Ethereum’s Proof-of-Stake architecture offers stronger protection compared to Bitcoin’s Proof-of-Work, argue leading voices in the crypto community.

Ethereum researcher and Merge architect Justin Drake has claimed that launching a 51% attack on the Bitcoin network would be “much cheaper” than carrying out a similar attack on Ethereum. Speaking about the comparative security of the two leading cryptocurrencies, Drake estimated that a 51% attack on Bitcoin would cost around $10 billion, significantly less than the funds required to compromise Ethereum’s blockchain.

His statements align with recent concerns voiced by other Ethereum advocates, highlighting the risks tied to Bitcoin’s long-term security model.

Bitcoin’s Security Budget Under Scrutiny

Grant Hummer, co-founder of Ethereum-focused marketing and product firm Etherealize, recently stirred debate with a post on X (formerly Twitter), asserting that Bitcoin’s current security budget is insufficient. Hummer estimated that it would cost approximately $8 billion to execute a 51% attack on the Bitcoin network today, and warned that this figure could drop as low as $2 billion in the future, making such an attack “virtually certain.”

“This will become blindingly obvious over the next decade,” Hummer wrote. He went on to describe Ethereum as the only “truly decentralised crypto-asset” with the potential to become the internet’s preferred store of value.

A 51% attack occurs when an individual or coordinated group gains majority control over a blockchain network’s mining or staking power, allowing them to alter transaction history or prevent new transactions from being confirmed.

Ethereum’s Higher Entry Barrier for Attackers

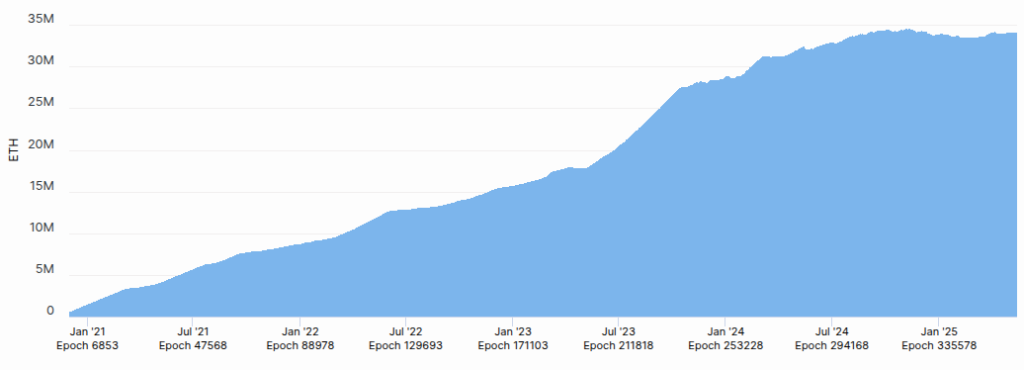

In contrast to Bitcoin’s Proof-of-Work (PoW) model, Ethereum’s newer Proof-of-Stake (PoS) system — implemented through the Merge — offers significantly higher resistance to such attacks, according to Drake. He explained that to control Ethereum’s blockchain, an attacker would need to acquire more than 50% of the staked ETH, which currently stands at over 34 million tokens.

With Ether trading at around $2,582, this would require an investment of at least $44.8 billion — just for acquiring half the stake. However, Drake and others argue the true cost would be much higher due to market impact and liquidity constraints. The required amount of ETH represents nearly 14.2% of the asset’s total market capitalisation and 180% of its 24-hour trading volume, suggesting any mass accumulation attempt would rapidly inflate prices, raising the barrier even further.

“A rich nation state can probably pull it off,” Drake admitted, but added that such an attack would still face steep economic and social resistance.

Community Defence and Social Slashing

Drake also pointed to Ethereum’s unique advantage in its ability to use social consensus to fight back against attacks. He noted that in the event of a 51% attack, the community could “socially slash” the malicious actor — essentially removing or punishing the attacker’s staked tokens by reaching a collective decision.

“This is a superpower of PoS that is not available with PoW,” Drake emphasised, referring to the “social layer” — a network-wide human majority that decides which version of the blockchain to support.

Matan Sitbon, CEO of blockchain interoperability developer Lightblocks, echoed this sentiment, stating, “Ethereum’s ultimate security lies not solely in cryptography or protocol rules, but in the community’s powerful social and economic coordination mechanisms.”

Bitcoin’s Limitations in Recovery Scenarios

While Bitcoin’s PoW model is simpler and has a proven track record, critics argue it lacks Ethereum’s ability to recover from centralised attacks through social or governance mechanisms. Pavel Yashin, a researcher at P2P.org, noted that if a centralisation attempt were detected on Ethereum, the community could resolve it by initiating a fork. The attacker’s chain would likely become irrelevant, with the majority of users moving to the new, community-backed version.

Hassan Khan, CEO of Bitcoin liquidity protocol Ordeez, offered a more balanced view, stating that the feasibility of a 51% attack on either network remains debatable. While technically possible, he argued that such an attack on Bitcoin would require immense computing power and energy, making it highly improbable. For Ethereum, the threat is less about computing power and more about economics and governance.

A Growing Divide Between Ethereum and Bitcoin

As the crypto industry continues to evolve, the differences between Ethereum’s PoS and Bitcoin’s PoW models are becoming more pronounced. Drake’s remarks and the ensuing debate have once again brought attention to the importance of long-term sustainability and resilience in blockchain networks.

While Bitcoin remains the most recognisable and trusted cryptocurrency globally, Ethereum’s advanced governance mechanisms and high attack costs are increasingly positioning it as a stronger contender in terms of decentralisation and future security.