BlackRock’s IBIT Leads Massive November ETF Outflows

The crypto market faced renewed pressure on Thursday as US spot Bitcoin ETFs recorded intense withdrawals, wiping out the brief inflow seen earlier in the week. After gaining $75.4 million on Wednesday, the funds experienced fresh redemptions worth $903 million on Thursday, which marked the largest single-day outflow in November and one of the biggest since spot Bitcoin ETFs launched in January 2024.

Total outflows for November have now reached $3.79 billion. This figure surpasses the previous monthly record of $3.56 billion set in February, placing the current month on track to become the worst for redemptions unless a significant reversal appears.

BlackRock’s iShares Bitcoin Trust (IBIT) has contributed the most to the sell-off. It registered $2.47 billion in net redemptions this month, which represents approximately 63 percent of the total outflows across all spot Bitcoin ETFs in the United States.

Treasury Secretary’s Surprise Pubkey Visit Electrifies Bitcoin Community

The US Bitcoin community erupted in excitement after Treasury Secretary Scott Bessent made an unexpected appearance at the launch of Pubkey, a new Bitcoin-focused bar in Washington DC.

The visit was immediately interpreted by industry voices as a symbolic moment. Ben Werkman, chief investment officer at Strive, wrote that the event could be one of those milestones which become obvious in hindsight.

Other well-known figures in the Bitcoin ecosystem shared similar enthusiasm. Steven Lubka of Nakamoto described it as “the sign you have been waiting for.” Analyst Fred Krueger, Gemini executive Jeff Tiller, podcaster Natalie Brunell, and Bitcoin Policy Institute co-founder David Zell also viewed the appearance as an encouraging development that may signal growing institutional comfort with Bitcoin.

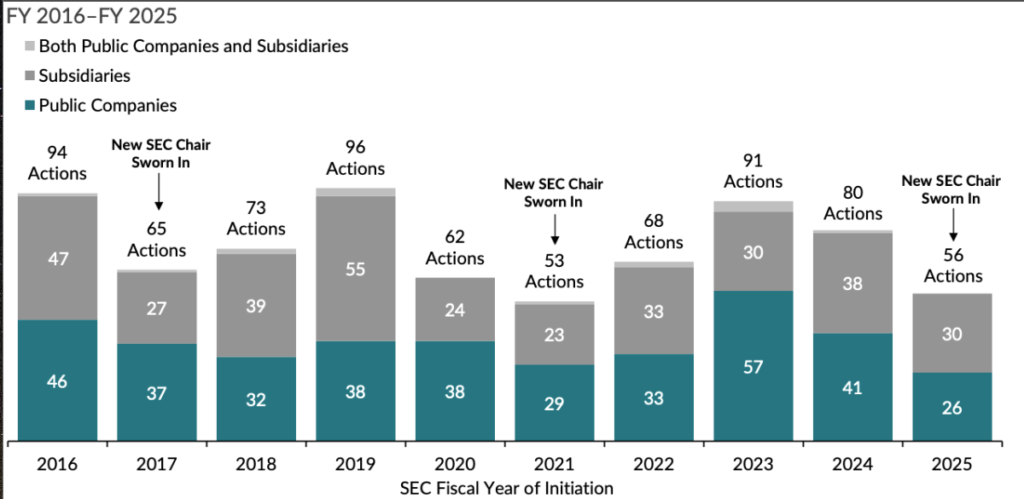

Sharp Decline in SEC Enforcement Under New Leadership

A new report from Cornerstone Research shows a steep drop in total enforcement actions by the US Securities and Exchange Commission during fiscal 2025. Since Paul Atkins took over as chair, the agency’s actions have fallen by roughly 30 percent.

The report states that this pattern aligns with previous transitions in SEC administrations, which often bring shifts in regulatory posture. The overall reduction has extended to the digital-assets sector as well.

The SEC has already rolled back several crypto-related investigations and lawsuits following Gary Gensler’s exit. One of the most notable developments was the dismissal of the agency’s case against Coinbase earlier this year.

According to the report, Chair Atkins intends to prioritise clearer rules for the digital-assets market. He aims to develop a more coherent and predictable framework to support responsible innovation across the sector.

What This Means for the Crypto Landscape

The combination of record ETF outflows, stronger signs of political visibility for Bitcoin, and a softer regulatory stance forms a complex backdrop for the market. Large-scale redemptions signal waning institutional appetite in the short term, although broader adoption narratives remain active.

Meanwhile, the presence of a Treasury Secretary at a Bitcoin-themed venue has boosted sentiment among industry supporters who view political acknowledgment as a long-term positive. The regulatory slowdown under the SEC’s new leadership adds another layer of uncertainty, though some market participants interpret it as a step toward more stable and transparent oversight.