The United States Federal Reserve has announced that it will host a major conference on payments innovation, drawing attention to the rapidly growing sector of tokenised real-world assets (RWA). The move comes during a week of record growth for the tokenisation industry, with new platforms and partnerships emerging.

Federal Reserve Plans Payments Innovation Conference

The Federal Reserve Board confirmed on Wednesday that it will hold the event on 21 October. The conference will feature industry experts discussing developments in tokenisation, decentralised finance (DeFi), stablecoin applications, and the role of artificial intelligence in payments.

Fed Governor Christopher Waller highlighted the importance of exploring both opportunities and risks. “I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments,” he said.

The announcement follows growing interest in tokenisation from Wall Street, particularly after the passage of stablecoin legislation in July.

RWA Market Value Surges

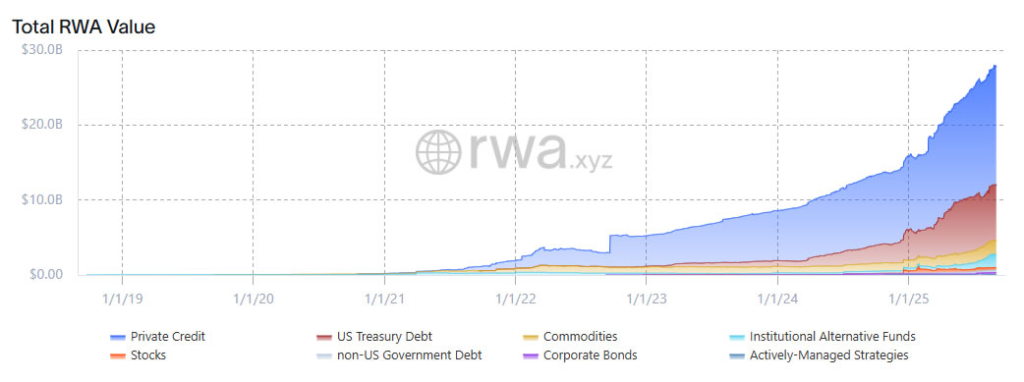

The focus on tokenisation comes as the onchain value of RWAs has hit a record high of 27.8 billion US dollars, according to data from RWA.xyz. This figure marks a 223% increase since the start of 2025.

Most of the growth has been driven by tokenised private credit and US Treasury debt. Ethereum remains the dominant blockchain for asset tokenisation, accounting for 56% of the market. When layer-2 networks are included, its share exceeds 77%.

Ondo Finance Launches Global Stock Platform

Adding to the momentum, Ondo Finance this week officially launched its Ondo Global Markets platform, which allows non-US investors to access more than 100 tokenised US stocks and exchange-traded funds on Ethereum.

The initiative, first announced in February, was described by Ondo as “Wall Street 2.0”. The platform aims to provide global investors with transparent and efficient access to US equities through blockchain technology.

Chainlink Joins Forces with Ondo

The launch has been strengthened by a new partnership between Ondo Finance and Chainlink, a leading decentralised oracle provider. Chainlink will provide a secure data infrastructure for the platform, helping ensure accuracy and reliability in tokenised financial products.

The collaboration reflects the wider push by crypto firms to integrate traditional financial assets with blockchain systems, offering investors faster settlement, greater transparency, and reduced costs.

A Defining Moment for Tokenisation

The surge in RWA adoption, coupled with fresh interest from regulators and central banks, signals a defining moment for the industry. The Federal Reserve’s decision to bring tokenisation and DeFi into its payments innovation agenda underscores the growing recognition of blockchain-based finance as a mainstream component of the global financial system.