Kraken has launched a derivatives trading platform in Bermuda, following approval from the Bermuda Monetary Authority (BMA). The platform is now licensed under the island’s regulatory framework, positioning Bermuda as an increasingly attractive hub for crypto businesses seeking to expand.

Class F License Secured

Kraken’s legal entity, Payward Digital Solutions, received a Class F Digital Business License from the BMA on July 30. This license enables Kraken to provide various services, including operating a digital asset derivatives exchange, offering wallet services, and facilitating digital asset lending. Alexia Theodorou from Kraken Derivatives praised the BMA’s licensing process for its fairness and focus on consumer protection.

https://www.instagram.com/p/C–RaHRR-Zz/?utm_source=ig_web_copy_link

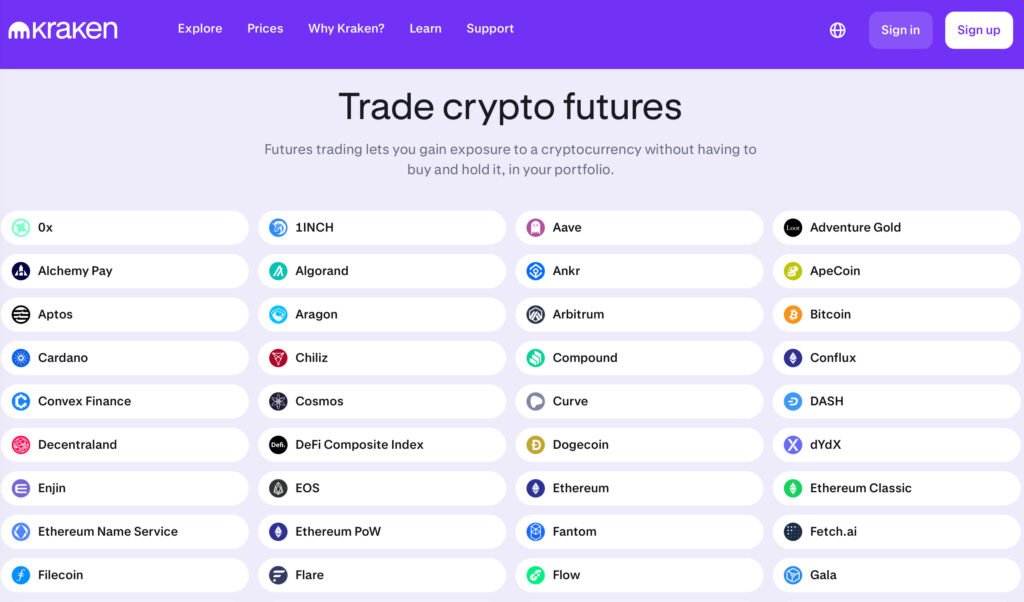

Wide Range of Derivatives Offered

Kraken’s new platform will initially offer perpetual and fixed maturity futures, with over 200 contracts available for trading. Users will have the option to use fiat currency and more than 30 cryptocurrencies as collateral. According to Kraken’s Head of Trading, Shannon Kurtas, derivatives now account for the majority of crypto trading volumes, and Kraken expects continued growth in this area.

Bermuda: A Growing Crypto Hub

Under Premier E. David Burt, Bermuda has established itself as a pro-crypto jurisdiction. The Bermuda Digital Asset Business Act passed in 2018, has attracted several crypto exchanges, including Binance and Coinbase International. Burt welcomed Kraken’s expansion, emphasizing Bermuda’s commitment to maintaining international compliance standards.

Kraken’s move comes as the exchange faces increasing regulatory scrutiny from the US Securities and Exchange Commission (SEC), which fined the company $30 million in February 2023 and charged it with operating an unregistered securities exchange later that year.