Hyperliquid, a layer-1 decentralized exchange (DEX) focused on perpetual futures, has posted its strongest month to date in July 2025. The protocol’s monthly trading volume surged to a record-breaking $320 billion, representing a 47% increase from June’s $216 billion and a 28% jump from May’s previous record of $248 billion.

This performance cements Hyperliquid’s position as the leading decentralized perpetual futures platform, commanding more than 75% of the DEX market for perpetuals and capturing 11.9% of Binance’s perpetual volume. For perspective, Binance’s perpetual volume reached $2.59 trillion in July, highlighting how rapidly Hyperliquid is closing the gap between centralized and decentralized trading infrastructures.

The month was driven by strong demand for Ethereum and altcoin derivatives, particularly Solana and Avalanche, and saw no idle trading days throughout. Open interest surged past $15 billion, supported by high-net-worth trader activity and increasing appetite for leveraged products.

Infrastructure & Execution Driving Competitive Edge

Hyperliquid’s rise isn’t just about market growth, it’s about infrastructure. Unlike most competitors, Hyperliquid is built as a layer-1 protocol specifically designed for perpetual contracts. This allows it to offer zero gas fees, a fully on-chain matching engine, and minimal latency, an ideal setup for traders demanding fast, transparent execution.

In July, traders frequently cited low slippage and execution reliability as core reasons for shifting away from centralized exchanges and toward Hyperliquid. The platform’s robust liquidity and efficient architecture make it highly suitable for large traders, often referred to as “whales,” who played a major role in July’s volume surge.

Fee Generation and Token Dynamics

Trading activity translated directly into significant protocol revenue. Hyperliquid generated between $2 million to over $4 million in daily trading fees throughout July. Meanwhile, the total value locked (TVL) on the platform reached $597 million, demonstrating strong liquidity support and capital confidence from users.

However, not all metrics were up. The platform’s native token, HYPE, declined by 17% over the month, falling from near $50 to around $38.50. While some attribute this to broader market risk aversion and thin liquidity, others point to profit-taking by early investors amid surging platform activity.

Still, the token remains core to the platform’s economic model with one key aspect drawing analyst attention.

Unprecedented Buyback Rate: Analyst Perspective

Perhaps the most underappreciated part of Hyperliquid’s July performance is its token buyback pace, which is becoming a central pillar of its long-term value proposition.

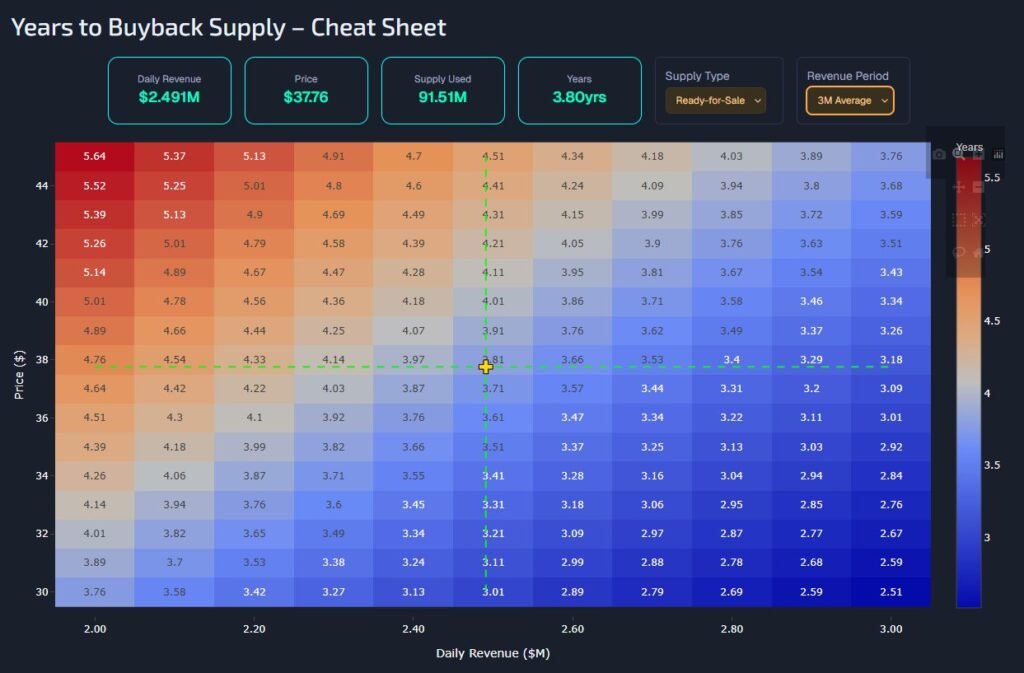

According to crypto trader Moon, if the current buyback rate continues, Hyperliquid will repurchase the entire circulating supply of HYPE tokens within four years. This claim, while bold, is supported by the numbers:

- Daily buyback estimate (based on revenue): Assuming 25–30% of fees are used for token buybacks, and an average of $3 million daily revenue, that’s $750K–$900K/day allocated to buybacks.

- Monthly buybacks: ~$23–27 million in HYPE tokens bought off the market.

- Current circulating supply value (@ $38.50 price): ~$1.5 billion.

- Estimated full buyback period: 3.7–4.2 years at current rates.

This level of deflationary pressure is unprecedented for a liquid token with this much utility. Most crypto tokens dilute over time; HYPE appears poised to become increasingly scarce, with consistent on-chain demand and rapidly decreasing float.

No other major crypto project, be it Ethereum, Solana, or even Bitcoin, has sustained this scale of revenue-backed, aggressive buyback mechanics within such a short time frame.

Can Hyperliquid Keep Up the Momentum?

While July’s performance is nothing short of historic for Hyperliquid, the road ahead is complex. The DEX must now sustain its trading volumes, fend off rising competitors like dYdX and GMX, and maintain user loyalty in an evolving regulatory and macro environment.

With perpetual futures markets seeing renewed institutional and retail interest, Hyperliquid has a clear runway for growth. Its ability to offer zero-gas trading, high liquidity, and tokenholder-focused incentives puts it in a strong position as the on-chain derivatives segment matures.

If August sees similar performance, Hyperliquid may not just dominate decentralized futures, it may reshape how traders and investors view crypto token models entirely.