As the crypto market navigates turbulent waters, Hamster Kombat (HMSTR) finds itself on the defensive, with its price chart reflecting five straight days of bearish pressure. From a local high of $0.0029 on May 10, the asset has slipped to $0.0024 at press time raising questions about the token’s short-term trajectory and long-term resilience.

While technical indicators suggest HMSTR is approaching oversold levels, a solid bullish reversal is not yet visible on the horizon. Here’s a deep dive into the current technical outlook and what may lie ahead for this altcoin.

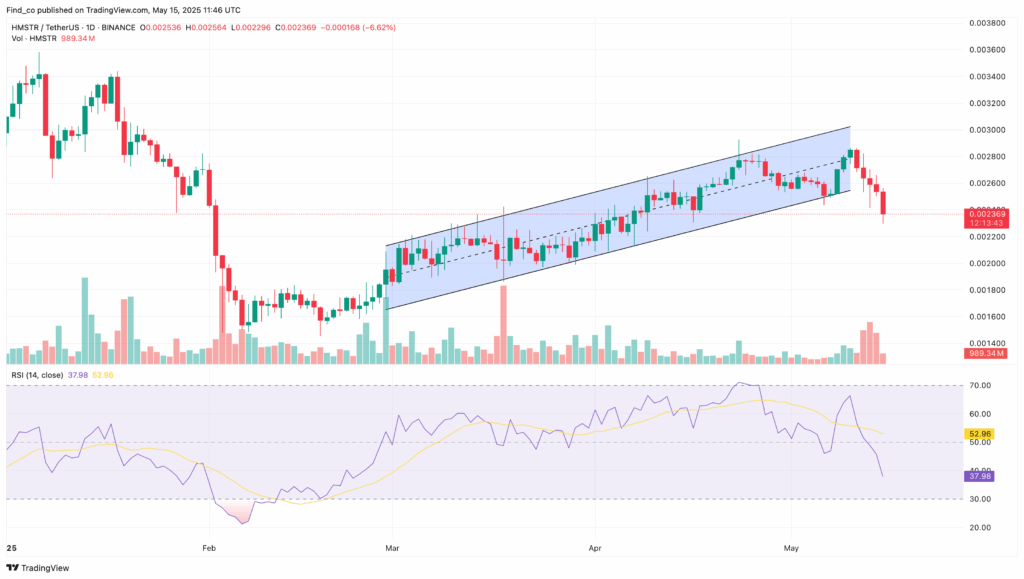

Consecutive Red Candles Signal Weak Momentum

Since May 11, HMSTR has been on a persistent downtrend, recording five consecutive bearish daily candlesticks. This slump followed a rally that pushed the token to $0.0029, but the gains were short-lived.

The Relative Strength Index (RSI), a momentum oscillator used to gauge market sentiment fell sharply from a high of 65.78 on May 10 to 38.10 at present. This substantial drop reflects a clear decline in bullish strength and buying interest. With the RSI moving closer to the oversold zone (below 30), a relief rally could be expected. However, reaching an oversold level does not guarantee an immediate bounce, especially when broader market momentum remains unclear.

Support and Resistance: The Battle Between $0.0023 and $0.0028

Between February 27 and May 10, HMSTR maintained a relatively bullish stance by trading within an ascending parallel channel, which supported a price climb from $0.0016 to $0.0028. However, the recent decline has broken both the upper and lower bounds of this channel, signalling a weakening structure.

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) indicator, HMSTR now finds itself squeezed between strong support and resistance levels. Roughly 7 billion tokens were purchased at the $0.0023 level, creating a potential cushion against further downside. Conversely, resistance is building near $0.0028, with over 4 billion tokens currently at a loss — a level likely to face significant selling pressure if revisited.

Given these dynamics, price consolidation between $0.0023 and $0.0028 appears likely in the short term, unless a sharp shift in sentiment or trading volume breaks the current equilibrium.

