Newly released emails from the US Department of Justice suggest that Jeffrey Epstein quietly gained exposure to the cryptocurrency sector years before digital assets entered the mainstream. The documents point to a multimillion dollar investment in Coinbase in 2014, made through intermediaries and layered entities, and later partially sold for a significant profit.

The emails add to a growing body of evidence that the late financier, who died in jail in 2019 while awaiting trial on federal sex trafficking charges, had financial ties to some of the earliest and most influential companies in the crypto industry.

Emails point to a 2014 Coinbase stake

According to the DOJ release, an entity linked to Epstein invested approximately $3.25 million in Coinbase in late 2014, when the US based crypto exchange was valued at around $400 million. The investment reportedly involved the purchase of 195,910 Series C shares.

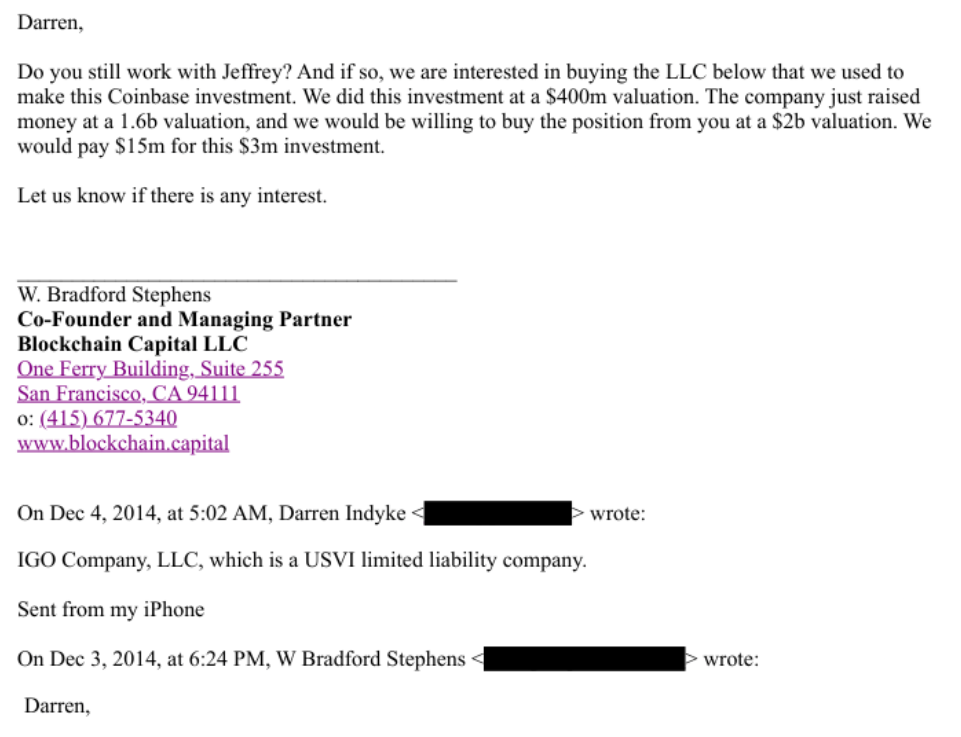

The emails indicate that the investment was structured through third parties rather than made directly in Epstein’s name. One message dated Dec. 4, 2014, was sent by Bradford Stephens, founder and managing partner of Blockchain Capital, to Darren Indyke, a longtime Epstein associate.

In that email, Stephens discussed finalizing which limited liability company would make the $3 million investment and noted that the name of the investing entity could be changed. The correspondence also included wire instructions, suggesting the transaction was close to completion at that time.

The DOJ documents do not show any evidence that Coinbase executives were aware of Epstein as the ultimate beneficial owner of the investment or that they had any direct interaction with him.

No indication of direct Coinbase involvement

The released records make clear that the alleged investment was made through intermediaries and investment vehicles, insulating Coinbase from direct contact with Epstein. There is no indication in the emails that the exchange’s leadership knew who stood behind the investing entity or that Epstein had any role in Coinbase operations.

This distinction is significant, as early stage startups often accept funding from venture firms or special purpose entities without full visibility into the individuals behind every limited partner. The emails suggest that Blockchain Capital played a key role in facilitating the investment on Epstein’s behalf.

Coinbase has been approached for comment regarding the emails and the reported investment, but the DOJ files themselves do not attribute any wrongdoing or awareness to the company.

Ties to early crypto venture capital

The Coinbase investment appears to be part of a broader pattern of Epstein’s involvement in early cryptocurrency ventures. The DOJ documents show that Epstein linked entities invested in several crypto native firms during the industry’s formative years.

Among them was Blockstream, a blockchain technology company that raised an $18 million oversubscribed seed round. Epstein associated entities reportedly participated in that round through multiple LLCs, including Crypto Currency Partners II LLC, Crypto Currency Partners II LLP, and Crypto Currency Partners LP.

The use of multiple entities reflects a complex investment structure, a common practice among wealthy investors seeking discretion. The emails suggest that Epstein viewed crypto not as a fringe experiment, but as a serious emerging asset class worth backing at an early stage.

Partial exit at a much higher valuation

Four years after the initial Coinbase investment, Epstein was approached about selling part of his stake. In January 2018, as Coinbase’s valuation surged amid a booming crypto market, Stephens emailed Epstein to propose buying half of the original position.

The offer was based on a $2 billion valuation, far higher than the $400 million valuation at which the shares were acquired. Stephens proposed paying $15 million for roughly half of the stake that had originally cost about $3 million.

In the email, Stephens noted that Coinbase had recently raised money at a $1.6 billion valuation and framed the offer as an attractive exit opportunity. The message suggested purchasing the LLC that held the investment rather than the shares directly.

A follow up email in February 2018 from Brock Pierce, co founder of Blockchain Capital, claimed that Stephens had already wired $15 million for half of the Coinbase position. Pierce wrote that Epstein would still retain equity worth around $15 million, along with several million dollars in cash from the partial sale.

Role of intermediaries under scrutiny

Pierce appears repeatedly in the DOJ released emails in connection with crypto related discussions involving Epstein linked entities. The documents suggest that both Pierce and Stephens acted as key intermediaries who helped facilitate introductions, investments, and later negotiations around exits.

The emails do not allege criminal conduct related to the investments themselves. However, their release has renewed scrutiny of how Epstein was able to integrate himself into influential financial and technology circles, often through layers of professional relationships that obscured his direct involvement.

The latest disclosures reinforce the picture of Epstein as an active investor in cutting edge financial technology, even as his criminal history and legal troubles were already known to some parts of the public.

A renewed spotlight on crypto’s early days

The DOJ emails arrive at a time when the cryptocurrency industry is increasingly being forced to confront its early history. Many of today’s largest firms were once small startups raising capital wherever they could find it, often with limited transparency into the backgrounds of all investors.

While the documents do not suggest misconduct by Coinbase or other companies mentioned, they highlight how opaque structures and intermediaries allowed controversial figures to gain exposure to high growth technology ventures.

As more historical records become public, the early funding stories of major crypto firms are likely to face further examination, not just for legal reasons, but for what they reveal about how the industry took shape.