Ethereum (ETH) has surged past the psychologically significant $4,000 mark for the first time in eight months, giving bulls fresh confidence and fuelling the ongoing altseason.

According to data from TradingView, ETH/USD peaked at $4,012 on Bitstamp on Friday, recording a daily gain of around 1.7%. The move places Ether within striking distance of its all-time high, now less than $900 away.

This milestone marks a symbolic moment for the second-largest cryptocurrency by market capitalisation, which has steadily gained ground on Bitcoin (BTC) over recent weeks.

Market Analysts Highlight Ether’s Strength

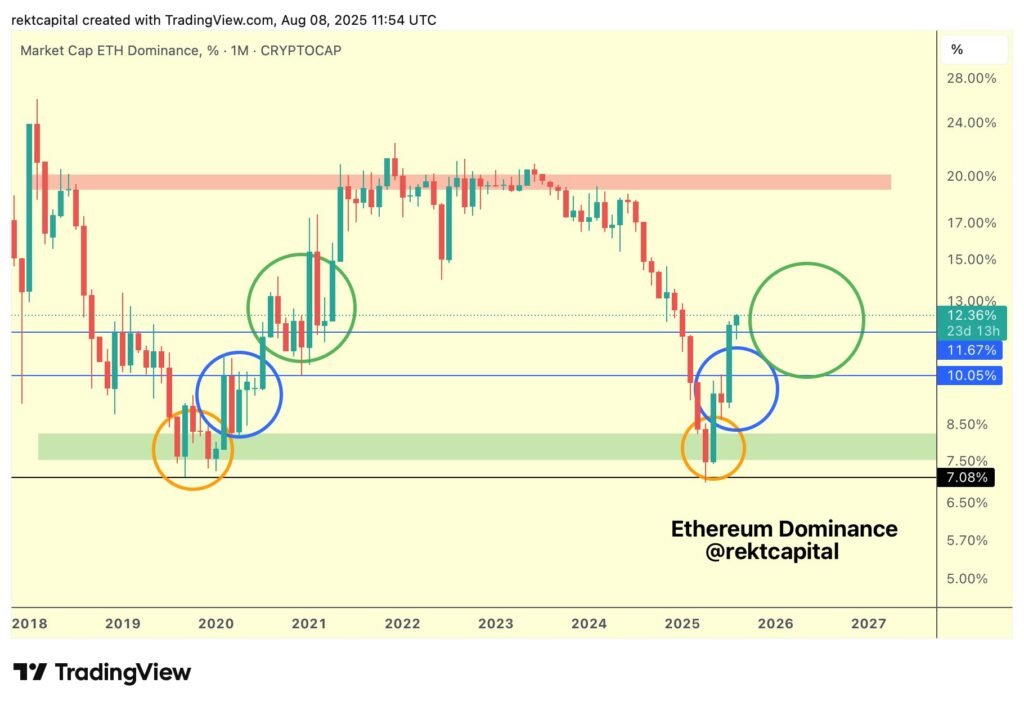

Popular trader and analyst Rekt Capital noted that Ethereum’s dominance in the total crypto market cap is already about “50–60% of the way in its Macro Uptrend,” drawing comparisons to the bullish cycle of 2021.

His analysis suggests ETH is entering a potentially prolonged growth phase, with investor interest intensifying as capital rotates from Bitcoin into altcoins.

Similarly, trader Cas Abbe observed substantial large-scale Ether purchases, pointing to growing institutional and whale-driven accumulation. Blockchain analytics platform Lookonchain confirmed whale wallet activity consistent with strategic positioning in anticipation of further ETH gains.

Long Liquidations Hint at More Upside

Exchange order book data revealed a “massive wall of long liquidations” just below the $3,960 level, a pattern noted by crypto market commentary account TheKingfisher.

“This is what smart money hunts,” TheKingfisher wrote on X (formerly Twitter), framing the situation as a “re-accumulation zone waiting to get fuelled.”

Rather than signalling weakness, analysts interpret the liquidation zone as a potential springboard for further price appreciation. The belief is that shakeouts in leveraged positions could clear the path for more sustainable upward momentum.

Bitcoin Dominance Under Pressure

While Ethereum rallies, Bitcoin’s market share is showing signs of strain. BTC dominance dipped to 60.7% on Friday, once again testing a key support level in the broader market structure.

Rekt Capital suggested that Bitcoin’s dominance could briefly rebound toward traditional peak levels of around 70%. However, he argued that a breakdown of its long-term technical uptrend is “inevitable.”

Once that shift occurs, he forecasts a sustained downtrend, with Bitcoin’s dominance potentially sliding into the low-40% or even high-30% range, a scenario that would mark a decisive power shift toward altcoins.

The Bigger Picture for Altseason

Ether’s climb to $4,000 reinforces the narrative of a strengthening altseason, where alternative cryptocurrencies outperform Bitcoin. With BTC dominance under pressure and whales funnelling capital into ETH, market sentiment is tilting toward a more diversified crypto landscape.

If Ethereum maintains momentum, the market could witness a scenario similar to 2021, where surging altcoins collectively chipped away at Bitcoin’s market leadership.

For now, the focus remains on whether ETH can consolidate above $4,000 and push toward its previous all-time high. Traders are also watching BTC dominance closely, a decisive breakdown could unleash the next major phase of altcoin gains.

With Ethereum’s bullish momentum building and Bitcoin’s market share facing structural headwinds, the crypto market could be on the cusp of a significant realignment, one where ETH plays a central role in driving the next wave of gains.