The inclusion of cryptocurrency in US retirement plans may push Bitcoin to record highs, with predictions suggesting a potential rise to $200,000 by the end of 2025.

Trump Order Opens Door to Digital Assets in 401(k) Plans

President Donald Trump signed an executive order on 7 August allowing Americans to include cryptocurrency in their 401(k) retirement plans. The move is expected to mark a major milestone for Bitcoin adoption, unlocking billions in potential investment capital.

André Dragosch, head of European research at crypto asset manager Bitwise, said the development could prove even more significant for Bitcoin’s long-term value than the approval of spot Bitcoin exchange-traded funds (ETFs) in January 2024. He described the change as “bullish” and projected that Bitcoin could climb to $200,000, calling the introduction of digital assets in 401(k) plans “bigger than the US Bitcoin ETF approval itself.”

Billions in Capital at Stake

The US 401(k) market is worth an estimated $12.2 trillion. According to Dragosch, even a modest 1% allocation of retirement portfolios to Bitcoin could add around $122 billion to the market. He stressed that 1% was a conservative estimate, with Bitwise surveys indicating financial advisers are more likely to recommend a 2.5% to 3% allocation.

The first flows of retirement capital into Bitcoin ETFs may begin as early as this autumn. Such inflows could coincide with expected Federal Reserve interest rate cuts, providing additional momentum for Bitcoin’s rise.

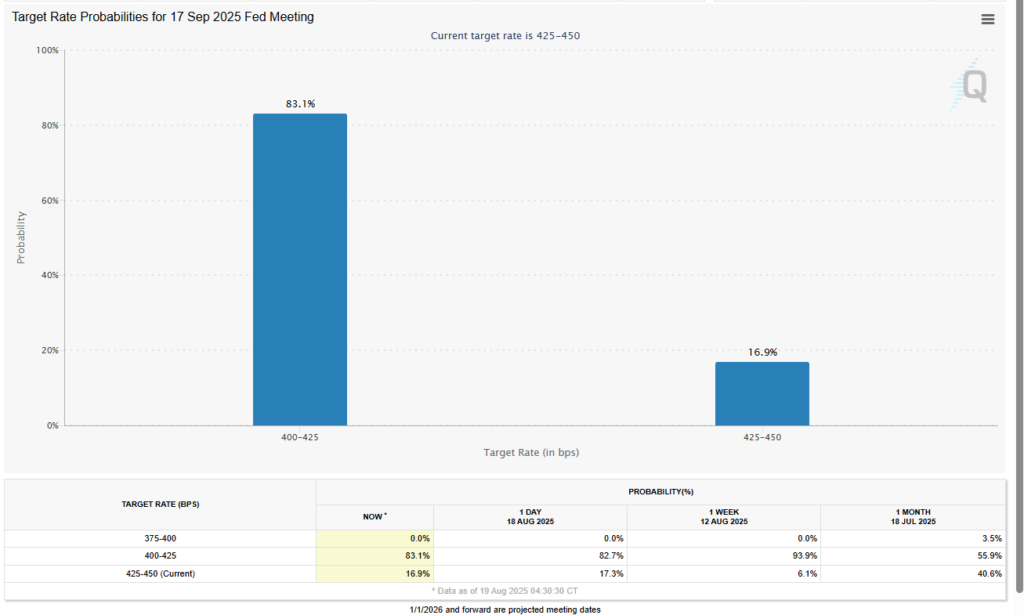

Federal Reserve Policy Adds Tailwind

The Fed is widely expected to lower rates at its next meeting on 17 September. Market data from CME Group’s FedWatch tool suggests an 83% probability of a 25 basis point cut. Dragosch argued that monetary easing combined with fresh retirement-plan inflows creates a strong case for Bitcoin hitting $200,000 by year-end.

Major Providers Likely to Join In

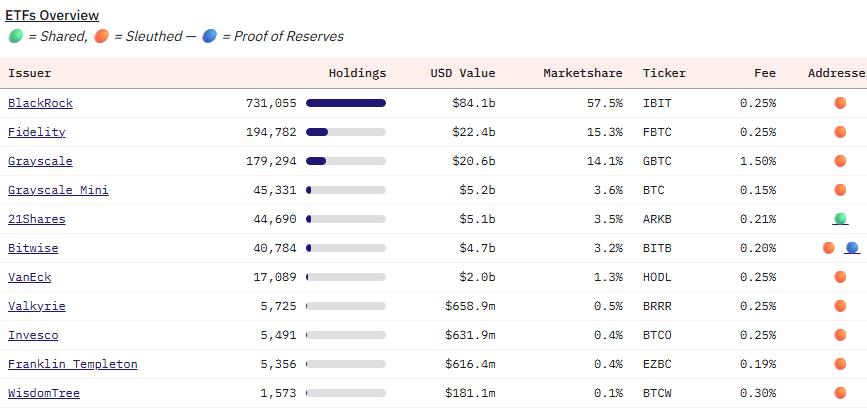

The success of this policy shift will depend heavily on the stance of major retirement plan providers. BlackRock and Fidelity, two of the largest players, have strong incentives to offer Bitcoin ETF exposure to clients. Vanguard remains more cautious, having not yet approved crypto ETFs.

BlackRock currently dominates the market with its iShares Bitcoin Trust, which controls $84 billion in assets, or 57.5% of total market share. Fidelity follows with $22.4 billion, equal to 15.3% of the market. These figures underscore the influence such firms could wield if Bitcoin becomes a standard component of retirement portfolios.

Regulators Push for Guardrails

The US Securities and Exchange Commission (SEC) is coordinating with the Trump administration to ensure that retail retirement investors can safely access alternative assets, including cryptocurrencies. SEC Chair Paul Atkins confirmed that while the agency supports broader access, it also insists on “proper guardrails” to protect investors.

Optimism Builds for Bitcoin’s Next Milestone

With new retirement inflows, regulatory collaboration and shifting monetary policy, analysts believe Bitcoin could be set for its strongest bull run yet. For Dragosch and other market watchers, the path to $200,000 no longer seems far-fetched but increasingly likely as mainstream adoption accelerates.