The cryptocurrency market experienced a notable surgeon 15 October, with total market capitalisation rising by 2.2% to reach $2.3 trillion. This rise followed a strong performance from US equities and growing investor demand for crypto investment products. Despite mixed reactions to China’s stimulus package, the market’s rally rekindled hopes for a bullish October, often referred to as “Uptober.”

Risk-On Sentiment Fuels Crypto Rally

The rally in the crypto market mirrored the strength seen in US equities. On 14 October, the S&P 500 hit an all-time high of 5,871.41, reflecting a 2.6% increase month-to-date. A surge in valuations of major companies, particularly in the technology and artificial intelligence sectors, was a key driver. Nvidia, for example, reached a new peak, boosting market confidence in both AI-related tokens and broader cryptocurrencies.

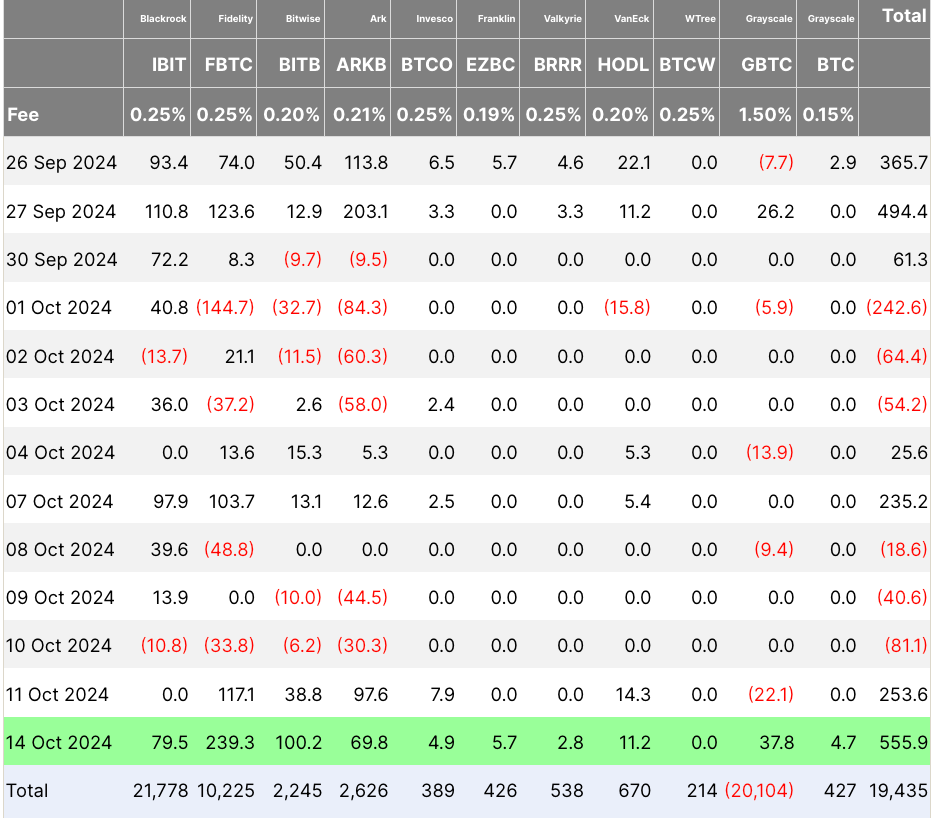

Spot Bitcoin ETF Inflows Accelerate Growth

Increased inflows into US-based spot Bitcoin exchange-traded funds (ETFs) further contributed to the market’s recovery. During the week ending 11 October, spot Bitcoin ETFs saw net inflows of $348.5 million, with an additional $555.9 million on 14 October. This brought total ETF reserves to $19.4 billion, signaling growing institutional interest in crypto assets.

Short Liquidations Drive Market Gains

The crypto market also benefited from liquidations of short positions across derivatives markets. According to data from CoinGlass, short traders—those betting against the market—suffered liquidations totaling $136.2 million in the last 24 hours, compared to $46.5 million for long traders. Bitcoin (BTC) alone saw $53 million in short liquidations, intensifying upward price momentum as traders were forced to exit their positions.

Technical Indicators Suggest Further Upside

From a technical perspective, the total market cap of all cryptocurrencies is trading within a bull flag pattern, indicating a continuation of the uptrend. A breakout above the $2.23 trillion resistance level could propel the market towards a high of $2.72 trillion, with further potential gains pushing it to $2.83 trillion—an increase of 27% from current levels.