The crypto market has slipped back into decline after a modest rebound yesterday, with more than $40 billion wiped off total market capitalisation. Bitcoin (BTC) saw only a marginal dip, but overall weakness in trading volume has raised concerns of further downside. Meanwhile, Donald Trump–linked World Liberty Financial (WLFI) is among the worst performers, tumbling nearly 20% in a single day.

$40 Billion Wiped Out: TOTAL Hovers Above Key Support

The broader crypto market capitalisation, tracked under TOTAL, has fallen by $40 billion over the past 24 hours. TOTAL now stands at $3.77 trillion, hovering just above the critical support floor of $3.73 trillion that has held steady since early August.

If bearish momentum continues, this level may not hold. A breakdown could push the market toward $3.57 trillion, signalling a deeper correction. However, if buying activity strengthens and volatility eases, a rebound may follow, with TOTAL potentially testing the $3.85 trillion mark in the short term.

This tug-of-war between bearish selling pressure and potential renewed inflows sets the stage for the next decisive move in overall market direction.

Bitcoin Sees Modest Dip as Volume Weakens

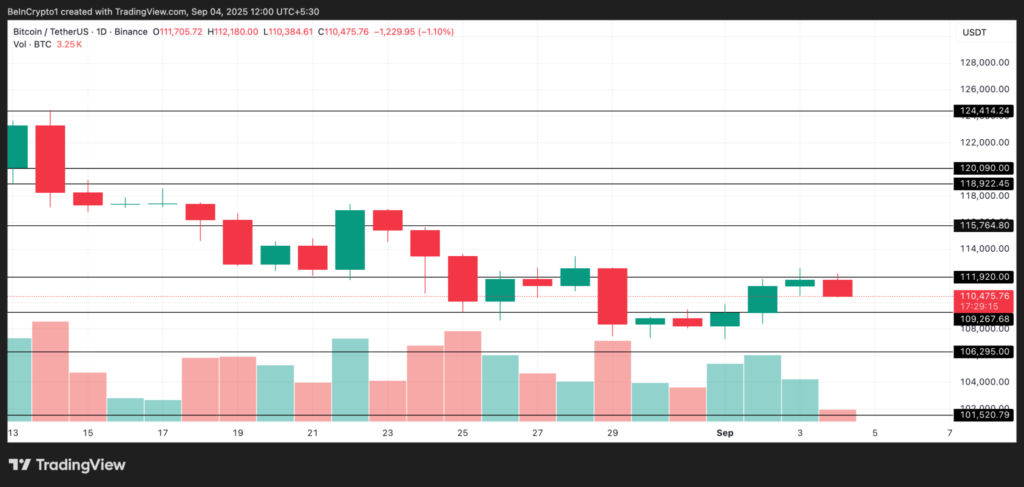

Bitcoin, the leading digital asset, is trading at $110,475 at the time of writing, down 0.06% in the last 24 hours. More concerning is the sharp 20% decline in daily trading volume, which has dropped to $58.36 billion.

When both price and trading volume move lower, it often signals weakening market participation and a lack of conviction among buyers. This suggests that BTC may face more downward pressure if demand fails to recover.

If the bearish momentum persists, BTC could slide to $109,267. A breach of that level risks accelerating losses toward $106,295. On the flip side, renewed buying could see the coin rebound toward $111,920, offering short-term relief for investors.

WLFI Token Faces Heavy Selling Pressure

The sharpest decline among major tokens came from WLFI, the Trump-linked token under World Liberty Financial. WLFI plunged by nearly 20% in a single day as traders moved to take profits following its rally earlier in the week.

The token peaked at $0.47 shortly after debuting on several crypto exchanges on Monday but has since faced significant sell-side pressure. Technical indicators such as the Balance of Power (BoP) on the 4-hour chart confirm a clear bearish tilt in sentiment.

If the selloff continues, WLFI risks slipping below its $0.18 support level, which would mark a new all-time low. However, a rebound remains possible if fresh demand enters the market, potentially pushing the token back toward $0.24.

Market Outlook: Buyers vs Sellers

Today’s downturn highlights the fragile balance in crypto markets as they attempt to recover from recent volatility. The $40 billion wipe-out underscores how sensitive sentiment remains, particularly when trading volumes weaken.

Bitcoin’s muted performance shows that while it continues to act as a stabilising anchor for the sector, it is not immune to broader market weakness. At the same time, speculative altcoins like WLFI demonstrate how quickly investor enthusiasm can turn into selling pressure.

The coming days may determine whether the $3.73 trillion support for TOTAL holds firm or breaks down. A bounce could restore short-term optimism, but continued outflows may drag the market into a deeper corrective phase.