The European Central Bank (ECB) has unveiled a two-track roadmap to revolutionise financial settlements in the eurozone using blockchain technology. At the heart of the plan is “Pontes”, a new initiative aimed at piloting blockchain-based settlements in central bank money by the third quarter of 2026.

Pontes will act as a short-term solution to connect Distributed Ledger Technology (DLT) platforms directly with TARGET Services, the ECB’s existing suite of payment and securities systems. By building a bridge between decentralised infrastructure and traditional central bank systems, the ECB hopes to bring innovation to Europe’s financial market without compromising safety or efficiency.

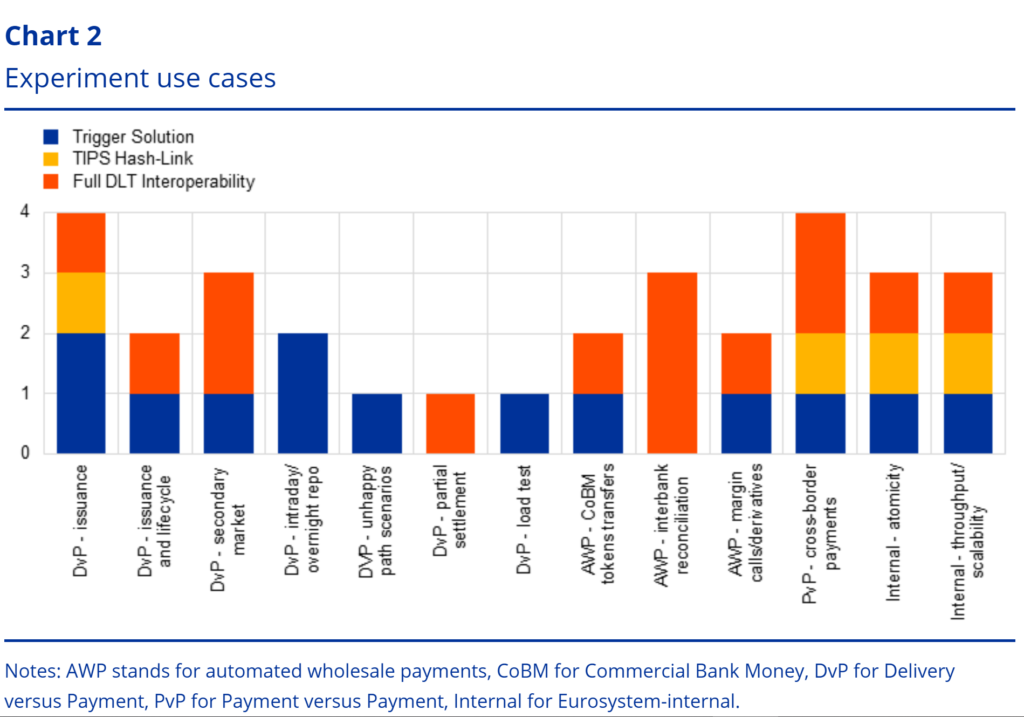

The pilot will incorporate insights from the ECB’s 2024 exploratory trials, which involved 64 financial institutions and settled €1.6 billion in tokenised assets. These trials demonstrated a strong demand for central bank-backed settlements of digital assets.

Appia: A Long-Term Vision for Blockchain Integration

While Pontes focuses on short-term implementation, the ECB’s second track, Appia, aims for a broader, future-facing goal. This initiative envisions an integrated European ecosystem for wholesale settlement using blockchain, with global efficiency and interoperability in mind.

Appia will see the ECB continue its research into DLT applications for central bank use, especially for large-scale transactions between financial institutions. Collaboration with both public and private stakeholders will be central to its development. To support this, the Eurosystem will establish market contact groups for both Pontes and Appia, designed to gather industry feedback and ensure alignment with evolving market needs.

A call for expressions of interest to join the Pontes market group will be issued shortly, inviting relevant institutions to participate in shaping the future of Europe’s blockchain financial infrastructure.

Why Blockchain Settlements Matter

Blockchain, or Distributed Ledger Technology, offers programmable, near-instant settlement of financial assets. One of its key innovations is atomic settlement, where asset transfer and payment happen simultaneously, reducing settlement risk and manual reconciliation.

The ECB’s DLT trials confirmed that blockchain could reduce “fragmentation, complexity, and technological inefficiencies” in Europe’s capital markets. These features are crucial in modernising the existing real-time gross settlement (RTGS) systems, which remain centralised and often slower.

However, successful adoption requires more than just technology. The ECB notes the need for standardised processes, harmonised legal frameworks, and interoperability with existing systems like TARGET Services. Pontes is designed specifically to address these transitional needs.

Global Momentum Behind Blockchain Settlements

The ECB’s plan is part of a wider global shift towards integrating blockchain into national financial systems. In 2023, the Bank of England conducted a DLT experiment through the BIS London Innovation Hub, demonstrating how tokenised interbank settlements could operate efficiently at scale.

Similarly, several Asian central banks are actively pursuing blockchain-based cross-border settlement systems, recognising the benefits of speed, transparency, and cost reduction.

For Europe, the Pontes and Appia initiatives aim to ensure that the euro remains technologically competitive in a digital age where financial infrastructures are rapidly evolving.

Balancing Innovation with Stability

The ECB’s two-track strategy piloting a blockchain settlement bridge by 2026 while pursuing a long-term vision underscores its commitment to innovation. By embracing blockchain while safeguarding the eurozone’s financial infrastructure, the ECB hopes to modernise Europe’s markets without sacrificing the stability of central bank money.

As the pilot progresses, the success of Pontes could become a cornerstone for future blockchain adoption in the eurozone, while Appia sets the direction for Europe’s next-generation financial ecosystem.