Solana Co-Founder Criticises Trump’s Crypto Reserve Plan

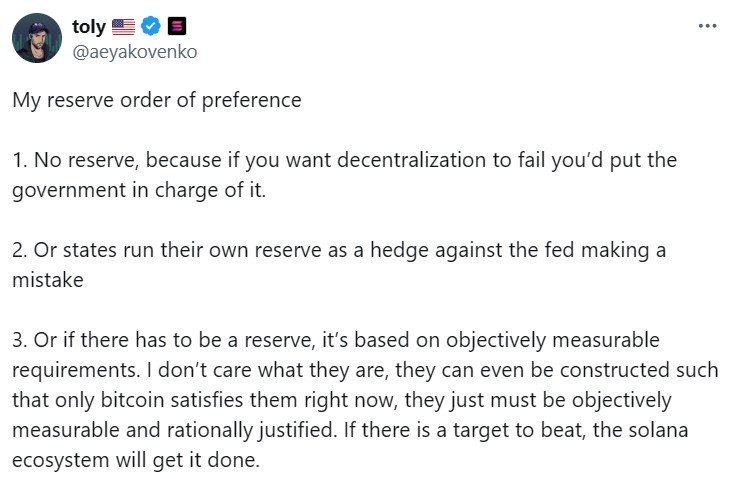

Anatoly Yakovenko, co-founder and CEO of Solana, has voiced opposition to the idea of a US national cryptocurrency reserve, arguing that government control could undermine decentralisation.

On March 6, Yakovenko shared his stance on X, stating that his first preference would be to have no national crypto reserve, as it could cause decentralisation “to fail.” As a second option, he suggested that individual US states could hold their own reserves to mitigate potential risks posed by federal monetary policies.

The statement follows former US President Donald Trump’s announcement of a planned strategic reserve of digital assets, which is expected to include Solana (SOL), Bitcoin (BTC), Ethereum (ETH), XRP, and Cardano (ADA).

Mt. Gox Moves $1 Billion in Bitcoin Amid Market Uncertainty

Defunct crypto exchange Mt. Gox has transferred 12,000 BTC, worth over $1 billion, as market volatility continues to shake the crypto sector.

On March 6, blockchain analytics platform Arkham Intelligence reported that the Mt. Gox wallet (1PuQB) made its first major move in a month. Of the 12,000 BTC, 166.5 BTC (approximately $15 million) was sent to the exchange’s cold wallet, while the remaining 11,834 BTC was moved to an unidentified wallet.

Mt. Gox-linked wallets currently hold around 36,080 BTC, valued at approximately $3.26 billion. The reason behind this latest transfer remains unclear, but it comes amid concerns over Bitcoin’s price fluctuations.

Trump Administration to Unveil Strategic Bitcoin Reserve Plan

US Commerce Secretary Howard Lutnick has confirmed that President Trump will announce details of a strategic Bitcoin reserve at the White House Crypto Summit on March 7.

Lutnick stated in an interview with The Pavlovic Today that Bitcoin will hold a special status in the reserve, alongside other digital assets such as Ether, Solana, Cardano, and XRP. However, critics argue that only Bitcoin, being a decentralised commodity, should be included in a national reserve.

Even longtime Bitcoin sceptic Peter Schiff acknowledged the logic of a BTC-only reserve while questioning the inclusion of altcoins. Addressing these concerns, Lutnick hinted that Bitcoin would be given priority in the framework but did not rule out a role for other cryptocurrencies.

With the upcoming announcement, the crypto industry awaits further details on how the US government plans to handle its digital asset reserves and whether this move will impact Bitcoin’s market trajectory.