Investigation Underway After Unusual Wallet Movements

Decentralized identity protocol IoTeX has confirmed it is investigating suspicious activity connected to one of its token safes after onchain analysts flagged a possible security breach.

In a post shared on X on Saturday, the project said its team is actively working to assess the situation and limit any potential fallout. According to IoTeX, preliminary findings suggest that the actual losses may be lower than figures circulating on social media.

The team also said it has coordinated with major exchanges and security partners to trace the movement of funds and, where possible, freeze assets linked to the suspected attacker.

“The situation is under control. We will continue to monitor closely and provide timely updates to the community,” the project stated.

Token Price Slips Following Disclosure

News of the suspected breach weighed on market sentiment. IoTeX’s native token IOTX fell more than 8 percent over 24 hours, trading at roughly $0.0049 at the time of reporting, based on data from CoinMarketCap.

While price fluctuations are common in the crypto market, security-related incidents often trigger sharper short-term declines as traders react to uncertainty. The extent of the financial damage remains under review, but the market response reflected investor caution.

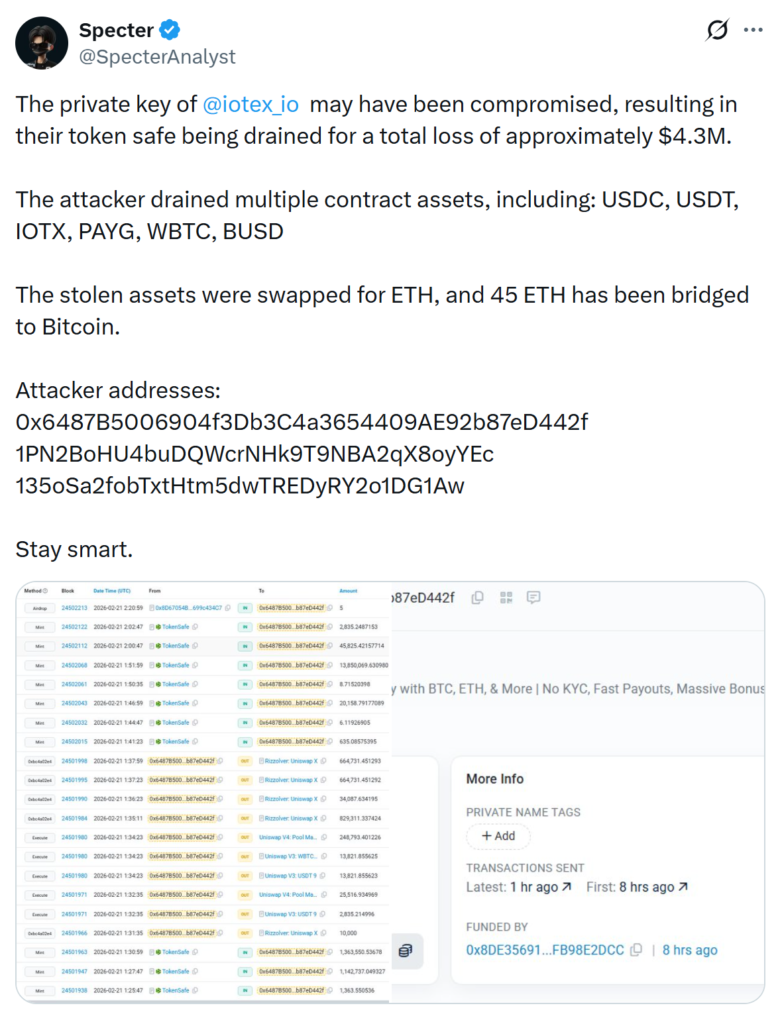

Analyst Points to Possible Private Key Compromise

The investigation follows claims by onchain investigator Specter, who suggested that a private key linked to the affected token safe may have been compromised.

According to the analyst, the wallet was drained of several assets, including USDC, USDT, IOTX and wrapped Bitcoin. Losses were estimated at around $4.3 million.

The stolen tokens were reportedly swapped into Ether, with approximately 45 ETH later bridged to Bitcoin. Transaction records shared by the investigator showed rapid token swaps and movements across decentralized exchanges, indicating a deliberate effort to convert and relocate funds quickly.

Such cross-chain transfers are often used to complicate tracking and recovery efforts, as they disperse assets across multiple networks within minutes.

IoTeX has not publicly confirmed the exact amount lost but reiterated that early assessments indicate lower exposure than widely rumored.

Coordinated Response With Exchanges

In its public update, IoTeX said it is working closely with exchanges and security firms to identify and freeze suspicious transactions. Freezing funds requires swift communication, especially when assets are moved through centralized trading platforms.

Projects facing similar situations often race against time in the first few hours after an incident. Rapid swaps and bridging activities can make recovery difficult if coordination is delayed.

The IoTeX team emphasized that containment efforts are ongoing and promised further updates as the investigation progresses.

Hacks Continue to Test Crypto Projects

Security breaches remain one of the biggest challenges in the digital asset industry. Industry leaders have noted that a large portion of crypto projects hit by major exploits struggle to recover fully, not only because of financial losses but also due to the way incidents are handled.

Mitchell Amador, CEO of Immunefi, previously said many teams are not adequately prepared for breaches. Delays in communication and unclear crisis management can intensify damage and erode trust.

Alex Katz, CEO of Kerberus, has also warned that even when technical issues are resolved, the reputational fallout can linger. Users often withdraw funds, liquidity declines and rebuilding confidence becomes an uphill task.

For IoTeX, the coming days will be critical. Transparent communication, effective fund tracking and timely updates will likely shape how the community and broader market respond to the incident.

While the full scope of the breach is still being determined, the episode serves as another reminder of the security risks that continue to shadow the fast-moving crypto ecosystem.