The crypto market thrives on information flow. Yet the main challenge for traders and investors is rarely scarcity but an overwhelming flood of news, social posts and onchain data. Sorting signal from noise often consumes more energy than the actual investment decision. Grok 4, developed by XAI, aims to simplify this process by combining social sentiment analysis, fundamental summaries and onchain checks in one tool.

With the ability to pull live conversations from X, apply DeepSearch across the web and use “Grok Think” for higher reasoning, the system presents itself as a rapid investigator. While it should not replace independent verification, it provides a structured way to filter out hype-driven projects and highlight tokens with stronger fundamentals.

Turning Social Hype into Research Signals

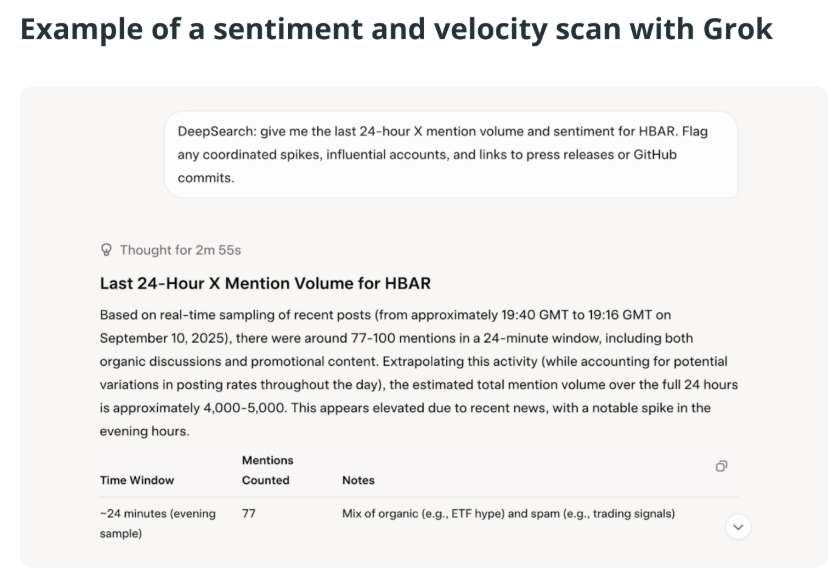

Many coins rise and fall on narrative momentum. A sudden surge in mentions on X or Telegram can move markets, yet most spikes fade before price action catches up. Grok 4 helps identify these shifts early by scanning sentiment volume and tone, while flagging whether the activity appears organic or coordinated.

Through DeepSearch, the model expands beyond tweets to gather context from primary sources such as token contracts, white papers and official announcements. This enables investors to move from scattered commentary to consolidated evidence.

The advantage lies in speed. What previously required hours of manual browsing across feeds and blockchain explorers can now be condensed into a single scan. Grok 4 effectively turns hype into structured data that can be ranked and compared.

Building a Repeatable Pre-Screen

Discipline is vital when assessing tokens. Instead of chasing every rumour, investors can use Grok 4 for a repeatable screening process. A suggested workflow includes:

- Creating a focused watchlist of 10 to 20 tokens, grouped by theme such as layer 2s or oracles.

- Running sentiment scans for mention spikes, tone and suspicious coordination.

- Summarising fundamentals by condensing white papers, roadmaps and tokenomics into bullet points highlighting use cases, issuance, audits and risks.

- Verifying contracts and audits by fetching addresses and audit reports, then cross-checking with blockchain explorers.

- Confirming onchain data such as fees, inflows, liquidity and total value locked through tools like DefiLlama and CoinGecko.

- Checking liquidity depth to avoid thin order books that could trap capital.

- Applying a red flag checklist covering token unlock schedules, wallet concentration, team transparency and audits.

By the time a project clears these filters, only a small fraction of tokens remain for deeper manual research.

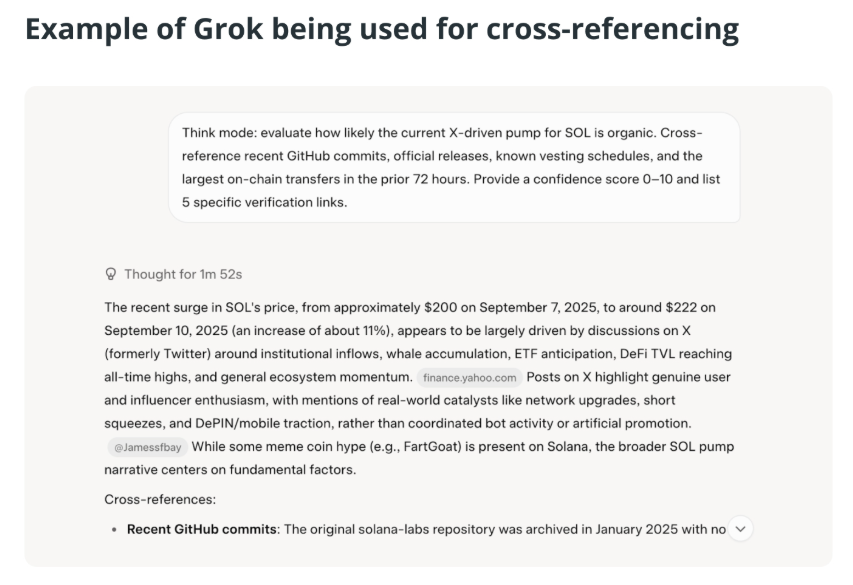

Confirming Signals Beyond Sentiment

Passing the initial filter is not enough. To avoid falling for short-lived pumps, Grok 4 can be combined with confirmation rules. For example, sentiment spikes must align with fundamental progress such as GitHub commits, white paper updates or active addresses rising onchain.

A practical rule set might include four conditions:

- A sentiment surge backed by at least three reputable sources.

- Onchain activity increasing by 20 per cent week on week.

- No major token unlocks approaching.

- Adequate liquidity in decentralised exchanges or order books.

Grok 4 can be prompted to cross-reference these elements and even assign a confidence score. When paired with checks on whale flows and exchange deposits, this step ensures that excitement on social media is supported by real market behaviour.

Backtesting and Automation for Consistency

To build a repeatable system rather than relying on ad hoc trades, investors can use Grok 4 in backtests. Historical sentiment spikes can be matched with price reactions across one-hour, six-hour and twenty-four-hour windows. If results show consistent patterns with manageable slippage, those signals may be worth integrating into a trading framework.

At scale, Grok outputs can feed into a structured engine combining alerts, confirmation rules and human approval. Automated order placement can then follow disciplined risk management rules, such as fixed position sizing or Kelly criterion adjustments.

However, reliance on a single tool introduces risks. Due to moderation issues and the potential for inaccurate summaries, Grok 4 should never be treated as a final arbiter. All insights require verification from independent sources before capital is deployed.

A Rapid Investigator, Not a Safety Net

In a market driven as much by narrative as by fundamentals, Grok 4 provides a valuable advantage: speed in turning hype into structured insight. It filters low-quality projects, highlights red flags and ensures that serious research time is spent only on viable tokens.

Yet it remains a tool, not a guarantee. Investors who treat Grok 4 as a fast investigator rather than a safety net will gain the most from its capabilities. In a landscape where narrative momentum can create fortunes or losses within hours, that discipline may prove its greatest value.