Bybit CEO Warns of Massive Liquidations

The cryptocurrency market has faced a severe downturn, with liquidations potentially reaching $10 billion, according to Bybit CEO Ben Zhou. This comes amid wider economic concerns following US President Donald Trump’s decision to impose import tariffs on China, Canada, and Mexico.

Data from CoinGlass shows that more than $2.24 billion was liquidated in just 24 hours on 3 February. However, Zhou suggests the actual figure could be five times higher.

“Bybit’s 24-hour liquidation alone was $2.1 billion,” Zhou posted on X (formerly Twitter). “I am afraid that today’s real total liquidation is a lot more than $2 billion—by my estimation, it should be at least around $8 billion–$10 billion.”

Altcoins Plunge as Market Continues to Recoil

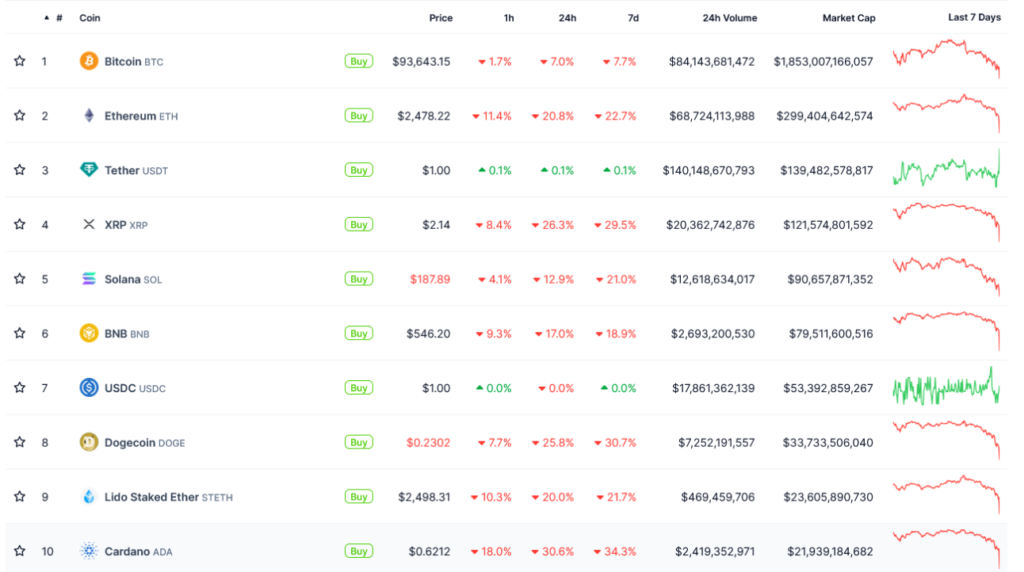

The impact of the market downturn was felt sharply across major altcoins, with Ether (ETH) and others experiencing double-digit losses within hours.

Ether, the second-largest cryptocurrency, fell 16% in a single hour, dropping to $2,368 on 3 February at 2:11 am UTC. Other top altcoins, including Avalanche (AVAX), XRP, Chainlink (LINK), and Dogecoin (DOGE), have plunged by over 20% in the last 24 hours.

The overall crypto market capitalisation has shrunk by 11.4%, falling to $3.17 trillion, according to CoinGecko data.

Markus Thielen, founder of 10x Research, described the market reaction as a “wave of stop-loss triggers combined with a buyer’s strike from retail investors.” He also noted that trading volumes had been declining over the past few weeks, signalling a lack of investor confidence.

India Reassesses Crypto Policies Amid Global Shift

Meanwhile, India is reconsidering its stance on cryptocurrency as regulatory frameworks evolve globally. Ajay Seth, the country’s economic affairs secretary, acknowledged that digital assets “don’t believe in borders”, highlighting the need for India to reassess its policies to remain competitive.

Seth’s remarks come in the wake of Trump’s recent executive order establishing the Working Group on Digital Asset Markets, a body designed to shape crypto regulations and explore the development of a US strategic crypto stockpile.

With shifting international policies and increasing institutional involvement in digital assets, India’s approach to crypto could see significant changes in the near future.