The cryptocurrency sector has seen a busy day of developments, with news ranging from a high-profile arrest in Thailand to leadership changes at the United States tax authority and predictions of a trillion-dollar stablecoin market.

South Korean Arrested in $50 Million Crypto-to-Gold Scam

Thai authorities have detained a South Korean man accused of converting over $50 million worth of cryptocurrencies into gold as part of a large-scale laundering operation.

The suspect, identified as Han, 33, was arrested at Bangkok’s Suvarnabhumi Airport under a warrant issued in February, according to The Nation. He faces charges of fraud, computer crime, money laundering and involvement in a criminal syndicate.

The case stems from a call centre scam that began in early 2024, which lured victims with promises of returns as high as 50 per cent. Initial payouts encouraged more deposits, but withdrawals were later blocked, citing fabricated requirements. The Technology Crime Suppression Division (TCSD) confirmed that at least ten suspects have been arrested so far, including alleged launderers and mule account holders.

IRS Digital Assets Head Steps Down

In the United States, the Internal Revenue Service has lost its newly appointed head of the digital assets division. Trish Turner resigned after just three months in the role, marking the end of a 20-year career with the agency.

In a LinkedIn post, Turner expressed gratitude for her time at the IRS, stating that she had helped lay the groundwork for the agency’s digital asset strategy as cryptocurrencies shifted from a niche market to the mainstream.

Turner will now join Crypto Tax Girl, a specialist crypto tax advisory firm, as its tax director. Founder Laura Walter confirmed her appointment on the same day.

Stablecoin Market Set to Pass $1 Trillion

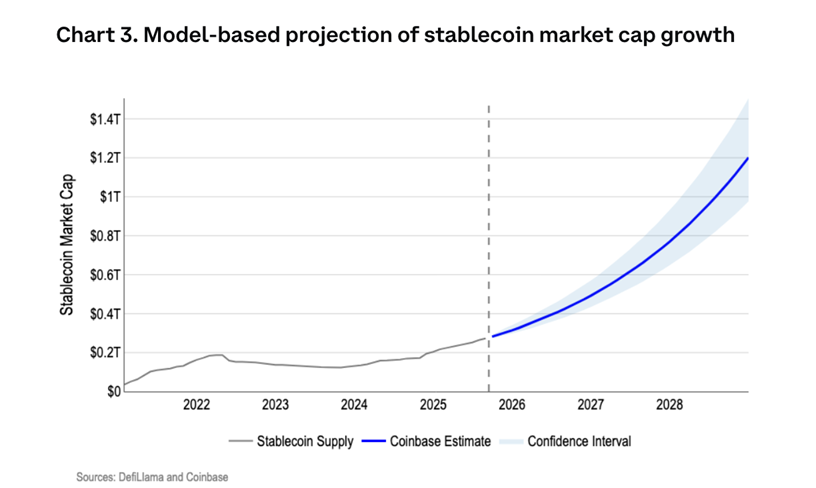

Meanwhile, research from Coinbase predicts that the US dollar-pegged stablecoin market could reach $1.2 trillion by 2028. The report cites regulatory clarity in the United States and the growing utility of stablecoins as key drivers of adoption.

Coinbase highlighted that as the market expands, demand for US Treasury bills will also rise, since stablecoin issuers rely heavily on these short-term instruments to back their reserves. The company dismissed fears that such demand would cause a major decline in Treasury yields, arguing that growth will be gradual and supported by policy.

GENIUS Act to Drive Adoption

A major factor in this projection is the GENIUS Act, a new regulatory framework designed to strengthen the dollar’s role as the world’s reserve currency through the use of stablecoins. Scheduled to take effect in January 2027, the Act is expected to provide the legal certainty needed for widespread adoption.