Industry Leaders Urge Congress to Repeal IRS Regulation

The Blockchain Association, representing 76 cryptocurrency firms, has urged US lawmakers to repeal the Internal Revenue Service’s (IRS) decentralized finance (DeFi) broker rule. The group argues that the rule poses a significant threat to crypto innovation in the United States and places an unfair burden on blockchain companies.

The association has rallied behind Senator Ted Cruz, calling on Congress to support his efforts to overturn the regulation, which was finalised in the final days of President Joe Biden’s administration.

Call for Repeal of Biden-Era IRS Rule

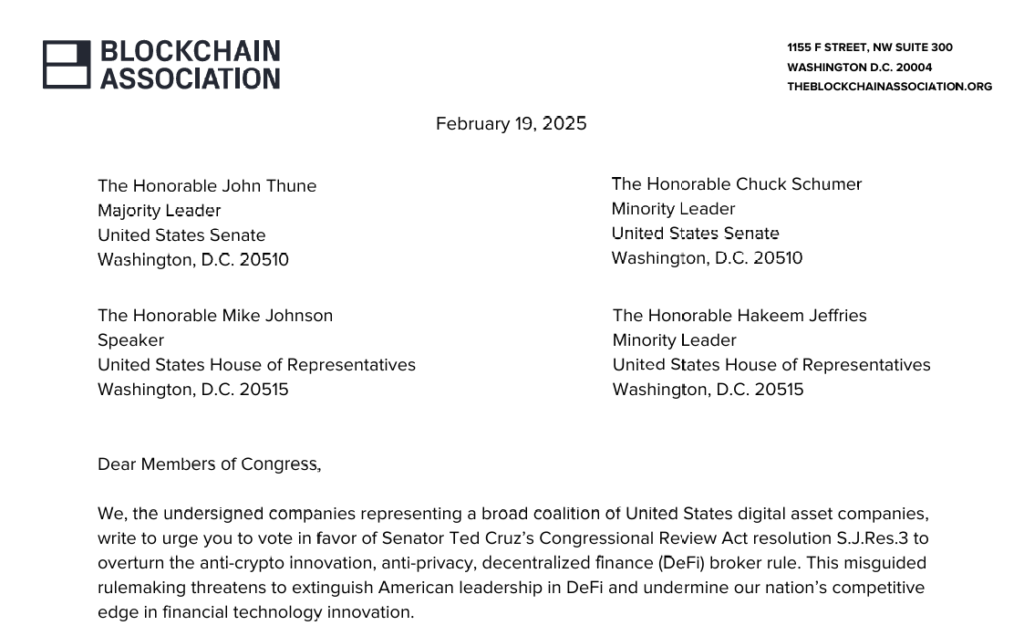

On 19 February, the Blockchain Association sent a letter to key congressional leaders, including Senate Majority Leader John Thune, Senate Minority Leader Chuck Schumer, House Speaker Mike Johnson, and House Minority Leader Hakeem Jeffries. The letter demands the repeal of a regulation that broadens the definition of a “broker” under US law to include software providers facilitating access to DeFi protocols.

Among the signatories were major crypto firms such as 0x Labs, a16z Crypto (Andreessen Horowitz’s crypto division), Aptos Labs, Crypto.com, Grayscale, Dapper Labs, and Ava Labs.

The IRS disclosed on 27 December 2024 that the DeFi broker rule, if implemented, would impact up to 875 DeFi brokers in the US. Set to take effect in 2027, the regulation would subject decentralised exchanges to the same reporting requirements as traditional financial brokers.

Industry Fears Stifled Innovation

The Blockchain Association strongly opposes the rule, arguing that it places unnecessary and severe restrictions on DeFi companies. It warns that compliance requirements would disrupt innovation in the digital asset sector and weaken the US’s global position in financial technology.

“Under the rule, software companies that never take custody or control of users’ assets will be required to radically rebuild their services in order to unnecessarily collect and then report to the government the personal identifying information and transaction details of potentially tens of millions of American users,” the association stated.

The letter also claims that the regulation unfairly targets US-based crypto companies and could “cripple DeFi innovation” by forcing excessive compliance measures.

Push for Legislative Action

The Blockchain Association asserts that the rule was rushed through in a last-minute “midnight rulemaking” effort, bypassing proper legislative scrutiny. It argues that decisions with such wide-ranging consequences should be made by Congress rather than regulatory agencies.

The association is now calling on lawmakers to support Senator Cruz’s Congressional Review Act (CRA) resolution, S.J.Res. 3, which seeks to repeal the DeFi broker rule. The group insists that reversing the regulation is essential for fostering economic growth, job creation, and financial inclusion within the crypto sector.

With growing opposition from industry leaders, the future of the IRS DeFi broker rule remains uncertain as the debate over cryptocurrency regulation continues in Washington.