Crypto exchange Kraken is reportedly looking to raise $500 million in a new funding round that would value the company at $15 billion. According to a report by The Information, the move comes as the American-based exchange positions itself for an initial public offering (IPO), expected as early as the first quarter of 2026.

Kraken was last valued at around $11 billion in 2022. The fresh capital injection is seen as part of its strategic push to strengthen its balance sheet and scale further ahead of its market debut. Bloomberg had previously reported Kraken’s IPO plans, noting that the firm was increasingly optimistic due to a more favourable regulatory climate in the United States under the Trump administration.

Riding the IPO Wave

Kraken is not alone in eyeing public markets. A wave of crypto and fintech firms have recently gone public or announced plans to do so, taking advantage of investor optimism and regulatory clarity.

Circle, the issuer of the USDC stablecoin, launched its IPO in June and raised $1 billion. Its shares debuted at $31 and have since soared over 484%, trading above $181 at the latest close.

Trading platform eToro also went public in May at $52 per share and has since gained over 16.5%, closing at $60.71. Coinbase, which went public in 2021, has surged over 50% in 2025 alone, while Robinhood Markets, which supports crypto trading alongside stocks, has gained 162% so far this year.

Kraken’s reported fundraising and IPO ambitions reflect growing confidence in the crypto market and renewed investor interest in blockchain-based businesses. The current momentum appears to be driven by more transparent regulations, surging crypto adoption, and increased institutional participation.

Kraken’s Market Standing and Growth

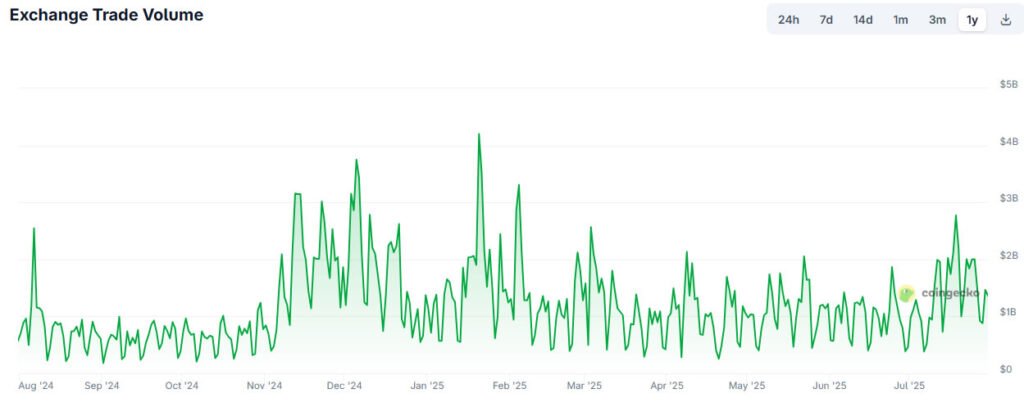

Kraken currently sees around $1.37 billion in daily trading volume and supports over 1,100 trading pairs, according to CoinGecko. Though smaller than its primary US competitor, Coinbase, which has $2.77 billion in daily volume and 448 trading pairs, Kraken continues to expand both its user base and service offerings.

With a broader selection of trading pairs and active development in user-facing tools, Kraken remains one of the most established players in the crypto exchange space. Its growing influence and upcoming IPO could help it close the gap with Coinbase, particularly if the market rally continues.

Regulatory Wins Boost Confidence

A major driver behind Kraken’s current momentum is the improving regulatory landscape in the United States. In March 2025, the Securities and Exchange Commission (SEC) dropped its long-standing securities lawsuit against Kraken, which had been seen as a cloud over its future public listing.

This dismissal is part of a broader regulatory shift. Under the current administration, several crypto-related legal actions have been resolved or dropped, paving the way for companies like Kraken, Ripple, Gemini, Galaxy Digital, Grayscale, and Bullish to consider or prepare for IPOs.

These developments suggest a friendlier environment for crypto innovation and growth, encouraging firms to go public and tap into traditional capital markets for expansion.

Expanding Global Footprint

Kraken is also making major moves in Europe. In June, the exchange launched a peer-to-peer payments app called “Krak,” allowing users to send both fiat and crypto across borders.

Additionally, Kraken secured a key licence under the European Union’s new Markets in Crypto-Assets (MiCA) framework. This regulatory approval enables Kraken to broaden its services across the EU, a market with increasing demand for regulated crypto services.

By entering new regions and rolling out consumer-friendly products, Kraken is not only positioning itself for its IPO but also preparing for long-term global competitiveness.

Kraken’s $500 million fundraising plan, $15 billion valuation target, and expected IPO in 2026 come at a time when crypto companies are gaining investor attention and regulatory support. With expanding operations, strong market presence, and a clearer regulatory path, Kraken’s next phase could mark a defining moment for both the company and the broader crypto industry.