JPMorgan has expanded its push into digital assets by launching its first tokenised money market fund on a public blockchain. The fund is being introduced through the bank’s asset management division which oversees around four trillion dollars in assets.

Named the My OnChain Net Yield Fund and trading under the ticker MONY the product is live on the Ethereum blockchain. The launch was announced by JPMorgan on Monday and marks a significant milestone for a global systemically important bank operating on a public network.

The fund has been issued through Kinexys Digital Assets which is JPMorgan’s in house tokenisation platform. It is structured as a 506(c) private placement and is aimed at qualified investors who can subscribe through the Morgan Money institutional trading platform. The fund offers US dollar denominated yields while providing investors with blockchain based access to their holdings.

John Donohue head of global liquidity at J P Morgan Asset Management said tokenisation could fundamentally improve the speed and efficiency of transactions while adding new functionality to traditional investment products.

Why tokenised money market funds matter

By placing a money market fund on a public blockchain JPMorgan says it is unlocking greater transparency and peer to peer transferability. Tokenisation also opens the door to broader use of the fund as collateral within digital finance ecosystems.

The bank described the launch as a step towards the future of asset trading where investors can receive fund tokens directly into their blockchain addresses. JPMorgan claims it is now the largest global bank to introduce a tokenised money market fund on a public blockchain.

The move highlights growing interest from traditional financial institutions in blending established investment products with decentralised infrastructure. Ethereum continues to be a preferred network for such experiments due to its liquidity and established developer ecosystem.

UK plans to bring crypto under financial laws

In regulatory news the United Kingdom is preparing to extend its existing financial services laws to cover crypto companies. According to reports the government will introduce legislation that places crypto firms under the oversight of the Financial Conduct Authority by October 2027.

Draft proposals were first shared by the Treasury in April and have seen only minor revisions. Once implemented crypto businesses would be subject to the same consumer protection standards as traditional financial services firms.

Chancellor Rachel Reeves said bringing crypto into the regulatory perimeter was essential to securing the UK’s position as a leading global financial centre in the digital age. She added that the legislation would provide clear rules while preventing bad actors from operating in the market.

Economic Secretary Lucy Rigby echoed this view saying the UK intends to lead globally in digital asset adoption. The planned framework is likely to be closely watched by the industry as it could shape how crypto firms choose to operate in the UK over the coming decade.

Bitcoin and the quantum computing question

Prominent Bitcoin analyst Willy Woo has weighed in on a long running debate around quantum computing risks. Woo suggested that even if a powerful quantum computer were to compromise early Bitcoin wallets the network would survive.

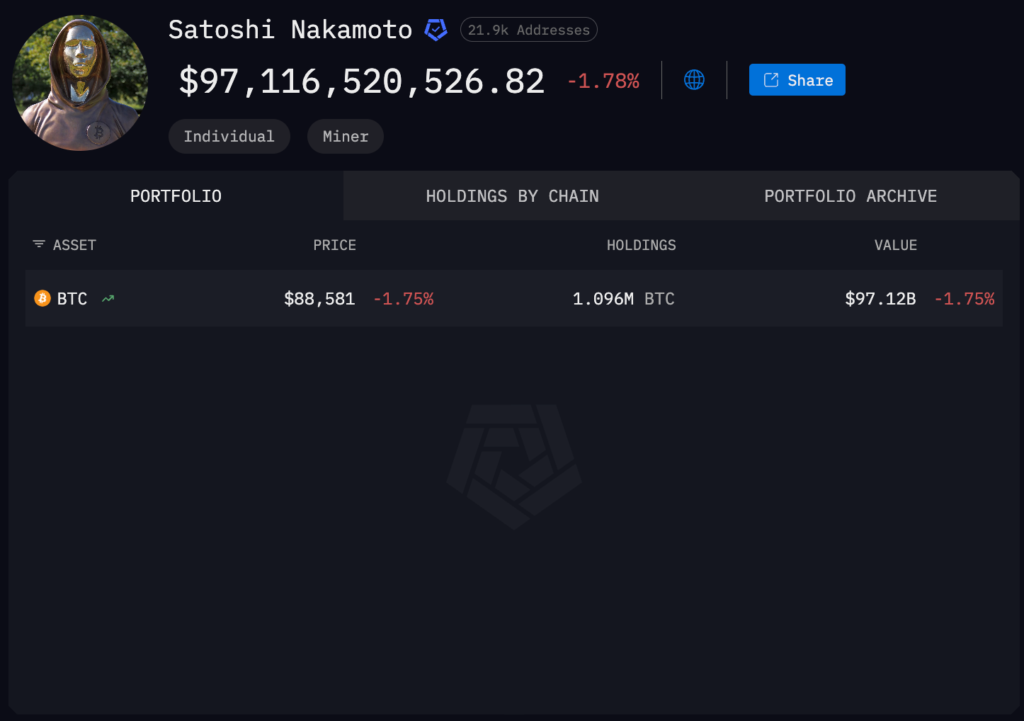

He said that if Satoshi Nakamoto’s estimated one million Bitcoin were hacked and suddenly sold many early Bitcoin holders would step in to buy during the resulting crash. According to Woo this buying pressure could help stabilise prices in the short term.

However he warned that a broader release of around four million coins held in older wallet formats could trigger a prolonged bear market. These older addresses expose public keys which makes them theoretically vulnerable to future quantum attacks.

Woo stressed that most Bitcoin remains safe for now but acknowledged the importance of preparing for long term technological risks.

Calls grow for quantum resistant upgrades

The crypto community continues to debate how soon quantum computing could threaten existing cryptographic standards. While such machines are not yet capable of breaking Bitcoin security many developers and executives are urging proactive action.

Proposals include migrating funds to quantum resistant address types and upgrading network standards well before the technology becomes viable. The discussion reflects a wider awareness that while crypto systems are resilient they must continue to evolve to remain secure in the long term.