Decentralised finance (DeFi) perpetual futures exchanges have reached an all-time high in trading volume, with the sector recording a remarkable $487 billion in July 2025. Leading this surge is Hyperliquid, which alone contributed $319 billion, reflecting the growing traction of decentralised platforms over their centralised counterparts.

Hyperliquid Leads the Pack with $319 Billion in Monthly Volume

According to data from DeFi analytics platform DefiLlama, Hyperliquid has set a new benchmark in the DeFi perpetual futures space by processing $319 billion worth of trades in July. This marks the highest monthly volume ever recorded for a decentralised perpetual exchange. The impressive figure signals a significant shift in trader behaviour, with more users embracing decentralised exchanges (DEXs) due to their transparency and control over funds.

Despite experiencing a 37-minute outage on 29 July, which temporarily halted trading, Hyperliquid maintained its momentum. The platform reimbursed affected users with a total of $2 million, a move that drew praise from the crypto community for its swift and responsible action.

DeFi Perps Grow 34 Percent Month-on-Month

The total DeFi perpetual futures market grew by 34 percent in July compared to June’s $364 billion volume. This growth is largely attributed to Hyperliquid’s rising dominance and increased user activity. The platform’s share now significantly outpaces other DeFi perp DEXs, with EdgeX coming in second with a monthly volume of $21 billion, followed by MYX Finance at over $9 billion.

DeFi perpetual futures allow traders to speculate on cryptocurrency prices without expiry dates, offering greater flexibility and continuous trading opportunities. As more users seek alternatives to centralised crypto exchanges, DeFi perps are becoming a preferred choice.

User Base and Features Fuel Hyperliquid’s Rise

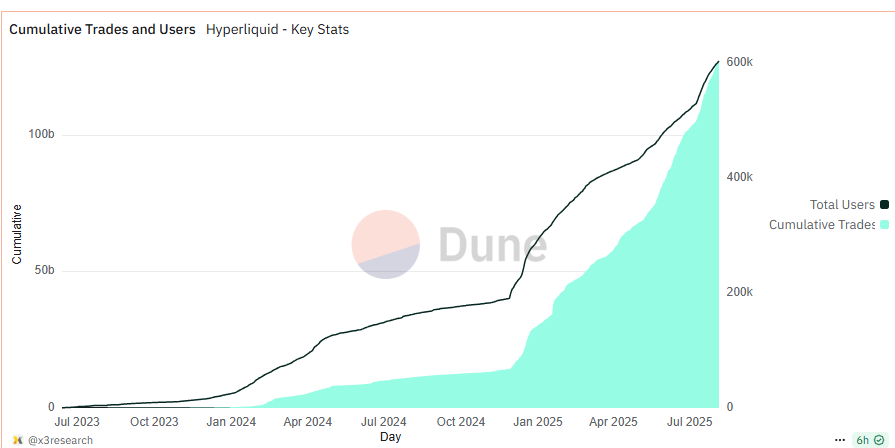

Hyperliquid’s user base has also seen rapid growth. As of early August, the exchange boasts over 604,400 registered users, up from 488,000 on 6 June, based on data from Dune Analytics. This sharp rise is attributed to the platform’s April 2024 launch of spot trading, supported by an aggressive token listing strategy and an intuitive user interface. These features have made the platform particularly attractive to both novice and experienced traders.

Hyperliquid now ranks as the seventh-largest derivatives exchange globally in terms of daily trading volume, underscoring its expanding influence in the crypto space.

The Shift from Centralised to Decentralised Exchanges

The growing popularity of Hyperliquid and other DeFi platforms indicates a broader shift within the crypto ecosystem. Traders are increasingly moving away from centralised exchanges (CEXs), favouring decentralised options that offer greater autonomy, reduced custodial risk, and often more competitive fees.

While centralised platforms still dominate the market in terms of total volume, the momentum is clearly tilting towards decentralised alternatives. Hyperliquid’s recent performance is not just a milestone for the platform, but a significant indicator of the evolving trading landscape.

Conclusion

The record-breaking figures posted by Hyperliquid and the DeFi perpetual futures sector in July highlight a growing trend in decentralised trading. With user-friendly platforms, enhanced trust, and increasing liquidity, DeFi perp DEXs are carving out a larger slice of the crypto market. As platforms like Hyperliquid continue to innovate and expand, the decentralised trading space appears poised for sustained growth.