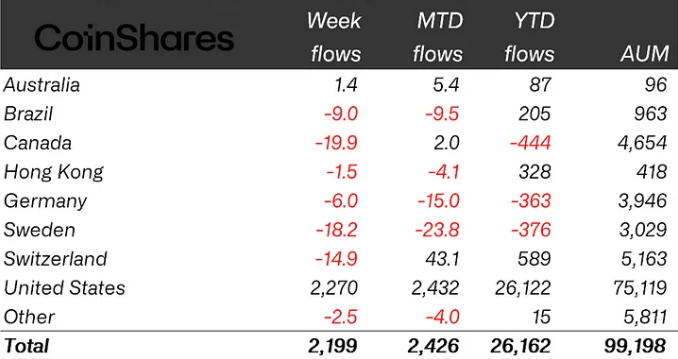

Today’s crypto news highlights significant developments affecting Bitcoin and the broader digital asset market. Notably, United States-based cryptocurrency investment products have experienced their largest inflows since July, reaching a total of $2.2 billion last week. This comes alongside concerns regarding a Federal Reserve proposal that could impact Bitcoin’s future.

US Election Optimism Drives $2.2 Billion Inflows

Digital investment products have seen a positive uptick, largely driven by optimism surrounding the potential Republican victory in the upcoming US elections. According to CoinShares’ latest Digital Asset Fund Flows Weekly Report, the US led the surge in crypto product investments during the week of October 12–18, with inflows totaling $2.3 billion. CoinShares’ head of research, James Butterfill, stated, “This renewed optimism stems from growing expectations of a Republican victory, as they are generally viewed as more supportive of digital assets.”

In contrast, Canada and Sweden recorded outflows of $19.9 million and $18.2 million, respectively, while Australia posted a modest $1.4 million in inflows.

Federal Reserve Proposes Tax or Ban on Bitcoin

A working paper released by the Federal Reserve Bank of Minneapolis has suggested that assets like Bitcoin may need to be taxed or banned to allow governments to maintain deficits. The paper argues that Bitcoin creates a “balanced budget trap,” complicating fiscal policy implementation. This proposal has sparked a significant backlash from crypto supporters, who argue that it undermines the principles of digital currencies.

MicroStrategy’s Stock Price Projected to Rise

Benchmark analyst Mark Palmer has suggested that MicroStrategy’s (MSFT) share price could see significant gains, potentially reaching $245 per share. This optimism is linked to the company’s ongoing Bitcoin acquisition strategy, despite concerns over its current overvaluation. Palmer noted that MicroStrategy holds more than 250,000 BTC, valued at approximately $17 billion as of October 17.

In conclusion, while inflows into crypto products signal renewed investor confidence, regulatory discussions, and company valuations present ongoing challenges for the market.