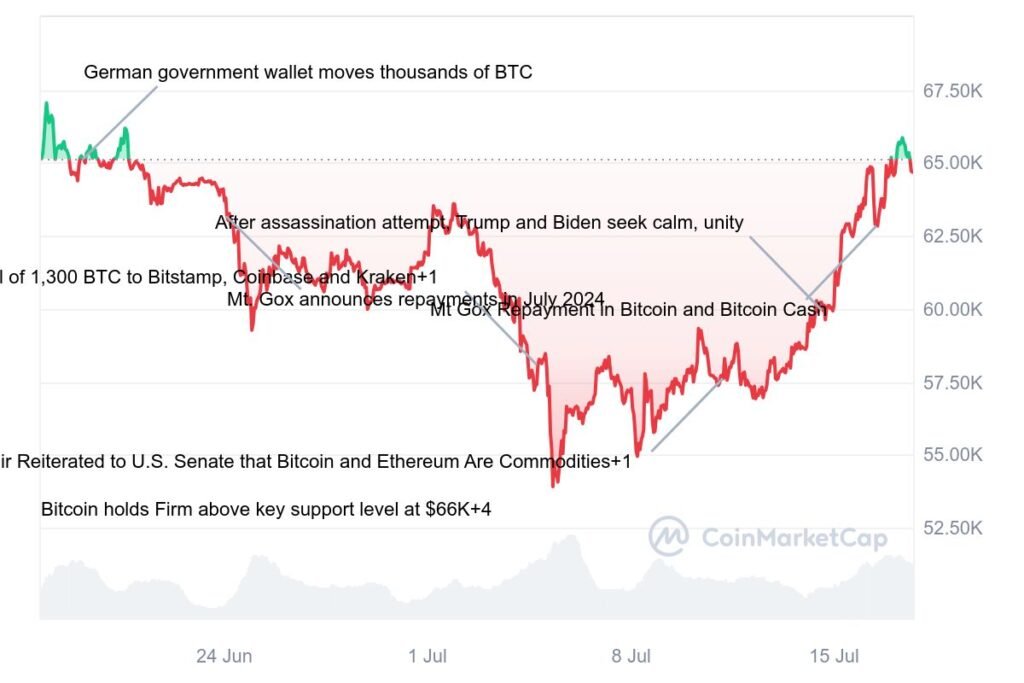

The German government has come under scrutiny after missing out on over $2.3 billion in potential profit by selling its Bitcoin holdings in mid-2024. According to blockchain intelligence firm Arkham, Bitcoin was sold at an average price of $57,900, well below its current market value, which has surged over 80% since the sale.

A Costly Move for Europe’s Largest Economy

The crypto intelligence firm Arkham revealed that a wallet labelled “German Government (BKA)” offloaded 49,858 Bitcoin during June and July 2024. The total sales amounted to over $2.89 billion. However, as of May 19, 2025, those same coins would be worth a staggering $5.24 billion, representing a missed opportunity of approximately $2.35 billion in unrealised profit.

The Bitcoin in question had been seized from the operators of Movie2k, a now-defunct illegal streaming platform. The stash was originally around 50,000 BTC, making it one of the largest government-held crypto assets in Europe.

Rushed Sale Raises Questions

Experts have criticised the manner in which the German authorities liquidated Bitcoin, calling the move poorly timed and inefficient. Miguel Morel, founder of Arkham Intelligence, commented that the pattern of transactions indicated a lack of strategy. “The last thing I would have expected is that they would just go to five different exchanges and start market selling,” Morel said during an interview at EthCC 2024.

He added that the behaviour suggested urgency: “The fact that they’re going to so many different exchanges just reads like they’re just trying to get as much liquidity from each order book as possible.”

This approach likely increased market impact, possibly depressing Bitcoin’s price during the period of sale, further minimising returns.

Initial Warning Signs in June

Speculation about a possible sell-off emerged on 19 June 2024, when the BKA-labelled wallet transferred 6,500 BTC worth over $425 million. Investors and market watchers saw this as a potential signal of large-scale liquidation, causing market jitters.

Throughout the following weeks, the German government continued to move and sell Bitcoin in tranches across several major exchanges. Analysts believe the pace and scale of the sell-off suggested a government priority for quick liquidity, possibly to plug budgetary gaps or address fiscal needs.

Bitcoin Bounced Back After Sales Ended

Bitcoin’s price dropped during the selling spree, with investor concerns about further downward pressure. However, once the government’s wallet was emptied, the market responded positively. On 14 July 2024, just a day after the final sale, Bitcoin recovered past the $60,000 psychological barrier.

Since then, the cryptocurrency has continued its upward trajectory. As of May 2025, Bitcoin is trading above $104,700, according to CoinMarketCap data.

A Lesson in Timing for Institutional Sellers

The episode has sparked debate over how governments and institutions should handle digital assets. While liquidation may serve short-term needs, strategic timing could result in significantly higher returns. In Germany’s case, the rush to sell may have cost taxpayers billions in potential public funds.

Critics argue that more cautious and informed handling of the asset, perhaps with the help of financial advisors or crypto-market specialists, might have minimised market impact and maximised returns. The event serves as a cautionary tale for other governments holding seized or state-owned cryptocurrencies.

As Bitcoin and other digital assets become increasingly integrated into financial ecosystems, how public institutions manage such holdings will remain a topic of close attention.