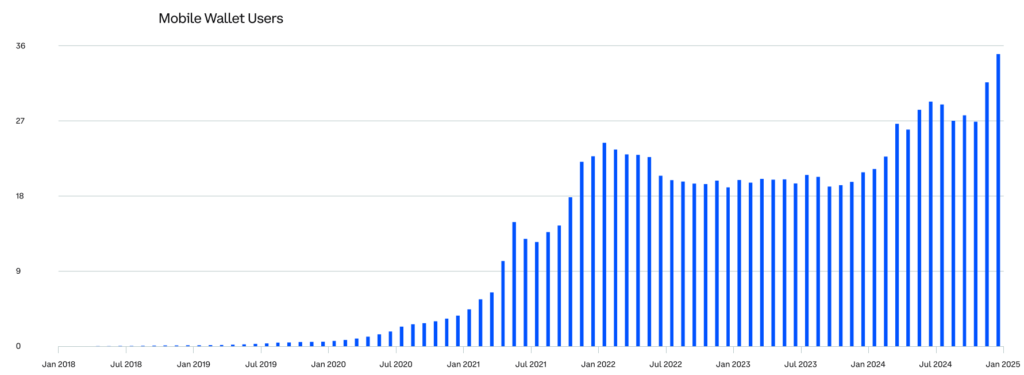

The number of mobile cryptocurrency wallets has surged to a record high of over 36 million in the fourth quarter of 2024, according to Coinbase’s latest crypto market report. This milestone reflects a shift from passive crypto ownership to active usage, as more individuals engage with blockchain-based protocols and decentralised finance (DeFi).

Rise in Active Crypto Users

Daren Matsuoka, data scientist at a16z Crypto, highlighted the significance of mobile wallets in driving user engagement. “Mobile wallets can play a critical role in turning passive crypto owners into active crypto users,” he noted. While crypto holders typically store digital assets without interaction, active users participate in DeFi and other blockchain applications.

Despite the 36 million active wallet users, global cryptocurrency ownership remains significantly higher, with approximately 560 million holders worldwide, according to the 2024 Cryptocurrency Ownership report by Triple-A. Experts predict this number could triple over the next two years, driven by increasing accessibility and adoption.

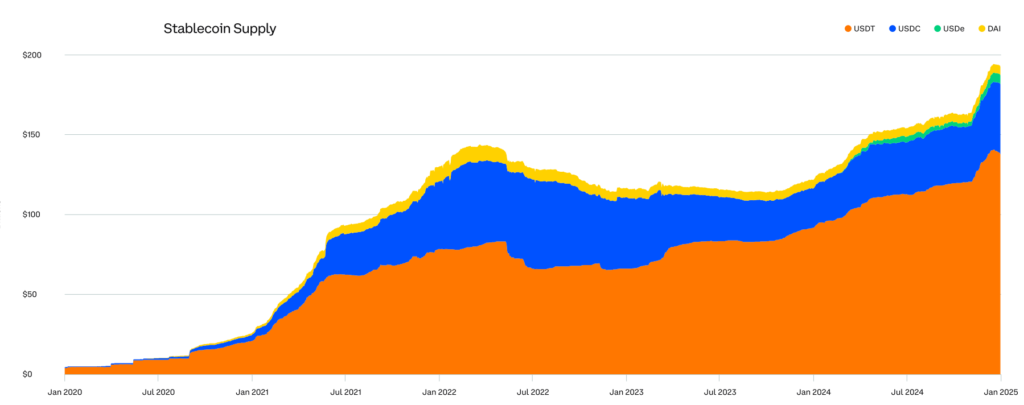

Stablecoins: The “Killer App” of Crypto

Stablecoins emerged as the standout application for cryptocurrencies in 2024, fuelling market liquidity and enhancing cross-border transactions. Coinbase’s report attributed this growth to the efficiency and cost-effectiveness of stablecoins, stating:

“Behind this growth lies a simple but powerful fact: stablecoins can make it faster and cheaper for both businesses and individuals to move money around the globe.”

The total stablecoin supply increased by over 18% in the fourth quarter of 2024, approaching the $200 billion mark. This expansion signals growing investor confidence, as stablecoins serve as the primary gateway from fiat currency to the crypto market.

