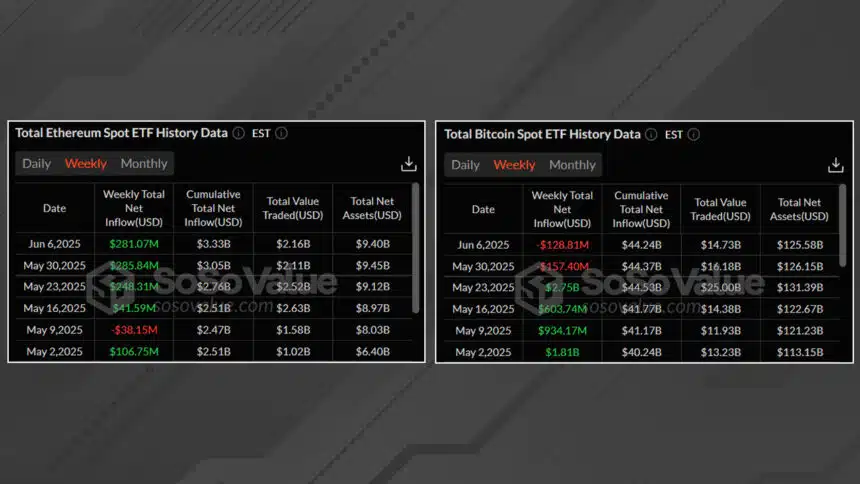

Ethereum (ETH), the second-largest cryptocurrency by market capitalisation, is currently dominating the digital asset investment landscape. Recent data reveals that ETH has outperformed Bitcoin in weekly exchange-traded fund (ETF) flows, with US-based spot Ethereum ETFs recording a total of $281.07 million in inflows. In stark contrast, Bitcoin ETFs experienced $128.81 million in outflows over the same period.

This shift signals growing investor confidence in Ethereum’s short- to mid-term prospects, driven by sustained price appreciation and favourable institutional sentiment. According to data from Sosovalue, Ethereum ETFs have now maintained four consecutive weeks of net positive inflows, amassing a total of $856.81 million. As a result, the total net assets under management (AUM) in Ethereum ETFs have surged to $9.40 billion, highlighting the rising appeal of ETH among institutional investors.

Ethereum Price Surges Over 50% in One Month

Fueling this bullish ETF momentum is ETH’s remarkable price rally. Over the past month, ETH has soared from $1,790 to above $2,700, marking an impressive 54% increase. At the time of writing, Ethereum is trading near the $2,500 mark, reflecting a 30% gain over the last 30 days despite minor setbacks.

The recent market turbulence, largely attributed to a public spat between Donald Trump and Elon Musk that briefly shook investor confidence, caused ETH to dip to $2,400. However, the digital asset quickly rebounded, showcasing strong underlying demand and resilience in the face of volatility.

Bitcoin ETFs See Cooling Interest

While ETH garners increased attention, Bitcoin appears to be losing its grip on institutional favour, at least for now. Spot Bitcoin ETFs have posted back-to-back weekly outflows $157.40 million and $128.81 million respectively, suggesting a notable dip in investor enthusiasm.

This divergence in ETF flows is likely a reflection of evolving market sentiment. Investors may be pivoting towards ETH due to its ongoing upgrades, potential scalability improvements, and its growing role in decentralised finance (DeFi) and smart contract ecosystems. As a result, Ethereum could be positioning itself as the more attractive long-term play in the crypto market’s next growth cycle.

Market Outlook: ETH Eyes $3,000 as Momentum Builds

With Ethereum gaining institutional backing and maintaining bullish price momentum, market analysts are increasingly optimistic about its near-future performance. Many are now eyeing a move back to $3,000, which would reinforce ETH’s dominance amid a broader crypto recovery.

Adding to the optimism are positive developments from the Ethereum Foundation, which continues to advance its mission of improving network performance and decentralisation. As Ethereum’s roadmap progresses, including the anticipated Proto-Danksharding and other scalability upgrades, investor confidence is expected to deepen further.

Final Thoughts

Ethereum is clearly enjoying a bullish phase, underpinned by robust ETF inflows and positive market sentiment. The recent divergence from Bitcoin in institutional investment patterns signals a potential changing of the guard in the crypto investment hierarchy. As ETH continues to gain momentum, all eyes are now on the $3,000 resistance level, a psychological and technical milestone that could usher in the next phase of its bull cycle.

In an evolving market landscape, Ethereum’s strong fundamentals, growing utility, and rising institutional interest position it as a top contender for the crypto crown.