Ether Leads Weekly ETP Inflows as Bitcoin Declines

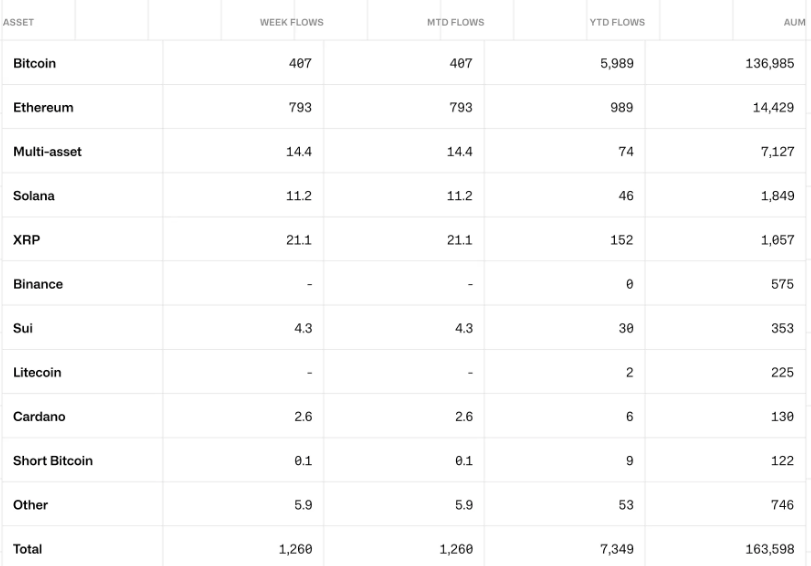

Cryptocurrency exchange-traded products (ETPs) have recorded their fifth consecutive week of inflows, accumulating a total of $1.3 billion. Notably, Ether-based ETPs outperformed Bitcoin ETPs for the first time in 2025, according to a report from CoinShares on 10 February.

Ether (ETH) ETPs saw a substantial $793 million in inflows, marking a 95% increase compared to Bitcoin (BTC) ETPs, which recorded inflows of $407 million in the past trading week. This surge in Ether inflows coincided with a market dip, as ETH fell below $2,700 on 6 February, triggering a wave of ‘buying-on-weakness,’ according to CoinShares’ research director James Butterfill.

While this marks the first instance of Ether ETPs leading Bitcoin in 2025, similar occurrences were observed in late 2024.

Bitcoin Remains Dominant in Year-to-Date Inflows

Despite losing ground to Ether in weekly inflows, Bitcoin remains the leader in year-to-date (YTD) inflows, amassing nearly $6 billion so far in 2025. This figure is significantly higher than Ether’s YTD total, standing at 505% above the latter.

Bitcoin ETP inflows dropped by 19% compared to the previous week, suggesting a possible shift in investor sentiment or temporary market adjustments.

Altcoins Gain Momentum in ETP Investments

Other major cryptocurrencies also experienced increased ETP inflows. XRP ETPs saw a 45% rise, climbing from $14.5 million to $21 million in the past week. Meanwhile, Solana (SOL) ETPs witnessed an even more dramatic surge, jumping 148% week-over-week to reach $11.2 million in inflows.

The growing interest in alternative cryptocurrencies suggests investors are diversifying their portfolios beyond Bitcoin and Ether, looking for growth opportunities in other digital assets.

Total Crypto ETP AUM Declines Amid Market Correction

Despite the continued inflow into crypto ETPs, the total assets under management (AUM) in the sector fell to $163 billion last week, marking a 4% decline from the previous week. This is also an 11% drop from the all-time high of $181 billion recorded in late January. Butterfill attributed the decrease to recent price corrections across the cryptocurrency market.

Institutional Flows: BlackRock Sees Gains, Fidelity Faces Outflows

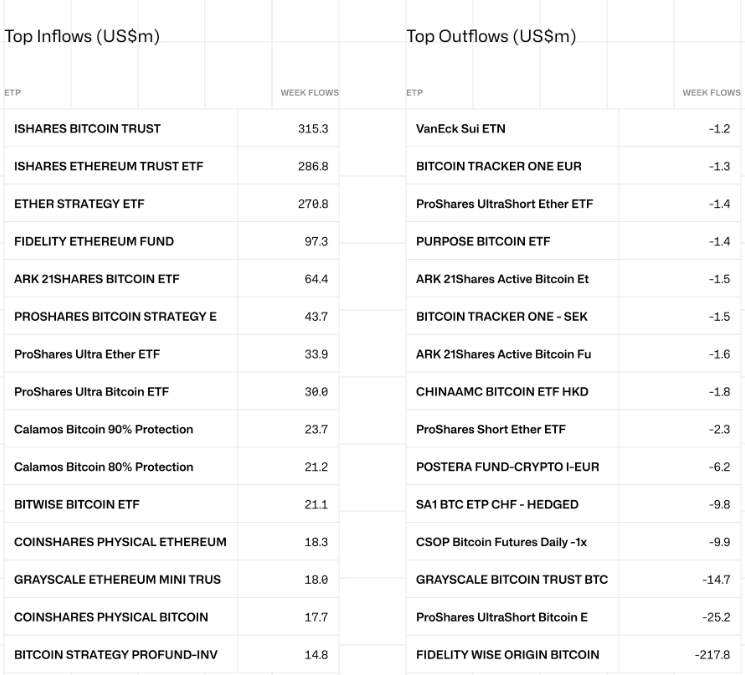

Among institutional players, BlackRock’s spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), led inflows, attracting $315 million last week. On the other hand, Fidelity’s Wise Origin Bitcoin Fund saw significant outflows, with $217 million withdrawn.

The contrasting performances of these major investment vehicles indicate shifting investor preferences within the crypto market, influenced by market movements and institutional strategies.

As the cryptocurrency market evolves, the growing appeal of Ether and other altcoins in ETP investments signals a broader diversification trend, potentially reshaping institutional and retail investment dynamics in the months ahead.