Stablecoin trading volumes soared to $30 trillion in 2024, with $5 trillion traded in December alone. This surge coincided with Bitcoin’s historic rally past $100,000. Notably, stablecoin inflows to crypto exchanges hit a record high of $9.7 billion on 21 November, just weeks before Bitcoin reached its peak.

Regulatory Clarity Needed for Further Adoption

While stablecoins are poised for broader adoption, regulatory frameworks remain a critical factor. Coinbase’s report emphasised the importance of clear regulations to promote financial inclusion, particularly in remittances and digital capital markets. It stated:

“The stage has now been set for broader adoption of stablecoins in remittances, digital capital markets, and financial services for the unbanked or underbanked.”

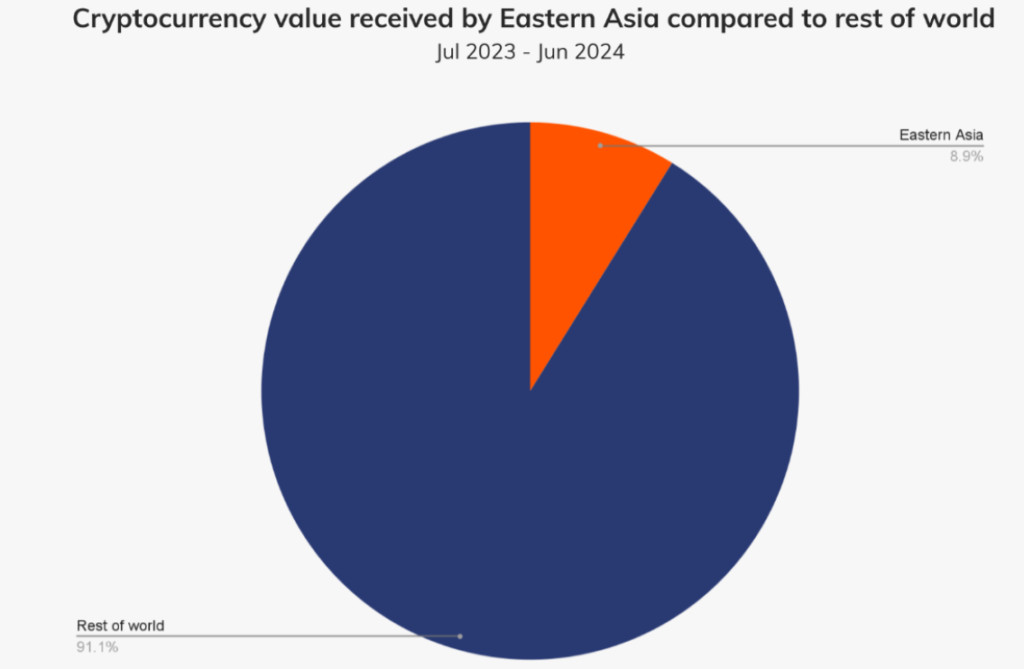

Stablecoins Challenge Fiat Dominance in East Asia

The rising adoption of stablecoins is beginning to challenge the dominance of traditional fiat currencies in East Asia. The region accounted for 8.9% of global cryptocurrency value received between June 2024 and July 2023, according to a report by Chainalysis.

Countries experiencing high inflation and currency devaluation are particularly driving this trend. Maruf Yusupov, co-founder of Deenar, a gold-backed stablecoin, noted:

“In most emerging markets, stablecoins are gradually replacing fiat because of lower barriers to entry, low cost, and ease of use. If the current adoption trend is sustained, the asset might fuel lower patronage to traditional banks as we have it today.”

With remittance fees averaging 7.34% in 2024 for bank account transfers, stablecoins offer a more affordable alternative. East Asia alone received over $400 billion in on-chain value between June 2024 and July 2023, further demonstrating the growing role of digital assets in cross-border transactions.

As mobile wallets and stablecoins continue their rapid expansion, the cryptocurrency landscape is shifting towards mainstream financial integration. However, regulatory developments will be crucial in shaping the future of digital assets in global markets.