The crypto markets faced a sharp downturn as stronger-than-expected U.S. employment data for December fueled concerns about the Federal Reserve’s monetary policy. Bitcoin (BTC) and altcoins saw significant selloffs, with traditional markets also reacting to the latest economic signals.

U.S. Jobs Data Exceeds Expectations

The U.S. economy added a robust 256,000 jobs in December, significantly outpacing forecasts of 160,000. This marked an increase from the revised November figure of 212,000 jobs. The unemployment rate also dropped unexpectedly to 4.1% from November’s 4.2%.

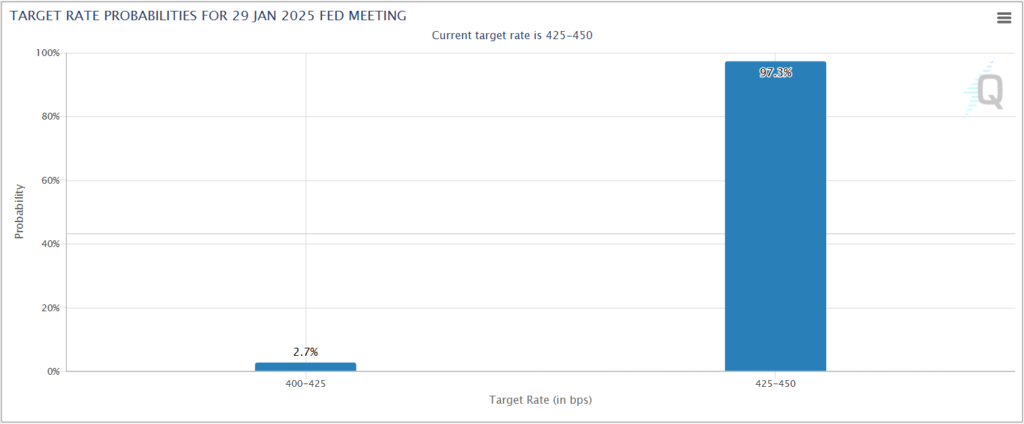

This strong labor market performance has cast doubt on the idea of continued Federal Reserve rate cuts in 2025. Following the report, traders quickly adjusted their expectations, reducing the likelihood of further monetary easing in the months ahead.

Bitcoin Tumbles Below $93,000

Bitcoin, attempting to recover from earlier declines, fell over 2% immediately after the jobs report release, trading around $92,800. This drop added to a broader slide that saw the leading cryptocurrency plummet from nearly $103,000 earlier in the week to below $92,000 on Thursday.

Major altcoins faced even steeper declines on a percentage basis, underscoring the fragility of the crypto market amidst shifting macroeconomic conditions.

Broader Market Reactions

The crypto market wasn’t the only sector impacted. U.S. stock index futures fell approximately 1% post-report, while the bond market experienced a strong reaction. The 10-year Treasury yield surged by nine basis points to 4.78%, reflecting heightened interest rate expectations.

The dollar index climbed 0.6%, further pressuring risk assets, while gold prices edged lower, settling just below $2,700 per ounce.

The latest employment data has led to a recalibration of Federal Reserve rate cut probabilities. According to CME FedWatch, the odds of a March rate cut have dropped to 28% from 41% before the report. Similarly, the likelihood of a May cut has decreased from 44% to 34%.

Average hourly earnings rose by 0.3% in December, matching expectations but showing a slowdown from November’s 0.4% increase. On an annual basis, earnings grew by 3.9%, slightly below forecasts of 4%.

Crypto Market Outlook

As macroeconomic conditions evolve, the crypto market remains vulnerable to external shocks. With the Federal Reserve adopting a cautious stance, traders may continue to brace for heightened volatility in the weeks ahead.

For now, stronger economic data and rising interest rates suggest that crypto bulls face an uphill battle as traditional markets adjust to the possibility of a slower pace of monetary easing in 2025.