Spot Ethereum ETFs continue to attract significant investor attention, with net inflows hitting $452.72 million on Friday. The strong demand has extended the inflow streak to 16 consecutive trading days, reflecting growing institutional confidence in Ethereum’s long-term potential.

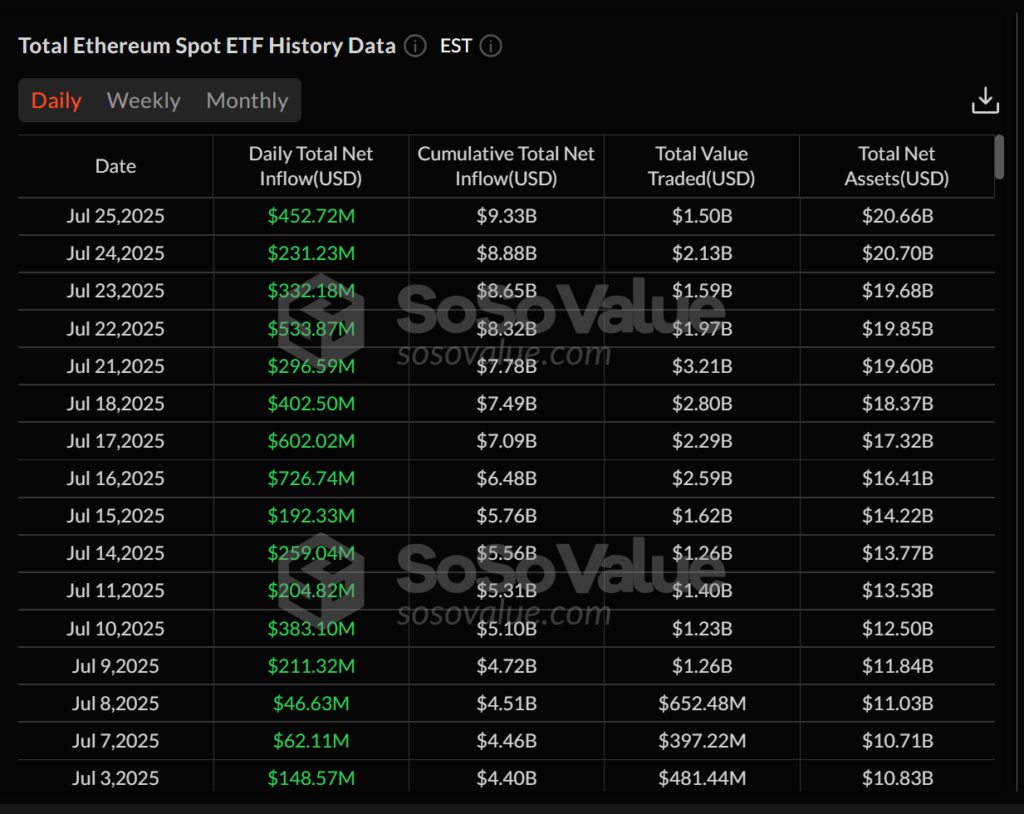

According to data from SoSoValue, the total net assets across US-based Ether ETFs have now reached $20.66 billion, representing 4.64 percent of Ethereum’s market capitalisation.

BlackRock Leads with $440M Inflow

BlackRock’s iShares Ethereum Trust (ETHA) once again dominated daily inflows, drawing $440.10 million on Friday. The fund has now accumulated $10.69 billion in assets, making it the largest Ether ETF in the United States.

Other funds saw comparatively smaller inflows. Bitwise’s ETHW attracted $9.95 million, while Fidelity’s FETH added $7.30 million. In contrast, Grayscale’s ETHE continued to struggle, recording an outflow of $23.49 million. Since its launch, Grayscale has seen a cumulative net outflow of $4.29 billion, the highest among all Ether ETFs.

$9.33B in Inflows Since July 2

Since the inflow streak began on July 2, net inflows across all US Ether ETFs have more than doubled—from $4.25 billion to $9.33 billion. The 16-day run peaked on July 16, with inflows reaching $726.74 million. Several other sessions recorded over $300 million in daily inflows, underlining consistent institutional and retail participation.

Trading volumes have also remained high, with $1.5 billion worth of Ether ETF shares changing hands on Thursday alone.

Investor Confidence in Ethereum’s Future

The surge in interest comes amid rising confidence in Ethereum’s role in decentralised finance, staking, and smart contracts. Investors are also positioning themselves for potential long-term gains linked to stablecoins and tokenisation trends.

Matt Hougan, Chief Investment Officer at Bitwise, commented on X that he expects sustained inflows into Ether ETPs. He estimated that between institutional funds and ETPs, demand could reach $20 billion worth of ETH over the next year. This translates to around 5.33 million ETH at current prices.

In comparison, Ethereum is projected to issue only 0.8 million ETH in the same period, suggesting that demand could outstrip supply by nearly seven times.

Bitcoin ETFs Rebound with $130M Inflows

While Ether ETFs led the week, Bitcoin ETFs also made a comeback. Spot Bitcoin ETFs registered $130.69 million in net inflows on Friday, following a turbulent few days. On July 21, they saw outflows of $131.35 million, followed by $67.93 million and $85.96 million on July 22 and 23, respectively.

Despite the recent volatility, Bitcoin ETFs have accumulated $54.82 billion in total net inflows. Overall net assets now stand at $151.45 billion. July has seen several high points for Bitcoin ETFs, including $1.18 billion in inflows on July 10 and $1.03 billion on July 11.