Day trading in cryptocurrencies is a high-speed pursuit where order books flip within seconds, narratives rotate rapidly and liquidity can vanish without warning. Traders need tools that help them process vast amounts of information without losing discipline. Google’s Gemini AI is emerging as a co-pilot for such traders, offering structured insights while leaving execution firmly in human hands.

AI as a Co-Pilot in Trading

Unlike swing traders who ride market trends for days or long-term investors who hold assets for months, day traders thrive on volatility. In crypto, that volatility is supercharged by 24/7 markets, sudden narrative-driven surges and thin liquidity that can punish unplanned entries. Gemini AI steps in as an assistant rather than a replacement. It helps filter genuine catalysts from background noise, summarise data and turn scattered signals into coherent strategies.

The AI’s strengths include reasoning over large contexts, summarising datasets in Google Docs or Sheets and generating quick visualisations. Developers can also use the Gemini API for more advanced scripts and dashboards. What it cannot do is execute trades directly or securely manage private keys, meaning traders must pair it with platforms such as TradingView, Glassnode or CryptoQuant to access real-time feeds.

Building a Trading Loop with Gemini

One of Gemini’s most practical uses lies in structuring daily workflows. Traders can create a “trading notebook” in Google Sheets divided into six tabs: Watchlist, Catalysts, Levels, Order Flow, Plan and Post-Mortem. Gemini then supports each step with reasoning and summaries.

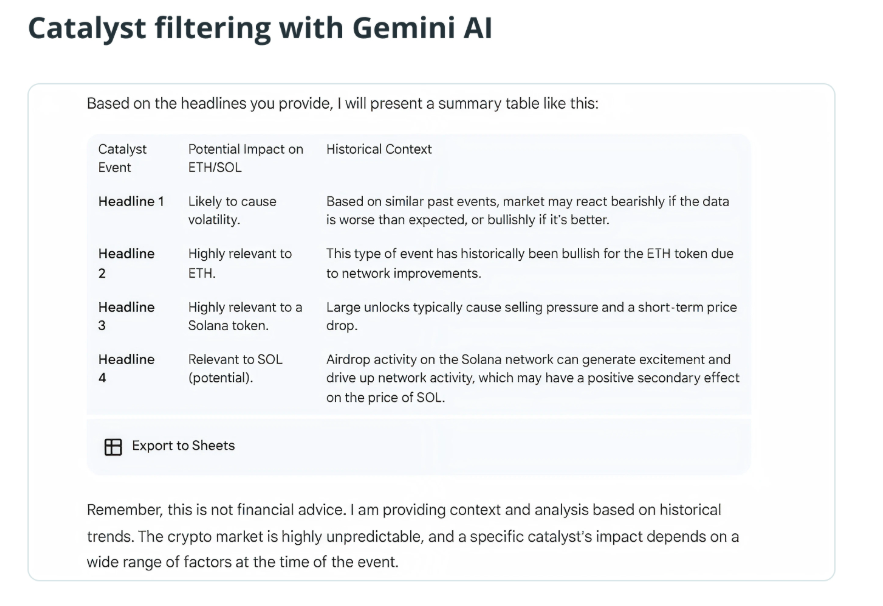

For instance, instead of monitoring fifty tokens, a trader might input data for just three such as Bitcoin, Cardano and Solana. Gemini can highlight which have shown the largest swings and rank them by risk profile. Similarly, pasting a list of headlines into Gemini can reveal which events are most likely to influence specific assets within the next twelve hours.

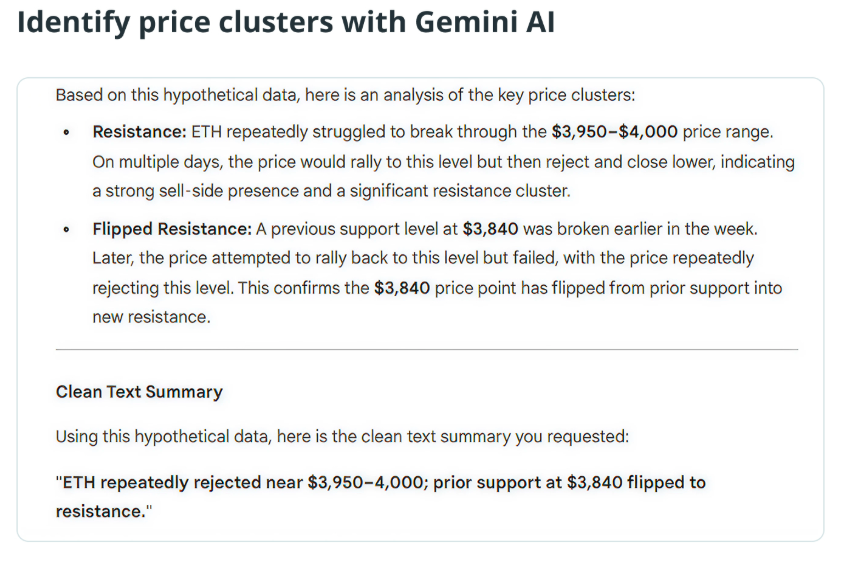

In technical analysis, the AI can interpret OHLCV data and identify repeated rejection zones or flipped support levels. It also helps interpret open interest and wallet flow data to show whether positioning is skewed towards longs or shorts.

Enforcing Trading Discipline

Day trading often suffers from emotional decisions made under pressure. Gemini AI helps enforce discipline by converting observations into structured plans. For example, traders can request three possible intraday scenarios complete with entry triggers and invalidation points. Instead of chasing FOMO, they follow pre-defined playbooks.

Post-mortem analysis is another area where the AI proves useful. By reviewing recent trades, Gemini can spot behavioural patterns such as cutting winners too early or letting losers run. This feedback loop helps traders adapt and improve systematically.

Strengthening Risk Management

Managing risk is crucial in fast-moving crypto markets. Gemini AI assists by calculating position sizes based on account size and leverage, ranking planned setups by risk-to-reward ratio and balancing capital allocation across assets. It can also generate bearish and sideways scenarios alongside bullish cases, ensuring traders remain flexible.

By integrating these functions, Gemini AI does not eliminate the dangers of crypto day trading but helps traders survive downturns and remain prepared for opportunities.

The Future of AI in Trading

Gemini Flash 2.5 remains limited by its lack of real-time data streaming. Cross-checking AI-generated insights against live charts is essential before acting on them. Even so, the system demonstrates how AI can transform a noisy, distraction-filled trading environment into a structured decision-making process.

As Google expands Gemini’s features across Workspace and its developer ecosystem, the model is likely to become more deeply embedded in financial workflows. For now, it stands as a valuable research and discipline tool rather than an autonomous trader.