Ethereum-focused firm Ether Machine has raised $654 million in private financing from Jeffrey Berns as it prepares for a public debut with one of the largest corporate Ether treasuries.

$654 Million Financing Secured

The Ether Machine confirmed a $654 million private financing round this week, backed primarily by Ethereum advocate Jeffrey Berns. The funds, equivalent to 150,000 Ether, will be transferred to the company’s wallet later this week, according to Reuters. Berns, recognised for his early investments in Ethereum infrastructure and Web3 initiatives, will also take a seat on the company’s board of directors.

This raise forms part of the firm’s wider strategy to establish a substantial Ether treasury in the run-up to its anticipated Nasdaq listing later this year.

From Merger to Market Listing

The Ether Machine was created following the merger of Ether Reserve and the blank-cheque firm Dynamix Corporation. Initially, the group had aimed to raise more than $1.5 billion from major investors such as Blockchain.com, Kraken and Pantera Capital. However, the company has since refined its approach and is moving forward with a different capital strategy.

At the time of its market debut, Ether Machine is expected to hold over 495,000 Ether, worth around $2.16 billion, alongside an additional $367 million set aside for further Ether acquisitions.

Growing Corporate Treasury

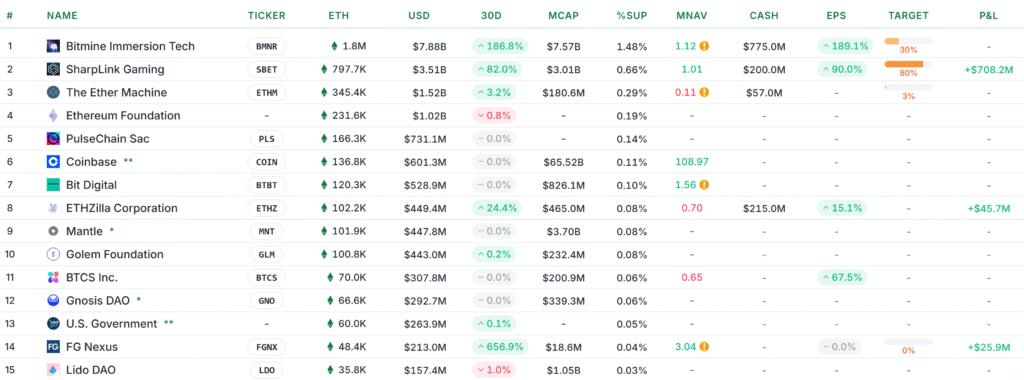

According to figures from StrategicETHReserve, Ether Machine is currently the third-largest corporate holder of Ether with more than 345,400 coins. This places it ahead of the Ethereum Foundation, which reportedly holds 231,600 Ether.

The company’s co-founder and chairman, Andrew Keys, explained that Ether Machine is leveraging tools such as convertible debt and preferred equity to secure capital without diluting its net asset value per share. He added that the firm’s on-chain yield generation model could outperform traditional exchange-traded funds.

“Between debt issuance and yield mechanics, we believe we can maintain a market premium over our net asset value indefinitely,” Keys told Reuters.

Citibank to Lead New Fundraising Round

In addition to its completed private financing, Ether Machine is preparing for a third capital raise. This round, led by Citibank, is targeting at least $500 million and will launch on Wednesday.

Bitcoin Whale Shifts Billions Into Ether

Separately, a mysterious Bitcoin whale valued at more than $11 billion has continued shifting assets into Ether. The investor recently sold $215 million worth of Bitcoin to acquire $216 million in spot Ether through Hyperliquid, raising their Ether holdings to 886,371 coins, now worth over $4 billion.

The whale first began diversifying on 21 August, selling $2.59 billion in Bitcoin for a $2.2 billion spot Ether position alongside $577 million in perpetual Ether longs. After closing part of the leveraged position with a $33 million profit, the investor has resumed acquiring Ether on the open market.

The large-scale movement highlights the growing institutional and private investor confidence in Ethereum as an asset class, particularly at a time when firms such as Ether Machine are strengthening their corporate treasuries.