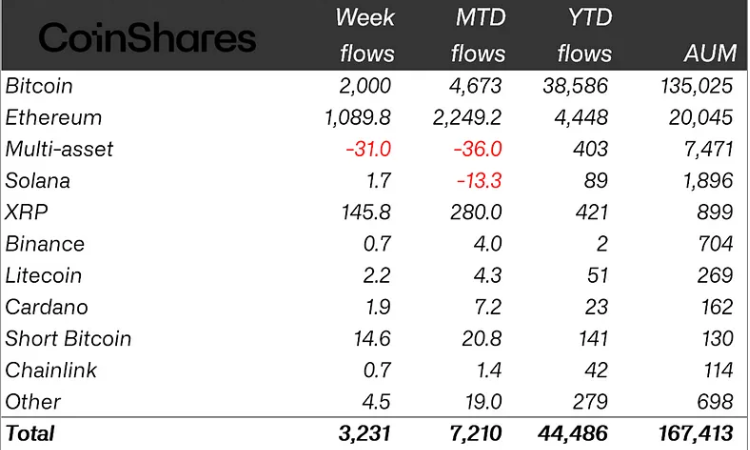

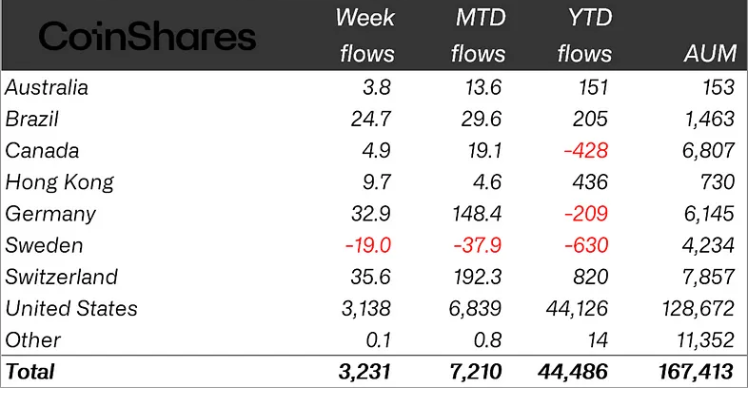

Digital asset investment products continue to experience significant growth, recording their 10th consecutive week of inflows as Bitcoin reaches new heights. According to CoinShares’ latest weekly flows report, the week of December 9-13 saw inflows of $3.2 billion, highlighting strong investor interest in cryptocurrencies.

Bitcoin Leads the Charge with $2 Billion Inflows

Bitcoin remains the primary driver of this surge, with $2 billion in inflows during the past week alone. Since the United States presidential election, Bitcoin investment products have amassed $11.5 billion.

While long Bitcoin products dominated the market, short Bitcoin exchange-traded products (ETPs) also saw an increase, with $14.6 million in inflows last week. However, assets under management (AUM) for short BTC products remain relatively modest at $130 million. Among key players, BlackRock’s iShares Bitcoin Trust led inflows with $2 billion, while Grayscale’s Bitcoin Trust experienced outflows of $145 million.

Ethereum ETPs Gain Momentum

Ethereum, the second-largest cryptocurrency by market capitalization, also demonstrated robust performance. Ethereum-based ETPs recorded their seventh consecutive week of inflows, attracting $1 billion last week. Over the past seven weeks, Ether ETPs have garnered $3.7 billion, reflecting growing investor confidence in the platform’s long-term potential.

Record-Breaking Year for Crypto Inflows

The past 10 weeks alone have contributed $20.3 billion to crypto investment products, accounting for 45% of the $44.5 billion total inflows for 2024. Notably, the prior week set a record with $3.85 billion in inflows. These figures underscore the sustained enthusiasm for digital assets despite market fluctuations.

The steady rise in inflows signals a broader trend of institutional adoption and retail interest in cryptocurrencies. Investment products such as exchange-traded funds (ETFs) and trusts continue to attract diverse investors seeking exposure to the crypto market’s growth potential.

As Bitcoin hits new all-time highs and Ethereum strengthens its position, the crypto market’s momentum shows no signs of slowing down, setting a promising tone for 2025.