment

Linea’s tokenomics are one of its most striking features. The total supply of LINEA is capped at 72 billion, with 22% (around 16 billion) made available at launch. Of this, 9% went to the airdrop, 1% to strategic builders, and a massive 75% was allocated to the ecosystem fund.

Only 15% of the supply is reserved for Consensys, Linea’s parent company and those tokens remain locked for five years. Importantly, there are no allocations for venture capitalists or insiders, a rarity in today’s crypto market.

Unlike many Layer-2 tokens, LINEA will not be used to pay gas fees. Instead, it is focused on ecosystem incentives, growth programmes and eventually, governance.

The dual-burn model is another innovation. Under this system, 20% of net Layer-2 fees are burned directly as ETH, while the other 80% is used to buy LINEA on the open market and then burn it. This mechanism creates steady buying pressure while reducing supply, reinforcing the token’s deflationary design.

However, there are trade-offs. The absence of a DAO or public governance means decision-making remains centralised. Without community voting rights, long-term transparency and control are potential concerns.

Price Reaction and Outlook

The market reaction to the airdrop has been volatile. LINEA’s price dropped by 27% shortly after launch, hitting an all-time low of $0.22. While it briefly recovered, the token has since slipped again, breaking below its ascending support line.

Analysts suggest that if the decline continues, the price could fall further towards $0.019, based on external Fibonacci retracement levels. Still, given the early stage of trading, any technical outlook remains speculative.

Long-term performance will likely depend on whether Linea’s ecosystem fund succeeds in driving adoption and whether its dual-burn mechanism delivers sustainable value to holders.

The Linea airdrop is one of the boldest token launches in Ethereum’s history. By excluding insiders and VCs, distributing billions of tokens to everyday users and introducing a dual-burn model, it offers a fresh approach to tokenomics.