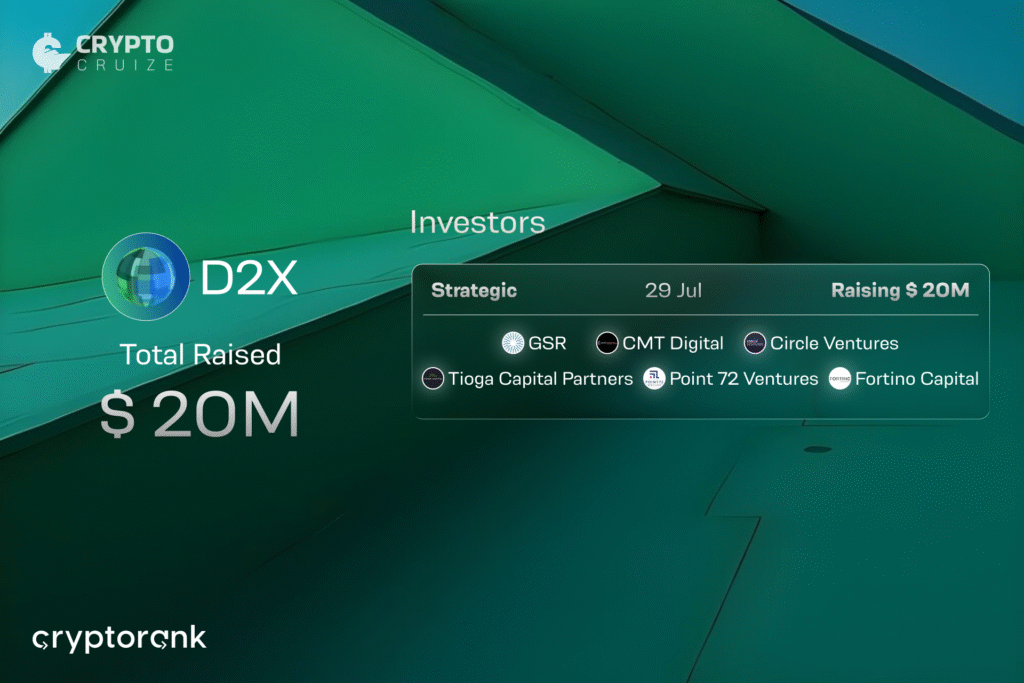

Amsterdam-based crypto derivatives exchange D2X has secured €4.3 million (around $5 million) in a strategic funding round aimed at expanding its institutional-grade trading platform. Designed specifically for professional investors, D2X operates under the European Union’s MiFID II framework as a Multilateral Trading Facility (MTF), positioning itself as a regulated and reliable alternative in the growing crypto derivatives market.

Strategic Backing from Leading Investors

The funding round attracted support from major industry players, including Circle Ventures, CMT Digital, and Canton Ventures. Existing backers such as Point72 Ventures, Tioga Capital, GSR, and Fortino Capital also participated.

Charlie Sandor, Investment Partner at CMT Digital, highlighted the firm’s motivation for investing: “At CMT Digital, we have long believed that regulatory clarity and institutional infrastructure are key to unlocking the next chapter of digital asset adoption. D2X addresses two of the most pressing challenges for European institutional investors: the lack of regulated trading venues and the disconnect between 24/7 crypto markets and traditional exchange hours.”

Pioneering Regulated Trading in the EU

D2X became the first platform in the European Union to obtain a MiFID MTF licence for crypto derivatives, granted by the Dutch Authority for Financial Markets (AFM). This regulatory status enables the firm to offer a robust, secure environment for institutional traders, with operations running seven days a week, a rare feature in regulated financial markets.

The exchange has already launched USD-denominated futures contracts for Bitcoin (BTC) and Ethereum (ETH). Options on both assets are expected soon, and the company also offers futures products denominated in euros.

Product Development and Institutional Onboarding in Focus

The newly raised funds will be used primarily to enhance the product suite and accelerate onboarding of institutional clients. This move comes more than a year after D2X raised €9.1 million in a Series A funding round.

Co-founder Theodore Rozencwajg expressed optimism about the company’s next phase, stating, “We are thrilled to welcome strategic investors who share our vision for a compliant and robust digital asset ecosystem. This funding allows us to enhance our product suite and accelerate the onboarding of Tier-1 institutions that require a trusted, regulated trading venue.”

Bridging Traditional Finance and Digital Assets

Founded by Theodore Rozencwajg, Don van der Krogt, and Laetitia Grimaud, D2X aims to close the gap between the traditional finance sector and the digital asset space. Its post-trade model, developed in collaboration with banking partners, ensures that client collateral is held off-exchange, a feature tailored to risk-averse institutional investors.

The platform is structured to offer institutional-grade infrastructure, aligning with expectations for compliance, transparency, and operational continuity, even during weekends.

Europe’s Competitive Crypto Derivatives Landscape

The crypto derivatives market is becoming increasingly competitive, with major exchanges such as Coinbase and Kraken expanding their offerings through acquisitions and new product launches. D2X aims to stand out by combining regulatory oversight with 24/7 trading capabilities, a rare combination in Europe’s crypto ecosystem.

By focusing on a MiFID II-compliant framework, D2X hopes to serve as a benchmark for regulated crypto derivatives trading in Tier-1 jurisdictions. As more institutions look to gain exposure to digital assets, the demand for secure and reliable trading venues is expected to grow.