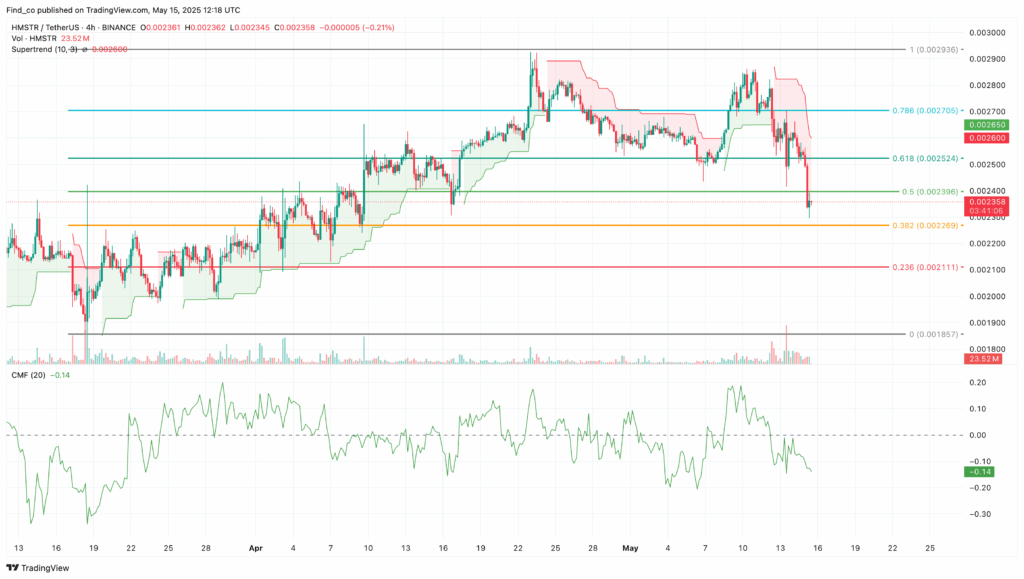

Supertrend and CMF Hint at Bearish Bias

Zooming in on the 4-hour HMSTR/USDT chart, two notable indicators, the Supertrend and Chaikin Money Flow (CMF), highlight growing bearish pressure.

The Supertrend indicator, which helps identify trend direction and potential entry points, has placed its resistance (red line) above the current price. This position typically indicates the path of least resistance is downward.

Simultaneously, the CMF, a tool that measures buying and selling pressure using both price and volume data, has dipped below the zero line. A negative CMF reading implies that selling volume is outweighing buying activity, further reinforcing the current bearish outlook.

If this trend persists, HMSTR could potentially dip to $0.0021, with a deeper decline to $0.0019 in a more pessimistic scenario. Both levels could act as medium-term buying opportunities if investor confidence returns.

Potential Reversal Requires Buyer Re-Engagement

Despite the current downtrend, HMSTR is not entirely out of the game. The approaching oversold conditions on the RSI, coupled with a strong support base near $0.0023, set the stage for a potential reversal but only if bullish momentum resurfaces.

Any signs of recovery would need to be validated by a rise in the CMF above the zero line and a flip in the Supertrend indicator back to green (support). In such a scenario, HMSTR could reclaim levels near $0.0030, marking a return to short-term bullish sentiment.

However, this remains speculative until clear signals of buyer interest emerge. The crypto market remains highly sensitive to sentiment shifts, and without strong trading volume or external catalysts, HMSTR’s consolidation phase could extend.

Final Thoughts: Consolidation Likely, Patience Required

For now, Hamster Kombat is treading water, hovering near oversold levels but lacking the conviction for a decisive move in either direction. Key support at $0.0023 is likely to be tested in the coming sessions, while resistance at $0.0028 remains a major obstacle for any bullish breakout.

Unless market sentiment improves and demand increases significantly, traders can expect the price to consolidate within this range. Short-term investors may view this as an opportunity to accumulate at lower levels, but risk remains elevated.

As with most micro-cap altcoins, volatility is the norm — and strategic patience may be the most valuable asset for HMSTR holders in the weeks ahead.