Global central bank leaders have publicly rallied behind US Federal Reserve Chair Jerome Powell, cautioning that political interference in the Fed’s work could destabilize not only the US economy but also the global financial system. The show of support comes as scrutiny of Powell intensifies at home, raising fresh concerns across markets and among policymakers worldwide.

Central banks unite in support of Fed independence

In a joint statement released on Tuesday, governors from 11 leading central banks expressed full support for the Federal Reserve and its chair, underlining that independence is essential for maintaining financial stability. The group stressed that central banks must be allowed to carry out their mandates free from political influence in order to manage inflation, growth, and financial risks effectively.

Among the signatories were European Central Bank President Christine Lagarde, Bank of England Governor Andrew Bailey, and Bank of Canada Governor Tiff Macklem. Central bank leaders from Sweden, Denmark, Switzerland, Norway, Australia, South Korea, and Brazil also joined the statement, along with senior officials from the Bank for International Settlements. Their message was clear that pressure on the Fed does not stop at US borders and could have global consequences.

Investigation into Powell heightens tensions

The coordinated response follows reports that US authorities have opened a criminal investigation into Powell related to a $2.5 billion renovation of the Federal Reserve’s headquarters. While details remain limited, the move has further strained relations between the Fed and the Trump administration, which has repeatedly criticized the central bank for keeping interest rates higher than the White House would prefer.

Analysts say the investigation has amplified existing concerns that political forces are seeking to exert greater control over monetary policy. For markets, even the perception of such pressure can be damaging, as confidence in central bank decision making plays a critical role in currency stability, bond markets, and long term investment planning.

Crypto markets watch for volatility

The unfolding situation has not gone unnoticed in digital asset markets. Farzam Ehsani, chief executive of crypto exchange VALR, said political pressure on the Fed sends mixed signals to investors.

Central bank independence has long been viewed as a foundation of macroeconomic stability, Ehsani noted. When that independence is questioned, investor confidence in dollar policy can weaken. In such environments, interest often grows in decentralized assets like Bitcoin. At the same time, sudden political developments can trigger sharp volatility, leading to short term selloffs across risk assets, including crypto.

Ray Youssef, chief executive of crypto app NoOnes, pointed to recent market movements as evidence of this tension. The US dollar has softened, while gold and silver prices have climbed, suggesting investors are shifting toward assets seen as safer stores of value.

Youssef said that an eventual interest rate cut could inject liquidity into markets and support crypto prices. However, he added that conditions remain fragile. Bitcoin has faced selling pressure during US trading hours, even as longer term interest from investors continues to build.

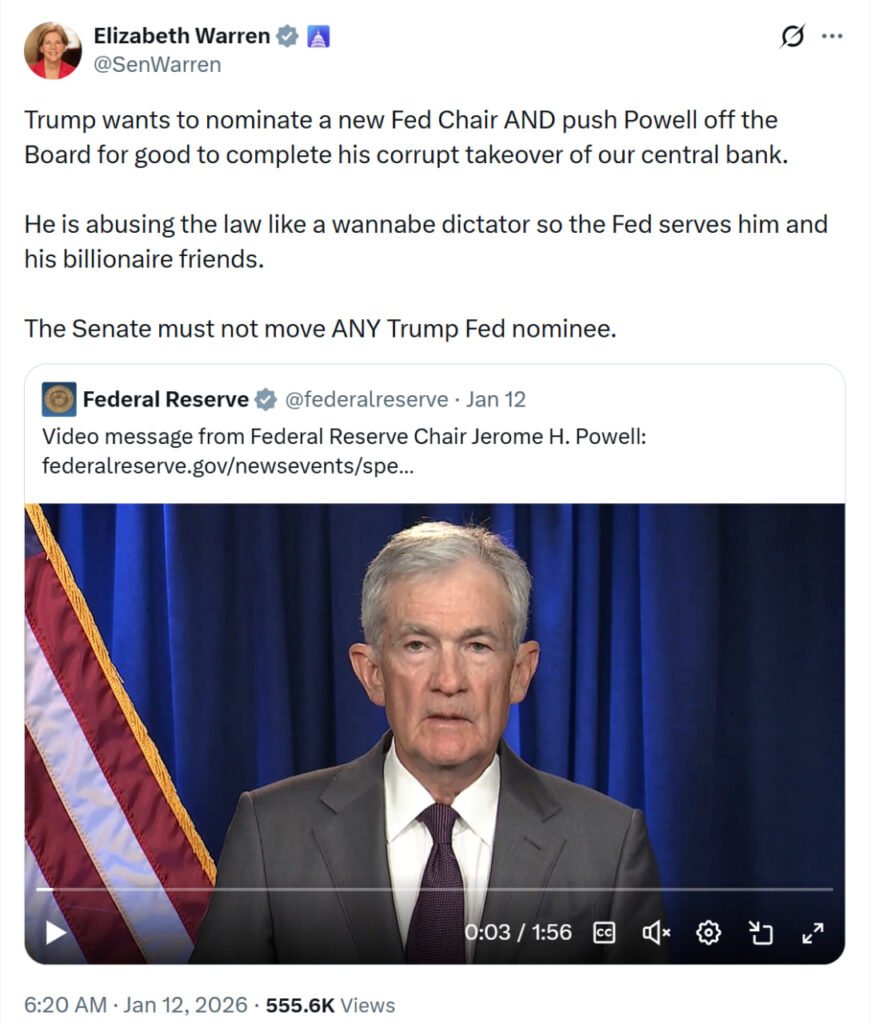

Trump allies emerge as potential successors

Speculation over Powell’s future has also intensified. President Donald Trump has reportedly lined up several close allies as potential replacements for the Fed chair, many of whom have publicly backed lower interest rates.

Kevin Hassett, a senior economic adviser to Trump and widely viewed as a leading candidate, has said that the president’s personal views on rates would not directly shape Fed decisions under his leadership. Even so, markets remain cautious about how much independence a new chair might truly have.

The administration has already increased its presence within the central bank. Last year, Stephen Miran, a close Trump ally, was appointed to the Fed’s board of governors. At his first policy meeting in December, Miran argued for a 0.5 percent interest rate cut, signaling a more dovish stance aligned with the administration’s preferences.

Global stakes remain high

For central banks abroad, the debate surrounding Powell is about more than US politics. The Federal Reserve sits at the heart of the global financial system, influencing capital flows, exchange rates, and borrowing costs worldwide. Any erosion of its independence could ripple through emerging and developed markets alike.

As scrutiny of the Fed continues, investors will be watching closely for signs of policy shifts, leadership changes, or further political pressure. For now, the rare public show of unity from global central bank leaders underscores how seriously they view the risks of interference and how high the stakes have become.