In a groundbreaking move for both the crypto and traditional finance industries, REX Shares is set to launch the first-ever US-based staked cryptocurrency ETF this Wednesday. The fund, officially named the REX-Osprey Solana and Staking ETF, will allow investors to gain direct exposure to Solana (SOL) while earning staking rewards, a unique combination not previously available through regulated US markets.

This development marks a significant step forward for the institutional adoption of altcoins and staking-based investment strategies, especially as the SEC becomes more open to crypto innovations.

Solana Staking ETF: What You Need to Know

The REX-Osprey ETF gives investors the opportunity to invest in spot Solana, meaning they’re exposed to the actual cryptocurrency, not just futures or derivatives, while also benefiting from the staking yield generated from the Solana network. This means holders of the ETF can passively earn income, just like crypto users who stake SOL directly on-chain.

This fund is structured as a C-Corporation, which has been a point of contention with the US Securities and Exchange Commission (SEC) in the past. However, REX Shares received positive feedback from the SEC on its updated prospectus, which cleared the way for the ETF’s debut.

Importantly, the SEC ruled in May 2025 that staking, in itself, does not violate securities laws, though it has remained cautious in formally approving other staked ETFs and altcoin-focused funds. REX’s success here could set a precedent for similar products involving other major blockchains.

SOL Price Jumps on ETF Buzz

Following the ETF confirmation, Solana’s price surged by 6%, reaching approximately $158, according to Cointelegraph. Over the past seven days, SOL has gained more than 12%, reflecting growing investor enthusiasm.

Despite this rally, SOL is still trading around 46% below its all-time high from January, based on CoinGecko data. Even so, Solana has maintained its position as the sixth-largest cryptocurrency, with a market capitalisation of about $83.5 billion.

This ETF launch could provide sustained momentum, as more institutional investors gain regulated access to SOL and its staking rewards, a previously complex task involving direct wallet management and technical staking procedures.

Altcoin Summer Incoming? Analysts Think So

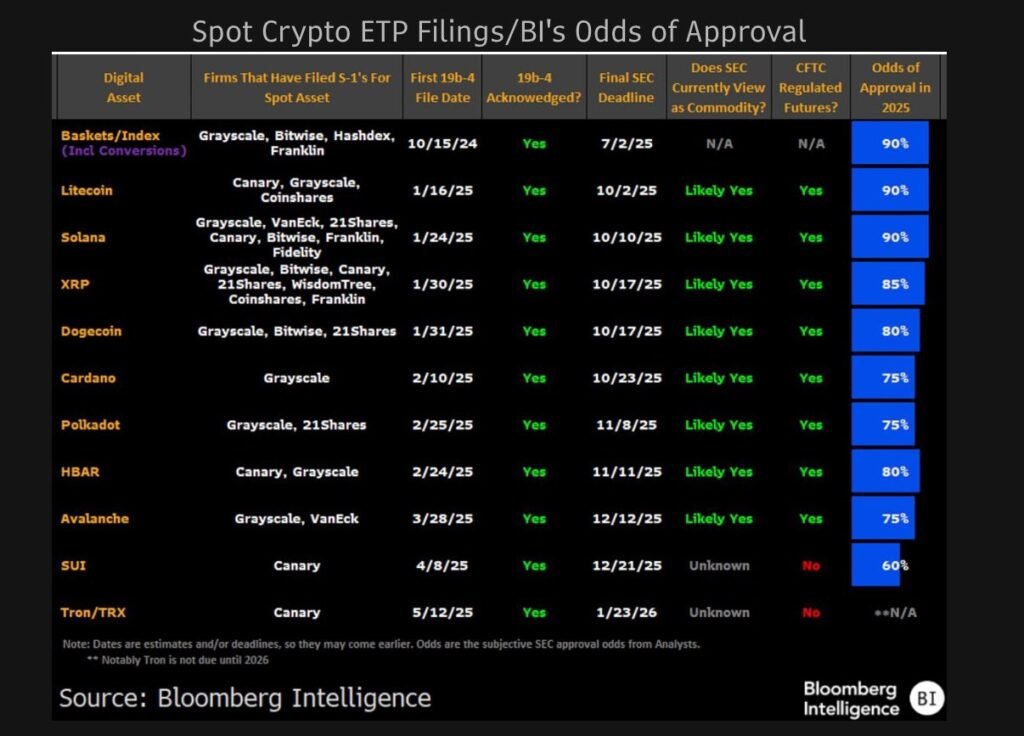

Several analysts believe this move could trigger a wider trend. Bloomberg ETF analyst Eric Balchunas noted that multiple altcoin-focused ETFs are on track for potential approval soon, and that Solana is likely to “lead the way.”

The term “altcoin summer” has been used by analysts to describe the potential surge in alternative cryptocurrencies (altcoins) and this ETF could be the spark. If successful, it may pave the way for similar funds focused on Ethereum, Avalanche, Polkadot, and other leading networks.

Solana’s Growing Influence in DeFi

Beyond the ETF hype, Solana’s decentralized exchange (DEX) ecosystem is also showing strength. Recent data from Cointelegraph and TradingView reveals that Solana’s DEX volumes have surpassed Ethereum’s, a major milestone for the network.

Projects like Raydium, Pump.fun, and Orca have been major contributors to this growth, providing high-speed, low-cost trading options for users. This growing on-chain activity further supports Solana’s position as a leading blockchain for decentralized finance and web3 applications.

The launch of the REX-Osprey Solana and Staking ETF is more than just another financial product, it’s a signal that US regulators are becoming more comfortable with crypto innovation, especially around staking and altcoin exposure.

With institutional investors now able to tap into Solana’s potential through a regulated vehicle, the ETF could usher in a new wave of capital into the crypto space. Combined with growing DeFi momentum and increased market confidence, this marks a major step forward in bridging traditional finance with the decentralised future.