Institutional demand drives record Ether purchases amid bullish price forecasts

Ethereum’s institutional momentum continues to accelerate, with blockchain data showing nearly $882 million worth of Ether (ETH) purchased in recent days by public miner BitMine Immersion Technology and an unidentified whale. The large-scale acquisitions underscore the intensifying appetite for Ether among corporate players and high-net-worth investors, even as profit-taking begins to emerge at elevated price levels.

BitMine Leads Institutional Buying Spree

Publicly listed Bitcoin mining firm BitMine Immersion Technology has aggressively expanded its Ether treasury, acquiring 106,485 ETH, worth approximately $470.5 million, within the past 10 hours. The miner’s latest haul brings its total holdings to 1,297,093 ETH, valued at around $5.75 billion.

Blockchain trackers confirm that much of the accumulation was executed via over-the-counter (OTC) deals and direct transfers from prominent institutional intermediaries, including Galaxy Digital, FalconX, and BitGo. The scale of BitMine’s acquisitions highlights a growing trend of miners diversifying beyond Bitcoin and moving capital into Ethereum ahead of expected network growth.

Whale Quietly Amasses $412M in ETH

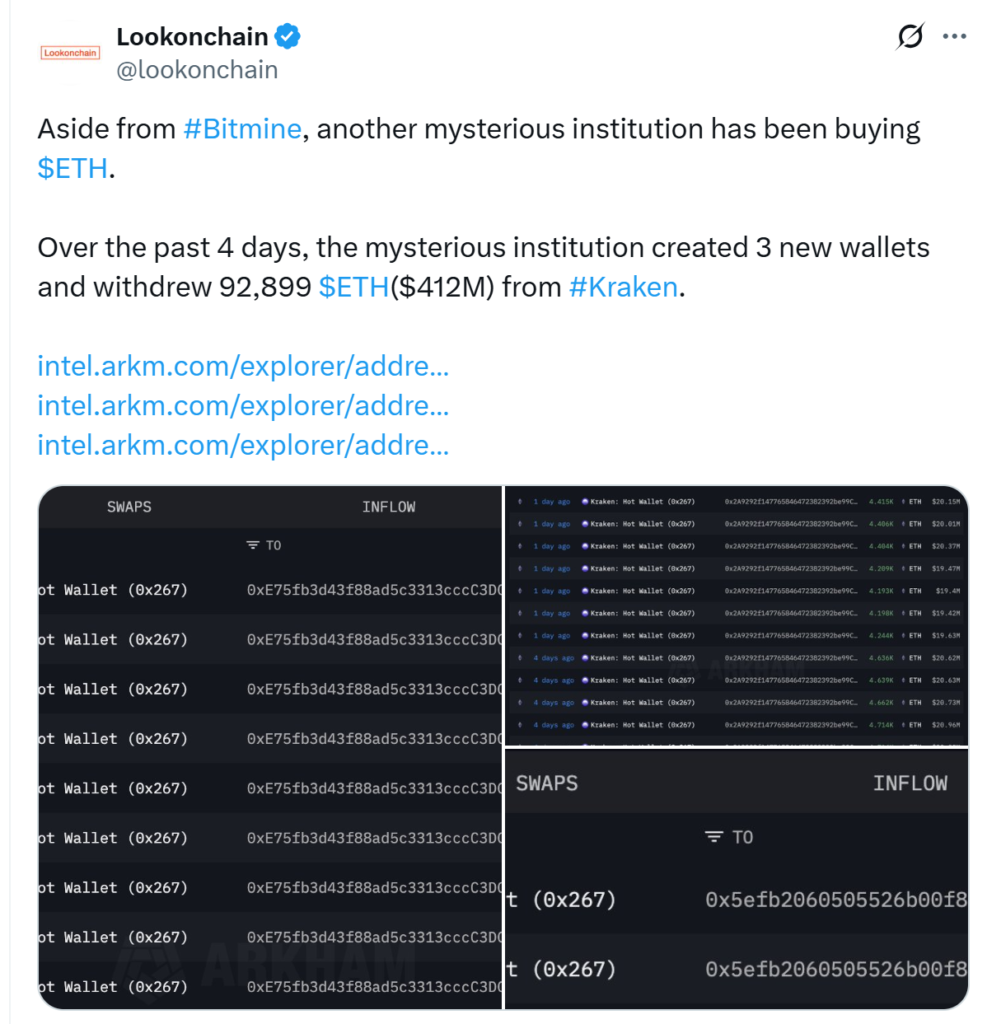

Alongside BitMine, an unknown whale investor has purchased 92,899 ETH, worth nearly $412 million, across a four-day window. The entity established three new wallets before withdrawing the Ether from Kraken, suggesting the funds are earmarked for long-term storage rather than short-term speculation.

The whale’s actions align with broader accumulation trends observed in recent weeks. Reports indicate another newly identified entity amassed $1.3 billion in ETH across 10 wallets this week, surpassing the $1 billion record inflows set by spot Ether ETFs only days earlier.

Corporate Funding Push Bolsters ETH Adoption

BitMine’s buying spree coincides with its announcement of a $24.5 billion at-the-market (ATM) stock offering, aimed at strengthening its balance sheet and expanding operational scale. Meanwhile, SharpLink, another publicly traded company, secured $389 million via a common share capital raise. Both moves highlight the growing corporate pivot toward Ether holdings as part of treasury diversification strategies.

Adding further momentum, Standard Chartered Bank has revised its Ether price target upwards, citing intensified institutional accumulation and expanding stablecoin adoption in light of favourable US regulatory developments. The bank now forecasts ETH at $7,500 by 2025, with a long-term trajectory of $12,000 in 2026, $18,000 in 2027, and $25,000 by 2028.

Profit-Taking Emerges as ETH Nears ATH

Despite the surge in institutional accumulation, signs of profit-taking are surfacing as ETH approaches a new all-time high. The whale collective known as “7 Siblings” liquidated 19,461 ETH, worth $88.2 million, within a 24-hour span at an average price of $4,532.

The Ethereum Foundation also joined in, offloading 2,795 ETH, valued at approximately $12.7 million, across two transactions earlier this week. These sales highlight a delicate balance between long-term accumulation and short-term profit realisation as Ethereum continues to consolidate near record levels.

Outlook

With BitMine’s massive treasury build-up, whales positioning for long-term storage, and institutions raising capital for Ether-centric strategies, Ethereum’s narrative as a core digital asset alongside Bitcoin is rapidly strengthening. While near-term volatility may arise from profit-taking, the broader trend of institutional adoption and rising price forecasts points to Ethereum’s growing role in the digital asset economy over the coming years.